Uncategorised (4996)

Transmission license exemptions grant UK offshore wind farm generators time to complete ownership transfer, says GlobalData

AdministratorWith the onset of COVID-19, the UK Government proposed time-bound exemptions for wind project generators in tender rounds 5 and 6 of the Offshore Transmission Owner (OFTO) regime. GlobalData anticipates that the exemption is likely to provide the developers of the projects that were impacted by the virus valuable time to execute the transfer process.

Somik Das, Senior Power Analyst at GlobalData, comments: “With the lockdown in-situ, there was a scarcity of working personnel. Now, because the lockdowns are gradually being lifted within the UK, movement is predicted to be restrained for some time. Conventional working practices are still impacted and uncertainties looming in the near term are expected to cumulatively delay any ownership transfers.”

Somik Das, Senior Power Analyst at GlobalData, comments: “With the lockdown in-situ, there was a scarcity of working personnel. Now, because the lockdowns are gradually being lifted within the UK, movement is predicted to be restrained for some time. Conventional working practices are still impacted and uncertainties looming in the near term are expected to cumulatively delay any ownership transfers.”

The Beatrice project was nearest to the end of its commissioning period, with the date set for October this year. Social distancing norms in the UK have hindered the project’s transfer, and, although things are expected to be back to shape by the end of the year, the cloud of uncertainty still looms ahead. An extension to the timeline is anticipated to bring utmost relief to the current owner.

Das continues: “In this Build-Own-Operate-Transfer (BOOT) model, the new owners after the transfer might need to rework project finances to account for any potential delay. In addition, the average monthly electricity price had been on the decline since March, and, as economic activities resume and demand normalizes, electricity tariffs are likely to improve. This tariff increase will benefit the new owners by way of improved revenues.”

to Editors

- Comments provided by Somik Das, Senior Power Analyst at GlobalData

- The government proposes a 12-month extension in the transfer of ownership of the 1.2GW Hornsea One Project to preferred OFTO bidder Diamond Transmission Corporation (DTC), 588MW Beatrice Project, and the 400.2MW Rampion project to Transmission Capital Partners. The transfer deadlines for Hornsea One, Beatrice, and Rampion projects are proposed to be extended to 14th January 2022, 2nd October 2021, and 27th November 2021, respectively.

- For new offshore wind projects in the UK, the generator builds the project and can own and operate the offshore transmission system for a maximum commissioning period of 18 months without possessing a transmission license.

- The proposal for granting an extension of the timeframe of ownership transfer, depends largely on the extent the wind project owners have been impacted by the crisis.

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.

The Rhenus Group has expanded its logistics services in the Asia-Pacific region, with a newly-built warehouse in Gurugram, India. The state-of-the-art 32,500 square meter facility is the latest addition to Rhenus’ global logistics operations.

The Gurugram logistics centre features 30,000 pallet spaces, 19 loading gates and 24-hour security protection. Sustainability has been prioritised throughout, with solar PV panels installed on the roof and water recycling technology integrated within the facility’s design.

The new Gurugram location serves customers from the consumer, industrial goods, automotive, mechanical engineering and chemical sectors, among others. The warehouse has good transport links to the Jaipur Highway, the Kundli-Nabesar-Palwal Expressway and the Delhi-Mumbai Corridor to Delhi and other parts of northern India.

“Our flagship warehouse is raising the bar even higher in terms of quality, sustainability and safety. It is our goal, as a service provider, to be the first choice for integrated logistics solutions and scalable storage across India. Well-trained staff, standardised systems and modern processes are our advantage,” says Vivek Arya, Managing Director of Rhenus Logistics India.

The new flagship warehouse is the 69th Rhenus branch in India. The total storage capacity Rhenus operates across the country has thus increased to more than 175,000 square meters across 30 logistics centres.

“India is one of our key markets for our growth plans for the APAC region. Our high quality standards and decades of experience enable us to provide professional support to customers along the entire logistics chain,” says Jan Harnisch, Global COO Rhenus Air & Ocean.

About Rhenus

The Rhenus Group is a leading logistics service provider with global business operations and an annual turnover of EUR 5.5 billion. Rhenus has business sites at 750 locations worldwide and employs 33,000 people. The Rhenus Group provides solutions for a wide variety of different sectors along the complete supply chain; they include multimodal transport operations, warehousing, customs clearance as well as innovative value added services.

Warren Controls Announces ILEA 5800E Series Electrically Actuated Valves

AdministratorWarren Controls, a leading manufacturer of control valves and specialty fluid handling products, announces its new ILEA 5800E Series of high-quality, modulating, linear, electrically actuated industrial globe control valves.

The E5800 Series features bolted bonnets and cage-retained seats in rugged, high-efficiency bodies of steel or stainless steel for ease of maintenance in a variety of trim materials and port sizes. The equal percentage and linear plugs provide excellent modulating control of a wide array of fluids. The 5800E Series is ideally suited for applications including but not limited to the chemical, district energy, food and beverage, general service, marine, pulp and paper, refining, and pharmaceutical industries.

The 5800E Series performs for temperatures from -20 to 800o F – handling severe service, dirty fluids, high pressure drops, and corrosive fluids. Available styles are a 2-way unbalanced cage-retained seat and a 2-way cage-balanced cage-retained seat. Sizes range from ½ to 4 inches with ANSI Class IV and Class VI leakage and with a rangeability of 50:1.

For more information visit Warren Control’s website.

About Warren Controls

Warren Controls is an industry leader in Industrial Control Valves, Building Automation Valves, Deaerator and Boiler Level Controls, and Military/Marine Valves. For more than 70 years, the company has maintained a strong commitment to providing specialty alloys, quick deliveries, and knowledgeable customer service. Warren Controls has earned a sterling reputation as a quality provider of valve specialties to OEM’s and USA military programs. From its state-of-the-art 60,000 square foot industrial complex, the company offers its experience, product design excellence, and superior production capabilities to the open market. At Warren Controls, the most technically qualified representatives in the industry are available to assist customers develop cost-effective, dependable solutions. Learn more at www.WarrenControls.com.

US’ proposed ITC extension to 2025 would mean more than 25% share of solar and wind, says GlobalData

AdministratorThe proposed Investment Tax Credit (ITC) extension is greatly welcomed by power industry associations and developers. Cost-effectiveness is better observed in these large-scale utility projects, as they achieve break-even faster - as the generation is bartered for the long term. Hence, GlobalData expects that rejection of the extension would greaty bruise the developers involved in these projects.

Somik Das, Senior Power Analyst at GlobalData, comments: “GlobalData notes that renewables (including small hydro) formed 17% of the overall installations at the end of 2019. Benefitted by the presence of tax incentives, solar PV has enjoyed a great run in the last two decades, from no presence to more than 6% of the cumulative installed capacity by 2019. When combined with the effects of COVID-19, the future growth trajectory of the solar and wind traction could be put in jeopardy without the extension.”

Along with the ITC, an extension to the Production Tax Credit (PTC) in the current situation is likely to boost installations in the wind segment as well, which forms the majority of the renewable installed capacity in the US. The extensions are anticipated to provide a positive thrust to the wind and solar PV sectors, which together, as per GlobalData, could form around 25% of overall installations by 2025.

Along with the ITC, an extension to the Production Tax Credit (PTC) in the current situation is likely to boost installations in the wind segment as well, which forms the majority of the renewable installed capacity in the US. The extensions are anticipated to provide a positive thrust to the wind and solar PV sectors, which together, as per GlobalData, could form around 25% of overall installations by 2025.

Das added: “The ITC has already reaped benefits as installed costs have dropped significantly since 2008. A lot of government investment comes back through tax revenues, and employment within the sector has increased multi-fold. The events around COVID-19 has set the stage to a point where an ITC extension might help provide a necessary green thrust to economic recovery.

"With the onset of the crisis, the US renewables space was forced to cut jobs. The proposals made in the Moving Forward Act has the potential to generate significant employment opportunities to revitalize the economy in the present downturn."

Notes to Editors

- Comments provided by Somik Das, Senior Power Analyst at GlobalData

- As a part of the proposed Moving Forward Act, the US’ House Democrats vouched for a US$1.5trillion bill to be voted on the 4th of July. It is aimed at improving infrastructure and boosting the nation's economy in the period following the COVID-19. The moving Forward Act, inclusive of the Growing Renewable Energy And Efficiency Now (GREEN) Act is, expected to expand the development of renewable energy. Allowing investments in enhanced efficiency and emissions model, the GREEN Act aims to reduce the nation’s carbon footprint.

- The measures in the bill propose an investment of more than US$70billion to modernize energy infrastructure, an extension of the solar ITC at a rate of 30% through till 2025, promotion of green energy and energy storage projects and widespread deployment of EV infrastructure. Along with aiding an economic recovery, the bill is expected to help in bringing about a clean energy future.

- The bill throws some sunshine on the solar sector. It proposes a 5-year extension of the solar Investment Tax Credit (ITC) at 30% through to 2025, beyond this, it would be reduced over two years. In 2026 the rate would drop to 26% then to 22% in 2027 and then drop to 10% for utility-scale and commercial solar projects. From 2028 it would be removed entirely for the residential sector. Along with this the ITC also included a direct cash payment option for recipients. Being an expected tool to aid economic recovery, the proposed extension of the ITC is greatly welcomed and cheered by industry associations and developers.

- As a part of the proposed Moving Forward Act, the US’ House Democrats vouched for a US$1.5trillion bill. It is aimed at improving infrastructure and boosting the nation's economy in the period following the COVID-19.

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.

Sparrows Group extends relationship with Vedanta with three-year rental crane contract renewal

AdministratorSparrows Group has secured a three-year contract renewal to supply a rental crane to Vedanta Resources Limited, extending its relationship with the company to nine years.

A Sparrows manufactured ECR-20 crane will be mobilised to the Lakshmi and Gauri oil and gas fields of Cairn Oil & Gas, located off the west coast of India, near Cambay basin in Gujarat. Vedanta has been operating these blocks since 2017, following the merger of Cairn India with Vedanta Limited.

The crane will be used to support well service operations across multiple platforms in the fields. As part of the workscope, Sparrows will also conduct various upgrades on the crane, which has been operated by Vedanta since 2011.

The enhancements will include a new boom, winches, lifting sheaves, load indicator and wire ropes to assure the ongoing safety and performance of the crane. It will also be further adapted to increase the current lifting capacity from 15Te to 18Te.

The upgrade work is being undertaken at Sparrows’ workshop in Mumbai with the offshore mobilisation planned for September this year, when experienced lifting personnel from the facility will be installing, commissioning and operating the crane in the field.

Stewart Mitchell, chief executive officer of Sparrows said: “We have developed a strong relationship with Vedanta since 2011 and this further three-year contract demonstrates the value our services and equipment have delivered and our continued commitment to operational and safety excellence.

“We’ve been supporting clients in India since 2011, the country continues to be an area of growth for Sparrows and we have established a good track record in the region. Our engineering capability in Mumbai and our ability to carry out work locally has been a crucial part of this, as well as the work with Vedanta it has also enabled us to undertake a multi-million-pound contract with India’s Oil and Natural Gas Corporation (ONGC) for the refurbishment of 21 cranes.”

The Sparrows Group is a global provider of specialist equipment and integrated engineering services to the oil and gas, renewables and industrial sectors. The firm supports customers by delivering a broad range of expert solutions that optimise efficiency and ensure the performance, reliability and safety of critical equipment and people.

Ashland announces definitive agreement to sell maleic anhydride business to AOC Materials, LLC for $100 million

AdministratorAshland Global Holdings Inc. (NYSE: ASH) today announced a definitive agreement to sell the company’s maleic anhydride business and manufacturing facility in Neal, West Virginia to AOC Materials LLC, for $100 million.

Maleic anhydride is manufactured industrially on a large scale for applications in coatings and polymers. The maleic anhydride business was previously excluded from the sale of Ashland’s Composites business and the butanediol (BDO) manufacturing facility in Marl, Germany, to INEOS Enterprises. The transaction with AOC is expected to close prior to the end of calendar year 2020, contingent on customary regulatory approvals and standard closing conditions.

Maleic anhydride is manufactured industrially on a large scale for applications in coatings and polymers. The maleic anhydride business was previously excluded from the sale of Ashland’s Composites business and the butanediol (BDO) manufacturing facility in Marl, Germany, to INEOS Enterprises. The transaction with AOC is expected to close prior to the end of calendar year 2020, contingent on customary regulatory approvals and standard closing conditions.

“Today’s announcement furthers Ashland’s strategic focus to streamline our portfolio and to focus on specialty ingredients and improved margins,” said Guillermo Novo, chairman and chief executive officer, Ashland. “The Maleic business and its respective employees have made important contributions to Ashland, and AOC will take a strategic view of the business to drive growth and continue their success.”

“We are delighted to have this business as a part of our company and welcome the employees who have made it successful to the AOC family,” remarked Joe Salley, chief executive officer, AOC. “We are excited about the growth prospects, not only as a source for our internal consumption but also for the merchant market as well.”

Citi is acting as financial advisor to Ashland, and Squire Patton Boggs LLP is acting as legal advisor.

About Ashland

Ashland Global Holdings Inc. (NYSE: ASH) is a premier global specialty materials company serving customers in a wide range of consumer and industrial markets, including adhesives, architectural coatings, automotive, construction, energy, food and beverage, nutraceuticals, personal care and pharmaceutical. At Ashland, we are approximately 4,600 passionate, tenacious solvers – from renowned scientists and research chemists to talented engineers and plant operators – who thrive on developing practical, innovative and elegant solutions to complex problems for customers in more than 100 countries. Visit ashland.com to learn more.

About AOC

AOC is the leading global supplier of resins and specialty materials that enable customers to create robust, durable, and versatile products and components. With strong capabilities around the world in both manufacturing and science, the company works closely with customers to deliver unrivaled quality, service, and reliability for today, and create innovative solutions for tomorrow.

Industry partners with University of California in nanoscale study on advanced batteries

AdministratorA team of scientists from the University of California is set to unlock the inner workings of lead batteries with the help of nanoscale technology.

Working with the Consortium for Battery Innovation (CBI), the new industry-academia partnership based in Los Angeles will explore the fundamental processes occurring inside lead batteries as part of the Consortium’s plans to deliver performance improvements in the technology for the growing automotive and utility grid storage sectors.

The University of California, Los Angeles (UCLA) will use an innovative implementation of Scanning Transmission Electron Microscopy (STEM) that allows researchers to observe the crystallization and dissolution of the phases involved in the charge and discharge of a lead battery during operation at the nanoscale.

This image of Pb dendrite growth and collapse were acquired in real time with a transmission electron microscope. Certain nucleation sites consistently nucleate larger dendrites. For more information see doi:10.1021/nn3017469

This image of Pb dendrite growth and collapse were acquired in real time with a transmission electron microscope. Certain nucleation sites consistently nucleate larger dendrites. For more information see doi:10.1021/nn3017469

This pioneering work, spanning 18 months, will provide deeper understanding into sustaining these materials to deliver improved battery performance and longer lifetimes.

Prof. Chris Regan, who leads the research team from UCLA said: “Lead batteries have been a mainstay technology for more than a hundred years, but there is a significant amount that is still to be understood about the fundamental reactions occurring in this chemistry. We believe this new technique will help unlock new technological data to improve the performance potential.”

Dr Alistair Davidson, Director of CBI, said: “This kind of fundamental research is key to designing the next generation of advanced lead batteries. As demand grows for ever more sophisticated and high-performance rechargeable batteries, we are ensuring that the science supports new innovation.”

Rapid technological advances and falling costs for installed grid battery storage underpin predictions that energy storage in the U.S. alone will reach 100 GW of new energy storage by 2030. By providing flexibility for the grid and protecting against vulnerabilities, the role of batteries is central to the transition to low-carbon energy systems across the globe.

As the world’s only pre-competitive lead battery research hub, research undertaken by the Consortium has a ripple effect allowing its global membership of battery manufacturers, recyclers, material suppliers and testing institutes to benefit from new insights gained through its extensive suite of technical projects.

As demand continues apace for high-performing batteries for clean mobility and more reliable utility grid storage, CBI is undertaking groundbreaking research to continue to push the boundaries of advanced lead battery technology, building on the key research goals set out in its technical roadmap.

About CBI:

- The Consortium for Battery Innovation is the world’s only global pre-competitive research organization funding research into lead batteries for energy storage, motive and automotive applications. For more than 25 years, with its global membership of battery manufacturers, industry suppliers, research institutes and universities, CBI has delivered cutting-edge research pushing the boundaries of innovation in lead battery technology, setting the standard for advanced lead batteries and the next generation of energy storage. For more information, visit our website: www.batteryinnovation.org

Schlumberger’s outlook for stability and future growth supported by severe cost cutting measures, says GlobalData

AdministratorFollowing the release of Schlumberger’s Q2 2020 earnings call;

Effuah Alleyne, Senior Oil & Gas Analyst at GlobalData, a leading data and analytics company, offers her view:

“As with many companies in the oil and gas industry, Schlumberger has taken the approach to reduce capital spending and focus on enhancing existing performance through technology. The company’s short-term focus to re-align the business with a new, leaner organizational structure has come at a huge price as it has had to hand out severance payments to the tune of US$1bn - roughly translating to thousands of lost jobs - as well as make cut backs on infrastructure and assets. Schlumberger remains keen on executing capital discipline, allocating capital to areas of solid returns, as well as to expand its reliance on digital technology solutions – especially for reservoir evaluation.

“Severely cutting its workforce has meant digital technology has become an even more critical aspect of its new business model, with remote drilling operations increasing by 25% in Q2 and the implementation of digital inspections. Globally, the company has also fielded several digital solutions contracts geared toward increasing reservoir evaluation performance, including an agreement with ExxonMobil deploying DrillOps and DrillPlan technology. Furthermore, Schlumberger was awarded a contract by Dragon Oil that enables agile reservoir modeling through DELFI – the first partnership of its kind in the Middle East and North Africa region. With this strategy in play, Schlumberger looks to further mitigate its losses - considering its overall revenue dropped in Q2 by 28% over Q1 to US$5.4bn - but there isn’t much room however for comfort.

“Severely cutting its workforce has meant digital technology has become an even more critical aspect of its new business model, with remote drilling operations increasing by 25% in Q2 and the implementation of digital inspections. Globally, the company has also fielded several digital solutions contracts geared toward increasing reservoir evaluation performance, including an agreement with ExxonMobil deploying DrillOps and DrillPlan technology. Furthermore, Schlumberger was awarded a contract by Dragon Oil that enables agile reservoir modeling through DELFI – the first partnership of its kind in the Middle East and North Africa region. With this strategy in play, Schlumberger looks to further mitigate its losses - considering its overall revenue dropped in Q2 by 28% over Q1 to US$5.4bn - but there isn’t much room however for comfort.

“While the sharp contraction of the North American market caused a 48% decrease in revenue for Schlumberger in this region, that only accounts for less than a third of its business. Of greater concern is international revenue, which may have only decreased by 19% in Q2 over Q1, but accounts for over two thirds of the company’s market and poses a high risk - especially considering a shrinking market with project setbacks and delays, on top of no clear signs of an infusion of new capex. While focus’ on China and OPEC+ countries may yield advantageous markets, Schlumberger should consider diversifying their portfolio, perhaps considering the alternative energy market as an option.”

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make timelier and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.

Diamond Light Source, the UK’s national synchrotron science facility located in Oxfordshire, has appointed Inspec Solutions, a leading independent control, safety & automation systems supplier to the UK's energy, metals, chemicals, oil & gas and manufacturing industries, to provide Functional Safety Services across its operations.

Inspec Solutions was approached by the organisation to help meet its demanding proof test schedule as Diamond recognised the importance of effective high integrity automatic safety systems to protect hazardous processes.

Because of its expertise in delivering customer-critical infrastructure, Inspec Solutions will be able to deploy a team and begin testing, which would allow Diamond staff to focus on their core working duties.

Mark Ritson, Managing Director of Inspec Solutions, explains: “We are really excited to be working with Diamond Light Source on this important project. Diamond should save a significant amount of time by outsourcing this service. They will benefit from our ability to operate as a highly qualified independent company to verify the integrity of their safety system. By having certified Functional Safety Engineers in the team, we will provide a fresh, thorough, and ongoing review of the existing proof test procedures, highlighting opportunities for improvements.”

Diamond is one of the most advanced scientific facilities in the world and its pioneering capabilities are helping to keep the UK at the forefront of scientific research. Its technology accelerates electrons to near light speeds so that they give off light 10 billion times brighter than the sun. This allows scientists to use the light to study a vast range of subject matter, from new medicines and treatments for disease to innovative engineering and cutting-edge technology.

The Inspec Solutions team supporting Diamond includes certified TÜV Functional Safety Engineers, as well as highly experienced offshore technicians with backgrounds in supporting critical infrastructure in the UK North Sea.

Inspec Solutions has over 15 years of Functional Safety experience in many different industries, focusing on both continuous process and machinery installations.

This experience means the company can carry out proof testing on safety critical systems to a very high standard and to work with clients to improve their own procedures. Including a certified Functional Safety Engineer in the team provided a fresh and thorough review over the existing proof test procedures, highlighting opportunities for improvements.

The company provides high integrity, SIL rated systems and offers every stage of the safety lifecycle from Risk Assessment / HAZOP / LOPA, SRS, through design, installation, validation or and SIF proof testing services.

For further information please contact Inspec Solutions Ltd on This email address is being protected from spambots. You need JavaScript enabled to view it.

More details about the work of Diamond Light Source can be found at https://www.diamond.ac.uk/

Revolutionary Solid-State Batteries Will Create a $6 Billion Market in 2030

AdministratorSolid-state batteries keep on attracting tremendous attention and investment with the maturing technologies and closeness to mass production. Even with the influence of COVID-19, the potential market size is expected to grow to over $6 billion by 2030, according to IDTechEx’s report “Solid-State and Polymer Batteries 2020-2030: Technology, Patents, Forecasts, Players”.

With the potential of excellent safety, simplified battery pack design, and higher energy densities, solid-state batteries became extremely popular around 2015. In 2015, Volkswagen got a 5% stake in QuantumScape, Dyson acquired Sakti3, Bosch acquired SEEO and Johnson Battery Technologies sold its solid-state batteries to BP. More electric vehicle companies joined this game, such as BMW partnered with Solid Power, Ionic Materials worked with Hyundai, although in 2017, both Bosch and Dyson abandoned the two companies they acquired in 2015. Now in 2020, we can see lots of further interests in solid-state batteries, such as the newly developed solid-state batteries based on argyrodite electrolyte by Samsung, and a further $ 200 million investment by Volkswagen on QuantumScape. Besides the companies we just mentioned, Toyota, Honda, Nissan, Fisker, Panasonic, Samsung, CATL also get involved in this game.

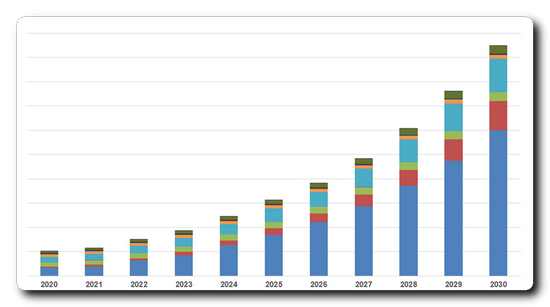

The market demand for solid-state batteries mainly comes from electric vehicles. Energy storage system, consumer electronics such as smartphones, tablets, laptops are also its targeting markets and the later may come true earlier.

Solid-state battery addressable market size. Source: IDTechEx, “Solid-State and Polymer Batteries 2020-2030: Technology, Patents, Forecasts, Players”.

Solid-state battery addressable market size. Source: IDTechEx, “Solid-State and Polymer Batteries 2020-2030: Technology, Patents, Forecasts, Players”.

With most of the companies' mass-production plans, like Japan ~2025-2030, Europe ~2025-2026, mainland China & Taiwan ~2022-1023, it is likely that solid-state batteries will take off around 2025, although small-scale production may happen even earlier. The car plug in market will take the most share (65%) in 2030, followed by smartphone applications.

With a battery market currently dominated by East Asian companies, European and US firms are striving to win this race that might, in their view, shift added value away from Japan, China, and South Korea. New material selection and change of manufacturing procedures show an indication of the reshuffle of the battery supply chain. From both technology and business point of view, the development of solid-state batteries has become part of the next-generation battery strategy. It has become a global game with regional interests and governmental supports.

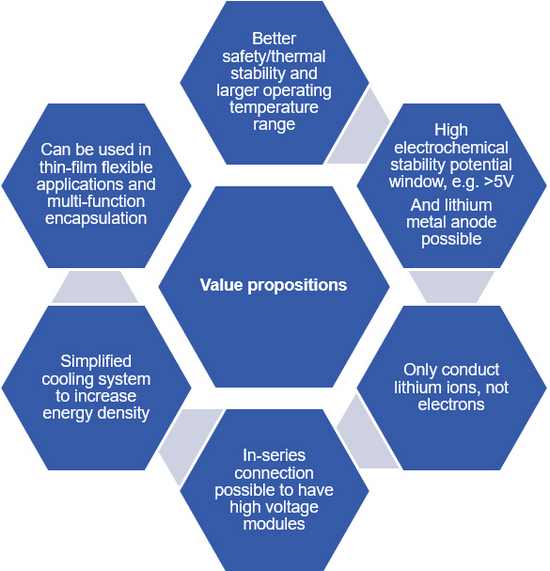

In solid-state batteries, both the electrodes and the electrolytes are solid-state. Solid-state electrolyte normally behaves as the separator as well, allowing downscaling due to the elimination of certain components (e.g. separator and casing). Therefore, they can potentially be made thinner, flexible, and contain more energy per unit weight/volume than conventional Li-ion. In addition, the removal of liquid electrolytes can be an avenue for safer, long-lasting batteries as they are more resistant to changes in temperature and physical damages that occurred during usage. Solid-state batteries can handle more charge/discharge cycles before degradation, promising a longer lifetime.

IDTechEx has identified solid-state battery technologies including solid polymer electrolyte, as well as other 8 inorganic electrolyte types such as LISICON-like, argyrodites, garnet, NASICON-like, Perovskite, LiPON, Li-Hydride and Li-Halide. Among them, the material systems based on oxide and sulfide systems stand out, together with the polymer systems, becoming the popular options in the next-generation development. Many solid polymer electrolytes, in a strict definition, should not belong to solid-state batteries. However, due to their popularity and market acceptance, IDTechEx also included them for benchmarking. Sulfide electrolytes have advantages of high ionic conductivity, even better than liquid electrolytes, low processing temperature, wide electrochemical stability window, etc. Many features make them appealing, being considered by many as the ultimate option. However, the difficulty of manufacturing and the toxic by-product that can be generated in the process make the commercialization relatively slow. IDTechEx has observed that more companies tend to focus more on the oxide system to reach a shorter time of return. This has also been reflected in the market prediction.

Value propositions of solid-state batteries. Source: IDTechEx

Value propositions of solid-state batteries. Source: IDTechEx

The IDTechEx report, “Solid-State and Polymer Batteries 2020-2030: Technology, Patents, Forecasts, Players”, covers the solid-state electrolyte industry by giving a 10-year forecast till 2030 in terms of capacity production and market size, predicted to reach over $6B. A special focus is made on winning chemistries, with a full analysis of the 8 inorganic solid electrolytes and of organic polymer electrolytes. This is complemented with a unique IP landscape analysis that identifies what chemistry the main companies are working on, and how R&D in that space has evolved during the last 5 years.

Additionally, the report covers the manufacturing challenges related to solid electrolytes and how large companies (Toyota, Toshiba, etc.) try to address those limitations, as well as research progress and activities of important players. A study of lithium metal as a strategic resource is also presented, highlighting the strategic distribution of this material around the world and the role it will play in solid-state batteries. Some chemistries will be quite lithium-hungry and put a strain on mining companies worldwide.

To better understand the solid-state battery industry for a complete analysis, please refer to IDTechEx’s report “Solid-State and Polymer Batteries 2020-2030: Technology, Patents, Forecasts, Players”, www.IDTechEx.com/SolidState or for the full portfolio of Energy Storage research available from IDTechEx please visit www.IDTechEx.com/research/ES.

IDTechEx guides your strategic business decisions through its Research, Consultancy and Event products, helping you profit from emerging technologies. For more information on IDTechEx Research and Consultancy, contact This email address is being protected from spambots. You need JavaScript enabled to view it. or visit www.IDTechEx.com.

More...

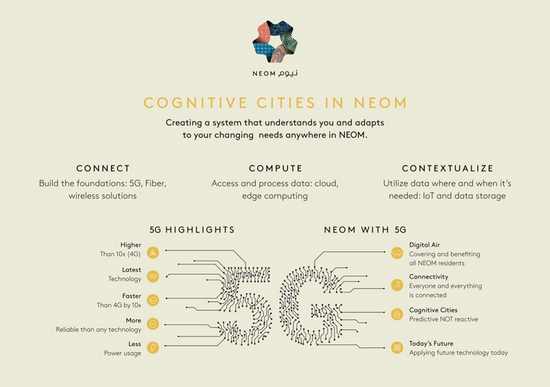

NEOM launches infrastructure work for the world’s leading cognitive cities in an agreement with stc

AdministratorNEOM Co. announced its first step to create the world’s leading cognitive cities that rely on leading technology for digital services after signing a contract with stc group to establish a 5G network infrastructure that will accelerate NEOM’s digital ambitions. In addition to the one-year contract to develop the network, the partnership also includes the development of an innovation center in NEOM to explore new 5G opportunities.

- NEOM’s next generation cognitive cities will support its cutting-edge urban environments, improving the lives of residents and businesses far beyond the capabilities of today’s smart cities.

- stc will deliver an advanced 5G and IoT network to support the development of NEOM

NEOM’s next generation cognitive cities will support its cutting-edge urban environments, improving the lives of residents and businesses far beyond the capabilities of today’s smart cities. NEOM will use one of the most advanced 5G technology in the world, to enable the proactive exchange and analysis of data between NEOM residents and city infrastructure.

stc will build a wireless 5G network enabling present and future 5G applications across NEOM. With a speed and capacity 10 times higher than standard 4G networks, 5G in NEOM will enable numerous segments such as Internet of Things (IoT), data analytics, virtual reality, augmented reality, smart homes, and autonomous vehicles. It will also provide the public safety network for NEOM security services.

Commenting on the agreement, NEOM CEO Nadhmi Al Nasr said: “We are glad to form this partnership with a leading national digital enabler such as stc to support our ambition and goal to be an accelerator of human progress and to create the world’s leading digitally sustainable, cognitive cities. NEOM’s infrastructure will utilize AI, robotics, and human-machine fusion to deliver greater predictive intelligence and enable faster decision making across all NEOM sectors. The procurement and deployment of a future-proof wireless network is a critical first for NEOM in realising our goal of driving innovation in the future digital economy.”

The CEO of stc Group, Eng. Nasser bin Sulaiman Al Nasser, added: “This agreement reflects stc’s commitment to enabling digital transformation and providing digital solutions across the Kingdom. We are proud to have been chosen to build the infrastructure for the 5G network and an innovation centre in NEOM - the land of the future and a model for sustainability, innovation, development, and prosperity. This agreement comes in line with stc’s vision as a digital enabler to develop infrastructure and provide the latest technologies that will enrich the experience of societies and foster innovation, which in turn will contribute to improve the customer experience and moving the digital transformation forward.

NEOM will also trial and test 5G solutions that will allow it to lead in fast-growing, future-focused sectors such as robotics, Artificial Intelligence (AI), and human machine interface technologies. Leveraging such technology will open up the enormous potential of NEOM as a new economic driver across a range of industry sectors for the Kingdom.

About NEOM

NEOM is an accelerator of human progress and a vision of what a New Future might look like. It is a region in northwest Saudi Arabia on the Red Sea being built from the ground up as a living laboratory – a place where entrepreneurship will chart the course for this New Future. It will be a destination and a home for people who dream big and want to be part of building a new model for exceptional livability, creating thriving businesses, and reinventing environmental conservation.

NEOM will be the home and workplace to more than a million residents from around the world. It will include hyperconnected, cognitive towns and cities, ports and enterprise zones, research centers, sports and entertainment venues, and tourist destinations. As a hub for innovation, entrepreneurs, business leaders and companies will come to research, incubate and commercialize new technologies and enterprises in ground-breaking ways. Residents of NEOM will embody an international ethos and embrace a culture of exploration, risk-taking and diversity - all supported by a progressive law compatible with international norms and conducive to economic growth.

Han® S: Reliable connections for modular energy storage systems

AdministratorNew series features housings accommodating a heavy-current contact up to 200 A

HARTING is now offering the Han® S, the first ever large-scale special connector for battery storage modules. The new series meets the technical requirements set down in the latest standards for stationary energy storage systems (including UL 4128) and offers users optimal reliability for connected units. The series features housings with space for a heavy-current contact up to 200 A.

The contacts are mounted in a housing, which is freely pivotable. The locking system engages intuitively. The use of red for plus and black for minus, combined with the mechanical coding system, means that the interfaces cannot be confused. Han® S thereby facilitates fast and reliable mating for energy storage modules and helps to process high numbers of connections. Alternatively, the new series can also be installed as part of a control line (BUS system) for the battery management system. It features special contacts in the housing to support this.

Han® S is the new, reliable connection technology for modular battery storage systems. The compact and flexible housings offer space for contacts up to 200 A.

Han® S is the new, reliable connection technology for modular battery storage systems. The compact and flexible housings offer space for contacts up to 200 A.

Interfaces in modular energy storage systems are subject to special requirements. For instance, the wiring for lithium-ion batteries requires compact plug connections that do not heat their surroundings even when transmitting high currents. The connector housing must move as freely as possible to serve storage units effectively in terms of enhancing performance and efficient cooling.

The Han® S series combines straight attachment housings with angled ‘sleeves’ that have integrated pivotable protective elements for the contacts. This combination can be rotated 360°, a key feature given the very limited space between the door opening and energy storage modules in a storage cabinet. This results in flexible connectors with high current load capacity, enabling the integration of the maximum number of storage components in the available space.

Han® S as a connecting element in energy storage cabinets (Tesvolt).

Han® S as a connecting element in energy storage cabinets (Tesvolt).

Further information:

www.harting.com/UK/en-gb/connector-battery-storage

About HARTING:

The HARTING Technology Group is one of the world's leading providers of industrial connection technology for the three lifelines of Data, Signal and Power and has 14 production plants and 44 sales companies. Moreover, the company also produces retail checkout systems, electromagnetic actuators for automotive and industrial series use, charging equipment for electric vehicles, as well as hardware and software for customers and applications in automation technology, mechanical and plant engineering, robotics and transportation engineering. In the 2018/19 business year, some 5,300 employees generated sales of EUR 750 million. Founded on 1 September 1945, the company celebrates its 75th anniversary in 2020.

For further information visit https://www.harting.com/UK/en-gb

~ Highlighting some of the companies helping in the fight against COVID-19 ~

The response from the engineering industry to help in the fight against COVID-19 has been overwhelming. Companies from all sectors have stepped up to produce everything from ventilators and face masks to hand gels and more. Here, Jeremy Whittingham, head of community and content at Advanced Engineering UK, highlights some of the generosity shown across the industry.

In the last stanza of Rudyard Kipling’s poem If, he writes, “If you can fill the unforgiving minute / With sixty seconds’ worth of distance run, / Yours is the Earth and everything that’s in it." There is no doubt that the COVID-19 crisis has been unforgiving and unrelenting. At the same time, however, it has also shown the compassion and generosity of engineering and manufacturing businesses and individuals in equal measure.

In factories, kitchens, bedrooms and living rooms across the world, those with the means and the equipment, no matter how small, have been 3D printing, assembling and delivering PPE and other essential supplies to hospitals, care homes and frontline staff, around the clock.

Worcestershire based Central Scanning began 3D printing 500 face visors at the end of March 2020, the first batch of which went to Queen Elizabeth Hospital in Birmingham. When production quickly fell short of demand, the company purchased an injection moulding machine to produce in excess of 4,000 parts a day. This included the production of valve adaptors for use on hospital equipment used in the fight against COVID-19.

Essex based CNC machine manufacturer Blackman & White used the spare capacity in its demo room in Maldon to make face visors. The 28–strong company explained that its, “Orion and Genesis V machines can use dual motion control, state-of-the-art routers and laser capabilities to produce 300 units every day”.

Further afield, Berlin based Leica Microsystems donated an advanced microscopy system to the Charité Institute of Virology in Berlin. The THUNDER 3D Live Cell imaging system will be used by scientists to deliver faster results and make the analysis of images easier, uncovering more information about the structural detail of the studied cells.

This is part of the research group’s aim to “develop clinical strategies to treat the disease, by investigating how the virus enters cells, what exactly happens when human respiratory cells are infected, and how antiviral drug candidates would work”.

For those that want to help but lack the means to make PPE, a company called 3D Hubs can help. The global platform for distributed manufacturing explains, “If you are an engineer designing parts for COVID-19 related projects, but lacking the funds and production facilities to manufacture the parts, we invite you to apply to the COVID-19 Manufacturing Fund.

“If your project is accepted, we’ll ensure you receive the money, access to our global manufacturing network, as well as expert DfM feedback on your designs.”

Not only do these examples highlight the level of engineering excellence in the sector, they also show just how the community has pulled together in this difficult time. From everyone at Advanced Engineering UK, thank you.

These and other companies will be exhibiting in one of six show zones at Advanced Engineering UK, the UK’s largest annual gathering of OEMs and engineering supply chain professionals, from November 4-5, 2020 at the NEC in Birmingham. Find out more at www.advancedengineeringuk.com

Chevron Corporation has just announced that it has entered into a definitive agreement with Noble Energy, Inc. (NASDAQ: NBL) to acquire all of the outstanding shares of Noble Energy in an all-stock transaction valued at $5 billion, or $10.38 per share. Based on Chevron’s closing price on July 17, 2020 and under the terms of the agreement, Noble Energy shareholders will receive 0.1191 shares of Chevron for each Noble Energy share. The total enterprise value, including debt, of the transaction is $13 billion.

The acquisition of Noble Energy provides Chevron with low-cost, proved reserves and attractive undeveloped resources that will enhance an already advantaged upstream portfolio. Noble Energy brings low-capital, cash-generating offshore assets in Israel, strengthening Chevron’s position in the Eastern Mediterranean. Noble Energy also enhances Chevron’s leading U.S. unconventional position with de-risked acreage in the DJ Basin and 92,000 largely contiguous and adjacent acres in the Permian Basin.

“Our strong balance sheet and financial discipline gives us the flexibility to be a buyer of quality assets during these challenging times,” said Chevron Chairman and CEO Michael Wirth. “This is a cost-effective opportunity for Chevron to acquire additional proved reserves and resources. Noble Energy’s multi-asset, high-quality portfolio will enhance geographic diversity, increase capital flexibility, and improve our ability to generate strong cash flow. These assets play to Chevron’s operational strengths, and the transaction underscores our commitment to capital discipline. We look forward to welcoming the Noble Energy team and shareholders to bring together the best of our organizations.”

“Our strong balance sheet and financial discipline gives us the flexibility to be a buyer of quality assets during these challenging times,” said Chevron Chairman and CEO Michael Wirth. “This is a cost-effective opportunity for Chevron to acquire additional proved reserves and resources. Noble Energy’s multi-asset, high-quality portfolio will enhance geographic diversity, increase capital flexibility, and improve our ability to generate strong cash flow. These assets play to Chevron’s operational strengths, and the transaction underscores our commitment to capital discipline. We look forward to welcoming the Noble Energy team and shareholders to bring together the best of our organizations.”

“This combination is expected to unlock value for shareholders, generating anticipated annual run-rate cost synergies of approximately $300 million before tax, and it is expected to be accretive to free cash flow, earnings, and book returns one year after close,” Wirth concluded.

“The combination with Chevron is a compelling opportunity to join an admired global, diversified energy leader with a top-tier balance sheet and strong shareholder returns,” said David Stover, Noble Energy’s Chairman and CEO. “Over the last few years, we have made significant progress executing our strategic objectives, including driving capital efficiency gains onshore, advancing our offshore conventional gas developments and significantly reducing our cost structure. As we looked to build on this positive momentum, the Noble Energy Board of Directors and management team conducted a thorough process and concluded that this transaction is the best way to maximize value for all Noble Energy shareholders. We look forward to bringing together our highly complementary cultures and teams to realize the long-term value and benefits that this combination will deliver.”

Transaction Benefits

- Low Cost Acquisition of Proved Reserves and Attractive Undeveloped Resource: Based on Noble Energy’s proved reserves at year-end 2019, this will add approximately 18 percent to Chevron’s year-end 2019 proved oil and gas reserves at an average acquisition cost of less than $5/boe, and almost 7 billion barrels of risked resource for less than $1.50/boe.

- Strong Strategic Fit: Noble Energy’s assets will enhance Chevron’s portfolio in:

- U.S. onshore

- DJ Basin – New unconventional position with competitive returns that can be further developed leveraging Chevron’s proven factory-model approach.

- Permian Basin – Complementary acreage that enhances Chevron’s strong position in the Delaware Basin.

- Other – An integrated midstream business and an established position in the Eagle Ford.

- International

- Israel – Large-scale, producing Eastern Mediterranean position that diversifies Chevron’s portfolio and is expected to generate strong returns and cash flow with low capital requirements.

- West Africa – Strong position in Equatorial Guinea with further growth opportunities.

- U.S. onshore

- Attractive Synergies: The transaction is expected to achieve run-rate operating and other cost synergies of $300 million before-tax within a year of closing.

- Accretive to Return on Capital Employed, Free Cash Flow, and EPS: Chevron anticipates the transaction to be accretive to ROCE, free cash flow and earnings per share one year after closing, at $40 Brent.

Transaction Details

The acquisition consideration is structured with 100 percent stock utilizing Chevron’s attractive equity currency while maintaining a strong balance sheet. In aggregate, upon closing of the transaction, Chevron will issue approximately 58 million shares of stock. Total enterprise value of $13 billion includes net debt and book value of non-controlling interest.

The transaction has been unanimously approved by the Boards of Directors of both companies and is expected to close in the fourth quarter of 2020. The acquisition is subject to Noble Energy shareholder approval. It is also subject to regulatory approvals and other customary closing conditions.

The transaction price represents a premium of nearly 12% on a 10-day average based on closing stock prices on July 17, 2020. Following closing of the transaction, Noble Energy shareholders will own approximately 3% of the combined company.

Advisors

Credit Suisse Securities (USA) LLC is acting as financial advisor to Chevron. Paul, Weiss, Rifkind, Wharton & Garrison LLP is acting as legal advisor to Chevron. J.P. Morgan Securities LLC is acting as financial advisor to Noble Energy. Vinson & Elkins LLP is acting as legal advisor to Noble Energy.

About Chevron

Chevron Corporation is one of the world's leading integrated energy companies. Through its subsidiaries that conduct business worldwide, the company is involved in virtually every facet of the energy industry. Chevron explores for, produces and transports crude oil and natural gas; refines, markets and distributes transportation fuels and lubricants; manufactures and sells petrochemicals and additives; generates power; and develops and deploys technologies that enhance business value in every aspect of the company's operations. Chevron is based in San Ramon, Calif. More information about Chevron is available at www.chevron.com.

About Noble Energy

Noble Energy is an independent oil and natural gas exploration and production company committed to meeting the world’s growing energy needs and delivering leading returns to shareholders. The Company operates a high-quality portfolio of assets onshore in the United States and offshore in the Eastern Mediterranean and off the west coast of Africa. Founded more than 85 years ago, Noble Energy is guided by its values, its commitment to safety, and respect for stakeholders, communities and the environment. For more information on how the Company fulfills its purpose: Energizing the World, Bettering People’s Lives®, visit www.nblenergy.com.