Super User

ArcelorMittal announces CAD$205 million decarbonisation investment in its flagship Canadian mining operations with support from the Quebec government

At an event held at COP26, ArcelorMittal (‘the Company’) and the government of Quebec announced a CAD$205 million investment by ArcelorMittal Mining Canada (‘AMMC’) in its Port-Cartier pellet plant, enabling this facility to convert its entire [1] 10 million tonne annual pellet production to direct reduced iron (‘DRI’) pellets by the end of 2025.

The investment, in which the Quebec government will contribute through an electricity rebate of up to CAD$80 million, will enable the Port-Cartier plant to become one of the world’s largest producers of DRI pellets, the raw material feedstock for ironmaking in a DRI furnace. The project includes the implementation of a flotation system that will enable a significant reduction of silica in the iron ore pellets, facilitating the production of a very high-quality pellet.

The project will deliver a direct annual CO2e reduction of approximately 200,000 tonnes at AMMC’s Port-Cartier pellet plant, equivalent to over 20% of the pellet plant’s total annual CO2e emissions. This reduction in CO2e emissions will be achieved through a reduction in the energy required during the pelletising process.

A DRI plant uses natural gas to reduce iron ore, resulting in a significant reduction in CO2 emissions compared with coal-based blast furnace ironmaking. In Hamburg, Germany, ArcelorMittal is trialing replacing natural gas with hydrogen to make DRI, with its industrial scale pilot project anticipated to be commissioned before the end of 2025. The DRI installations the Company has announced it is developing in Belgium, Canada and Spain are all being constructed to be hydrogen-ready, so as and when green hydrogen is available in sufficient quantities at affordable prices the Company can produce DRI with near zero-carbon emissions.

Approximately 250 jobs are expected to be created during the construction phase of the project in Port-Cartier, which is scheduled to be begin mid-2023 and complete before the end of 2025.

Expressing the Quebec government’s support for the project, Premier François Legault said:

“With this project, the Port-Cartier plant will become one of the world's largest producers of direct reduction pellets. The market is increasingly evolving towards this technology. We are therefore ensuring that ArcelorMittal will continue to create wealth in Quebec for many years. We are positioning our regions at the heart of the green economy of tomorrow. My message to companies looking for a place to reduce their GHG emissions is come and see us. We'll help you carry out your projects promptly. Quebec is the best place in the world to invest in the green economy. To build together a greener, more prosperous and prouder Quebec.’’

Aditya Mittal, ArcelorMittal CEO, said:

“This project has an important role to play in our efforts to reduce our group’s CO2e emissions intensity by 25% by 2030, and our longer-term ambition to reach net zero by 2050. Not only does it deliver a significant reduction in our emissions at AMMC, but it also expands our ability to produce high-quality direct reduced iron pellets, which we will need in significant volumes as we transition to DRI-EAF steelmaking at our steel plants in Canada and Europe.

“I am grateful to Premier Legault and his government for the support it is providing in realising this project. It is the first significant decarbonisation project we have announced for our mining business and fitting that we are able to make this announcement at COP26 as it exemplifies the transformational change we need to deliver this decade as we move towards becoming a carbon-neutral business.”

Mapi Mobwano, CEO, ArcelorMittal Mining Canada, added:

“This investment will see us become one of the biggest direct reduction pellet producers in the world, thereby propelling ArcelorMittal Mining Canada into the forefront of mining and steel decarbonisation. From 2025 onwards we will have the capacity to produce ten million tonnes of very high-quality iron oxide pellets, with low silica content and high iron density, which will be highly strategic in the years ahead. This transformation will enable us to reduce our own current emissions by 200,000 tonnes of CO2e per year – equivalent to removing 57,600 cars from the road each year. Moreover, it will support a significant reduction in the carbon footprint of primary steelmaking. These pellets are the feedstock for DRI-EAF steelmaking, which given its significantly lower carbon footprint is expected to replace a significant amount of blast furnace capacity in the coming decades. It also provides a boost to the local economy and community as 250 jobs will be created for the construction phase which will start in the summer of 2023.”

[1] AMMC’s pellet plant currently produces 10 million tonnes of pellets annually, of which 7 million tonnes are blast furnace pellets and 3 million tonnes are direct reduced iron pellets

About ArcelorMittal

ArcelorMittal is the world's leading steel and mining company, with a presence in 60 countries and primary steelmaking facilities in 17 countries. In 2020, ArcelorMittal had revenues of $53.3 billion and crude steel production of 71.5 million metric tonnes, while iron ore production reached 58.0 million metric tonnes. Our goal is to help build a better world with smarter steels. Steels made using innovative processes which use less energy, emit significantly less carbon and reduce costs. Steels that are cleaner, stronger and reusable. Steels for electric vehicles and renewable energy infrastructure that will support societies as they transform through this century. With steel at our core, our inventive people and an entrepreneurial culture at heart, we will support the world in making that change. This is what we believe it takes to be the steel company of the future. ArcelorMittal is listed on the stock exchanges of New York (MT), Amsterdam (MT), Paris (MT), Luxembourg (MT) and on the Spanish stock exchanges of Barcelona, Bilbao, Madrid and Valencia (MTS). For more information about ArcelorMittal please visit: http://corporate.arcelormittal.com/

Brenntag achieved outstanding results in the third quarter 2021 in still persisting exceptional market conditions

Brenntag (ISIN DE000A1DAHH0), the global market leader in chemicals and ingredients distribution, reports outstanding results in the third quarter 2021 in still persisting exceptional market conditions. Both divisions continue to deliver strong results with Brenntag Specialties in particular showing an excellent performance. The company’s transformation program Project Brenntag progresses according to plan and already contributed around 70 million EUR of additional operating EBITDA since the inception of the program.

Christian Kohlpaintner, Chief Executive Officer of Brenntag SE, said: “In the third quarter of 2021, Brenntag achieved outstanding results with both our two global divisions Brenntag Essentials and Brenntag Specialties contributing strongly to this performance. The unusual and challenging market conditions continued in Q3, and we expect to see them persisting well into 2022. To secure availability of products and keeping customers operating remain key priorities for Brenntag in this environment. We want to thank all our employees for their great performance and strong commitment in these special times.”

In the third quarter 2021, Brenntag generated sales of 3,738.2 million EUR. Operating gross profit rose by 23.7% to 862.3 million EUR compared to 695.2 million EUR in previous year’s quarter. Operating EBITDA reached 342.9 million EUR, a strong year-on-year increase of 29.7%. Earnings per share totaled 1.02 EUR compared to 0.76 EUR a year ago which is an increase of 34%.

In the third quarter 2021, Brenntag generated sales of 3,738.2 million EUR. Operating gross profit rose by 23.7% to 862.3 million EUR compared to 695.2 million EUR in previous year’s quarter. Operating EBITDA reached 342.9 million EUR, a strong year-on-year increase of 29.7%. Earnings per share totaled 1.02 EUR compared to 0.76 EUR a year ago which is an increase of 34%.

Georg Müller, Chief Financial Officer of Brenntag SE, said: “In the third quarter 2021, Brenntag continued on its successful path. While we achieved strong results in both of our global divisions, we are particularly delighted about the development of our Earnings per Share, which rose strongly by more than 34% to 1.02 EUR compared to 0.76 EUR in the third quarter 2020.”

Both divisions continue to deliver strong results

In the third quarter, Brenntag Essentials again showed a strong performance. In line with the long-term expectations, Brenntag Specialties grew stronger than Brenntag Essentials and delivered excellent results.

The Brenntag Essentials division which markets a broad portfolio of process chemicals across a wide range of industries again delivered strong results in the third quarter 2021. The division reached an operating gross profit of 520.2 million EUR (+19.5%). Operating EBITDA increased by 28.7% to 210.3 million EUR compared to the prior-year period. The EMEA, Latin America and particularly North America regions contributed to this positive performance. The business development in Asia Pacific was severely impacted by renewed and strict COVID-19 lockdowns in countries such as Thailand, Vietnam, and Indonesia, as well as dual control measures in China to reduce specific energy consumption and greenhouse gas emissions.

The Brenntag Specialties division which builds on Brenntag’s position as the largest specialty chemicals distributor worldwide, again delivered excellent results in third quarter 2021. The division achieved an operating gross profit of 334.3 million EUR (+30.1%). Operating EBITDA rose by 42.3% to 152.9 million EUR compared to the previous year’s quarter. These remarkable results are due to a broad-based positive performance across all focus industries. In the Americas region, Brenntag Specialties showed particularly strong results.

Project Brenntag makes very good progress

The implementation of the comprehensive transformation program Project Brenntag is going according to plan and makes very good progress since the launch of the new operating model in January 2021. Since its inception, Project Brenntag already contributed around 70 million EUR of additional operating EBITDA which is expected to ramp up to 220 million EUR annually by 2023. Additionally, the optimization of Brenntag's global site network is ongoing. Of the around 100 planned site closures, 68 have been completed to date. Furthermore, since the initiation of the program, more than 740 jobs have structurally been reduced out of approximately 1,300 planned over two years in a socially responsible manner. Brenntag is in close dialogue with the works councils in the different countries.

Chief Financial Officer Georg Müller not to extend his mandate

Georg Müller, Brenntag's long-standing Chief Financial Officer, has informed the Supervisory Board that he will not extend his mandate beyond his current term ending March 2022. Georg Müller has been a constant for the company holding various management positions over the last almost 20 years, thereof ten years as CFO. Brenntag is, also thanks to his work, the global market leader in chemicals and ingredients distribution. In particular, he contributed extensively over many years to Brenntag’s financial strength and its excellent reputation in the equity and debt capital markets. The Supervisory Board is currently conducting a structured and thorough succession process.

Outlook confirmed despite critical disruptions in global supply chains

Brenntag confirms its operating EBITDA guidance to be in the range of 1,260 million to 1,320 million EUR for the financial year 2021 (previously: 1,160 million to 1,260 million EUR). The guidance was raised twice this year, and takes into account organic growth, the expected efficiency gains from Project Brenntag, and the contribution to earnings from already closed acquisitions at the time of the guidance increase. It is based on the assumption that exchange rates will remain stable on the level at the time of the guidance upgrade. Brenntag expects the exceptional and challenging market conditions persisting well into 2022.

*Operating gross profit is defined as sales less cost of goods sold.

**Unless indicated otherwise, growth rates are on a constant currency basis.

***Brenntag presents operating EBITDA before holding charges and special items. Holding charges are certain costs charged between holding companies and operating companies. At Group level, these effects net to zero. Brenntag is also adjusting operating EBITDA for income and expenses arising from special items so as to improve comparability in presenting the performance of its business operations over multiple reporting periods and explain it more appropriately. Special items are income and expenses outside ordinary activities that have a special and material effect on the results of operations, such as restructurings.

About Brenntag:

Brenntag is the global market leader in chemicals and ingredients distribution. The company holds a central role in connecting customers and suppliers of the chemical industry. Headquartered in Essen, Germany, Brenntag has more than 17,000 employees worldwide and operates a network of more than 670 sites in 77 countries. In 2020, Brenntag generated sales of around 11.8 billion EUR. The two global divisions, Brenntag Essentials and Brenntag Specialties, provide a full-line portfolio of industrial and specialty chemicals and ingredients as well as tailor-made application, marketing and supply chain solutions, technical and formulation support, comprehensive regulatory know-how, and digital solutions for a wide range of industries. In the field of sustainability, Brenntag pursues specific goals and is committed to sustainable solutions in its own sector and the industries served. Brenntag shares have been listed at the Frankfurt Stock Exchange since 2010, initially in the MDAX and since September 2021 in the DAX. In addition, the Brenntag SE shares are listed in the DAX 50 ESG and DAX ESG Target. For more information, For more information, visit www.brenntag.com

Alfa Laval is part of the new Long Duration Energy Storage Council to accelerate carbon neutrality

At COP26 in Glasgow, UK, Alfa Laval announced its participation in the Long Duration Energy Storage (LDES) Council. Formed by technology companies, users and investors to achieve grid net-zero by 2040, the council will support governments, grid operators and major electricity users in adopting the most cost-effective energy storage solutions to replace the use of fossil fuels.

To achieve decarbonization, significant efforts must be made to reduce emissions across all sectors. The power sector, which accounts for roughly one-third of global emissions, is central to global decarbonization and will need to achieve net-zero emissions by 2040. Long duration energy storage can cost-effectively store electricity from wind, solar and other renewable sources and then make it available when needed. (Lithium-ion batteries offer an alternate solution but become too expensive for storage durations beyond eight hours.).

To achieve decarbonization, significant efforts must be made to reduce emissions across all sectors. The power sector, which accounts for roughly one-third of global emissions, is central to global decarbonization and will need to achieve net-zero emissions by 2040. Long duration energy storage can cost-effectively store electricity from wind, solar and other renewable sources and then make it available when needed. (Lithium-ion batteries offer an alternate solution but become too expensive for storage durations beyond eight hours.).

The LDES Council was established by 25 founder members including Alfa Laval, BP, Breakthrough Energy Ventures, ESS Inc and Siemens Energy. On November 23, 2021, the LDES Council will publish its first annual report on the need for long duration energy storage in order to reach net-zero carbon emissions.

“We are very pleased to be part of this council which will facilitate the transition towards more sustainable energy supply,” says Thomas Møller, President of the Energy Division, Alfa Laval. “We are contributing our expertise but also our heat exchanger technology which plays an important role in developing ideas into commercially viable alternatives. The coming report shows that LDES will make a big difference on the route towards decarbonization.”

Did you know… The LDES Council envisions approximately 10 percent of all energy being stored in long duration storage technologies, requiring 85-140 TWh of deployed capacity, equivalent to the yearly electricity production of around 14 000 wind turbines.

About the LDES Council

The LDES Council is a global, CEO-led body comprising technology providers, equipment providers, renewable energy companies, utilities, grid operators, investors, and end-consumers. It strives to accelerate decarbonization of the energy system at lowest cost to society by driving innovation, commercialization and deployment of long duration energy storage. The LDES Council provides fact-based guidance and information to governments, industry and broader society, drawing from the experience of its members which include leading energy companies, technology providers, investors and end-users.

This is Alfa Laval

Alfa Laval is a world leader in heat transfer, centrifugal separation and fluid handling, and is active in the areas of Energy, Marine, and Food & Water, offering its expertise, products, and service to a wide range of industries in some 100 countries. The company is committed to optimizing processes, creating responsible growth, and driving progress to support customers in achieving their business goals and sustainability targets.

Alfa Laval’s innovative technologies are dedicated to purifying, refining, and reusing materials, promoting more responsible use of natural resources. They contribute to improved energy efficiency and heat recovery, better water treatment, and reduced emissions. Thereby, Alfa Laval is not only accelerating success for its customers, but also for people and the planet. Making the world better, every day.

Alfa Laval has 16,700 employees. Annual sales in 2020 were SEK 41.5 billion (approx. EUR 4 billion). The company is listed on Nasdaq Stockholm.

BUCKMAN ANNOUNCES NEW SUITE OF IMMERSIVE DIGITAL TECHNOLOGY

Buckman, the specialty chemical company known for its relentless focus to deliver innovative solutions for customers in paper manufacturing, water treatment, process chemistry, and leather processing, announced a new suite of immersive digital technology that combines artificial, augmented, and mixed reality capabilities. Supported by Buckman’s expanding Ackumen™ platform, Ackumen Connected Reality enables Buckman personnel and customers to see, collaborate and solve problems remotely, dramatically reducing response time, errors, costs, and downtime.

“The pandemic only magnified the need for us to be able to collaborate and solve problems remotely,” said Dr. NM Rao, chief digital officer of Buckman. “Ackumen Connected Reality enables us to provide our customers with access to subject matter experts anywhere in the world to resolve, in just hours, issues that may have otherwise taken weeks with an in-person visit.”

“The pandemic only magnified the need for us to be able to collaborate and solve problems remotely,” said Dr. NM Rao, chief digital officer of Buckman. “Ackumen Connected Reality enables us to provide our customers with access to subject matter experts anywhere in the world to resolve, in just hours, issues that may have otherwise taken weeks with an in-person visit.”

Beyond collaborating remotely, Ackumen Connected Reality leverages 3D models and holograms that enable customers to make accurate space planning and logistical decisions prior to equipment installation, ensuring a smooth and surprise-free set-up which saves time and money from the start. Additionally, Ackumen Connected Reality provides documented guidance and access to expert advice via augmented reality technology so customers can solve routine maintenance, repairs, and operations (MRO) issues faster.

“We anticipate the continued need for remote collaboration post-pandemic and are excited about being able to offer this to our customers.” said Rao.

To learn more about Ackumen Connected Reality from Buckman, visit

https://www.buckman.com/smart-technology/ackumen-connected-reality/

About Buckman

Buckman is completely committed to helping our customers succeed, regardless of the challenges facing them, the industry they operate in or their location in the world. To fulfill that commitment, we surround our rigorously trained industry experts with the highest-quality chemicals, the latest smart technology, and advanced data analysis. All focused on helping our customers’ operations improve productivity, increase profitability, and ensure safety, compliance, and sustainability. That is more than chemistry. That is Chemistry, connected.

SAS, Vattenfall, Shell and LanzaTech to explore synthetic sustainable aviation fuel production

Vattenfall, SAS, Shell and LanzaTech will together investigate the production of the world’s first synthetic sustainable aviation fuel (SAF) using the LanzaJetTM “Alcohol to Jet” technology on a large scale in Sweden. Instead of using virgin fossil material in the production process, the synthetic SAF will be produced from fossil free electricity and recycled carbon dioxide from district heating.

The goal is that a new production facility will produce up to 50,000 tonnes of synthetic SAF annually, provided that an investment decision is made at a later stage. The synthetic SAF, also known as electrofuel, will be produced from fossil free electricity and recovered carbon dioxide using the LanzaJet “Alcohol to Jet” technology, developed by LanzaTech and the U.S Department of Energy’s Pacific Northwest National Laboratory (PNNL). When full production is up and running it could provide SAS with up to 25 per cent of its global demand for sustainable aviation fuel in the 2030s.

A joint study has shown promising conditions for the project, and all partner companies now agree to carry out in-depth analyses. The ambition is to commission the new production facility sometime between 2026 and 2027 near Forsmark on Sweden's east coast.

"SAS and Sustainability go hand in hand. That’s why we are incredibly proud to be part of this unique project where ambitious sustainability goals and agendas come together. Our joint commitment in finding ways to enable large-scale production of a more sustainable aviation fuel is a fantastic opportunity to accelerate the commercialization of SAF, and thus SAS’s transition towards industry-leading zero-emission flights,” says Anko van der Werff, President and CEO, SAS.

"This initiative shows the potential of cross industry partnerships to drive the decarbonization of a hard-to-abate sector. To innovate faster in order to bridge to a fossil free living within one generation. This is a really good opportunity and together we will explore further how to produce low emission electrofuel for aviation,” says Anna Borg, President and CEO, Vattenfall.

"Sustainable aviation fuel offers the greatest potential to reduce emissions from aviation. It is only by working together today across the aviation ecosystem to drive the technologies and infrastructure needed to produce SAF at scale that the aviation sector can achieve net zero by 2050. This is why I am excited for this collaboration to explore one more pathway for SAF production,” says Anna Mascolo, President, Shell Aviation.

“The aviation sector faces incredible challenges getting the volumes of SAF needed for sustainable flight. This project is the start of delivering on these volumes and by reusing carbon dioxide and fossil free power we have an opportunity for unprecedented scale. We need to rethink carbon and together with fossil free power, harness it to create a new climate safe future for all,” says Jennifer Holmgren, CEO LanzaTech.

The aim of the project is to get the production of electrofuel started in Sweden. The companies have signed a Memorandum of Understanding and agreed that Vattenfall will investigate fossil free electricity supply, hydrogen production and carbon dioxide recovery. Shell will investigate fuel production, logistics and be the electrofuel buyer. LanzaTech will provide its gas fermentation expertise to make ethanol from the input gas streams and parties will license the LanzaJet “Alcohol to Jet” technology to convert the ethanol to electrofuel. SAS will participate as a potential buyer of the electrofuel.

Facts:

- Electrofuel is one type of SAF (Sustainable Aviation Fuel).

- In contrast to fossil feedstock, fossil free electricity, recycled carbon dioxide and water will be the only inputs to the process of making electrofuel. Electricity will mainly be used to make hydrogen via electrolysis. Carbon dioxide plus hydrogen can be converted by LanzaTech’s process into ethanol which is then converted via the LanzaJet Alcohol to Jet process to the aviation electrofuel.

- Rather than be released, the carbon dioxide from a district heating facility will be captured and used for electrofuel production. When electrofuel is combusted by aircraft engines, the captured carbon dioxide is released into the atmosphere after being utilized a second time. The raw materials planned to be used are fossil free electricity from the Swedish electricity grid and carbon dioxide collected from Vattenfall’s combined heat and power plant in Uppsala, where approximately 200,000 tonnes of carbon dioxide can be recovered per year.

- Today’s aircraft are certified to fly with a maximum of 50% SAF depending on production pathway and the remainder with traditional aviation fuel.

- Our annual planned SAF production of 50,000 ton would strongly contribute to the Swedish national targets of a fossil free domestic air travel and corresponds to about 30% of the needed Jet fuel to reach that target.

About Vattenfall

Vattenfall is a leading European energy company, which for more than 100 years has electrified industries, supplied energy to people’s homes and modernised our way of living through innovation and cooperation. We now want to make fossil-free living possible within one generation. That's why we are driving the transition to a sustainable energy system through initiatives in renewable production and climate smart energy solutions for our customers. We employ approximately 20,000 people and have operations mainly in Sweden, Germany, the Netherlands, Denmark and the UK. Vattenfall is owned by the Swedish state. For more information: corporate.vattenfall.se

About SAS

SAS, Scandinavia’s leading airline, with main hubs in Copenhagen, Oslo and Stockholm, flies to destinations in Europe, the USA and Asia. Spurred by a Scandinavian heritage and sustainable values, SAS aims to be the global leader in sustainable aviation. To achieve net zero carbon emissions on its domestic markets in 2030 and on a global level before 2050, SAS will, over the coming years, source a growing share of SAF, both through its self-supply at the main hubs but also through into-plane suppliers at the locations from which SAS operates. Further information is available at www.sasgroup.net

About Shell

Shell is an international energy company with operations divided across Upstream, Integrated Gas and Renewable and Energy Solutions and Downstream. We are partnering with customers, businesses, and others to address emissions, including in sectors that are difficult to decarbonise such as aviation, shipping, road freight and industry. Shell aims to produce around 2 million tonnes of SAF by 2025, and by 2030, it aims to have at least 10% of global aviation fuel sales as SAF.

About LanzaTech

LanzaTech harnesses the power of biology and big data to create climate-safe materials and fuels. LanzaTech has created a platform that converts waste carbon into new everyday products that would otherwise come from virgin fossil resources. LanzaTech’s first commercial scale gas fermentation plant has produced over 27M gallons of ethanol which is the equivalent of keeping over 130,000 metric tons of CO2 from the atmosphere. Additional plants are under construction globally. Further information is available at www.lanzatech.com.

LOGISTEC USA orders two Konecranes Gottwald Generation 6 Mobile Harbor Cranes to reduce marine carbon footprint in Florida

Leading North American terminal operator LOGISTEC USA Inc. (LOGISTEC) has ordered two new eco-efficient Generation 6 Konecranes Gottwald Mobile Harbor Cranes for their terminal at the Port of Manatee in Tampa Bay, Florida, USA. The order, booked in August, will be handed over by February 2022.

LOGISTEC operates 80 terminals in 54 ports across North America. The company handles all kinds of cargo, and their terminal at the Port of Manatee deals mostly with containers, pallets, steel and break-bulk. In the light of their continued commitment to the port, they are anticipating increasing levels of container traffic.

“With the arrival of our two new electric drive cranes from industry-leader Konecranes, we will be serving our customers in an eco-friendly way. These new additions to our fleet of cargo handling equipment are well aligned with our focus on reducing our marine carbon footprint in support of our Green Marine initiatives. This is great news for our customers, our community and the environment in Port Manatee,” said Rodney Corrigan, President of LOGISTEC USA Inc.

“2021 marks 50 years of Konecranes presence in the Americas, and this order from LOGISTEC is a good illustration of the strength of our long-term partnerships in the region,” says Alan Garcia, Sales Manager, Port Solutions, Region Americas for Konecranes. “The order also shows clearly that our new Generation 6 cranes are living up to their potential in the market, offering high performance and reliability while lowering fuel costs and reducing emissions.”

The two new Generation 6 cranes will be Konecranes Gottwald ESP.7 Mobile Harbor Cranes, with a working radius of up to 51 m and a lifting capacity of 125 t. These cranes are the natural successors of the two Generation 5 cranes already on-site. They feature a higher tower cab for a better view of the vessels in port and stronger lifting capacity curves for improved handling performance and a higher classification, which doubles their service life in container handling operations. Their on-board drive follows the strict EPA Tier 4 final standards. It’s a smart hybrid drive combining a diesel engine with optimized fuel consumption and an ultracap. This allows for both eco-efficient operation and peak performance when necessary.

A strong focus on customers and commitment to business growth and continuous improvement make Konecranes a lifting industry leader. This is underpinned by investments in digitalization and technology, plus our work to make material flows more efficient with solutions that decarbonize the economy and advance circularity and safety.

Konecranes is a world-leading group of Lifting Businesses™, serving a broad range of customers, including manufacturing and process industries, shipyards, ports and terminals. Konecranes provides productivity enhancing lifting solutions as well as services for lifting equipment of all makes. In 2020, Group sales totaled EUR 3.2 billion. The Group has around 16,500 employees in 50 countries. Konecranes shares are listed on the Nasdaq Helsinki (symbol: KCR).

Norway: TotalEnergies, Iberdrola and Norsk Havvind join forces for offshore wind development

TotalEnergies, Iberdrola and Norsk Havvind have joined forces to respond to the Norwegian authorities' call for tenders for the development of floating and bottom-fixed wind projects for a cumulated capacity of 4.5 GW at two offshore sites in southern Norway.

The consortium will leverage in its offer the proven technical expertise of its members in both bottom fixed and floating offshore wind, as well as its in-depth knowledge of the challenges, territories and stakeholders in Norway. Besides, on successful award, the consortium will focus on strengthening the local industrial competencies and ensuring the successful development of the Norwegian offshore wind supply chain.

"Investing in energy projects in Norway and the North Sea has been at the heart of TotalEnergies' history for several decades, especially in developing the offshore industry. As a global multi-energy company, TotalEnergies is therefore delighted to join forces with Iberdrola and Norsk Havvind to develop Norway's great offshore wind potential”. said Olivier Terneaud, VP offshore wind at TotalEnergies. “The energy transition is gathering speed and Norway, with its world-class wind resources, is a great place to invest in new energy”.

“This agreement in Norway fits with Iberdrola's strategy to consolidate its position as the world's largest renewable energy company and builds on previous transactions and investments in offshore wind carried out by the company in recent years. We see very good long-term potential for offshore wind projects in the Norwegian market and are determined to strengthen skills and the supply chain in the North Sea offshore wind industry,” said David Rowland, Offshore Wind Business Development Director at Iberdrola.

“Together with our partners Iberdrola and TotalEnergies we will work hard to develop the Norwegian offshore wind industry, reduce emissions and create new jobs for the Norwegian supply chain”, said Peder Sortland, CEO at Norsk Havvind.

TotalEnergies and offshore wind

TotalEnergies is already developing a portfolio of offshore wind projects with a total capacity of more than 6 gigawatts, of which 2/3 are bottom-fixed and 1/3 are floating. These projects are located in the United Kingdom (Seagreen project, Outer Dowsing, Erebus), South Korea (Bada project), Taiwan (Yunlin project), and France (Eolmed project). The Company has also been qualified to participate in competitive tenders in the US, UK, France, Denmark and Norway.

TotalEnergies and renewables electricity

As part of its ambition to get to net zero by 2050, TotalEnergies is building a portfolio of activities in renewables and electricity. At the end of September 2021, TotalEnergies' gross renewable electricity generation capacity is 10 GW. TotalEnergies will continue to expand this business to reach 35 GW of gross production capacity from renewable sources by 2025, and then 100 GW by 2030 with the objective of being among the world's top 5 producers of electricity from wind and solar energy.

About TotalEnergies

TotalEnergies is a global multi-energy company that produces and markets energies on a global scale: oil and biofuels, natural gas and green gases, renewables and electricity. Our 105,000 employees are committed to energy that is ever more affordable, cleaner, more reliable and accessible to as many people as possible. Active in more than 130 countries, TotalEnergies puts sustainable development in all its dimensions at the heart of its projects and operations to contribute to the well-being of people.

About Iberdrola

Iberdrola is one of the world's biggest energy companies, a leader in renewables, which is spearheading the energy transition to a low carbon economy. The group supplies energy to almost 100 million people in dozens of countries. It carries out renewables, networks and commercial activities in Europe (Spain, the United Kingdom, Portugal, France, Germany, Italy and Greece), the United States, Brazil, Mexico and Australia, and, as growth platforms, it is present in markets such as Japan, Ireland, Sweden and Poland, among others.

With a workforce of more than 37,000 and assets in excess of €122.5 billion, in 2020, it achieved a turnover of €33 billion and a net profit of over €3.6 billion. The company contributes to sustain 400,000 jobs along its supply chain, with annual procurement of €14 billion. A benchmark in the fight against climate change, it has allocated more than €120 billion over the last two decades to building a sustainable energy model, based on sound environmental, social and governance (ESG) principles.

About Norsk Havvind

Norsk Havvind is a newly formed independent project developer for offshore wind. The company is majority owned by Valinor. Valinor, through its subsidiary Norsk Vind, has been the leading private developer of onshore wind parks in Norway. Valinor has also invested in early-stage investments in cutting-edge technology companies to enable solutions for tomorrow. The now listed Zaptec AS is one example.

Research institute launches global fund for the removal of previously emitted greenhouse gases

A new fund based in Norway launched yesterday will finance research into technologies that can be used to remove greenhouse gases from the atmosphere and oceans.

As you read this, the first seaweeds in the world cultivated for the purpose of absorbing CO2 before being buried under the sea floor are being planted in the sea off Trondheim in Mid-Norway.

This project is part of a family of climate change mitigation technologies towards the development of which SINTEF, one of Europe’s largest independent research organisations, is now asking players all over the world to contribute.

We are talking about technologies that remove greenhouse gases from natural oceanic and atmospheric cycles.

Launching at the COP26 Climate Change Summit

Launching at the COP26 Climate Change Summit

Research in this field is currently grossly underfunded, but is essential if climate change mitigation targets are to be met.

With the aim of financing research into such technologies SINTEF is launching a global ‘Climate Fund’ during the COP26 Climate Change Summit in Glasgow. SINTEF is injecting NOK 21 million into the fund and is inviting contributions from external donors.

Necessary according to scenarios

The reason for this initiative is that even major reductions in man-made emissions will not be sufficient to fully mitigate climate change. Reductions on their own will not be able to limit global warming to one and a half degrees.

Human beings have already emitted so great a volume of greenhouse gases that, according to all realistic scenarios, we will also have to ‘suck’ significant amounts of previously emitted CO2 from the atmosphere and oceans.

A new-born market needs a midwife

Major players such as Microsoft are currently promoting the creation of an emerging market for the technologies we need. The company has earmarked significant sums for the purchase of technologies that can ‘take back’ the greenhouse gases that it has emitted during its years of operation.

“However, there are too few of these technologies available, and those that exist are either inadequate or at too small a scale”, says SINTEF CEO Alexandra Bech Gjørv. “There is also a lack of financial backing for studies that can further advance and commercialise the many conceivable but as yet unrealised technologies in this field”, she says.

It is precisely studies such as these that charitable organisations, the business community and donors across the world are now getting the opportunity to support by injecting capital into the recently established fund, as compensation for their own emissions.

An appeal to organisations and the business community

On the international stage, the company Climeworks is well underway with its project to suck CO₂ directly out of the air.

Here in Norway, the company Fortum has planned to use chemicals to capture CO2 from the waste and energy recycling facility at Klemetsrud in Oslo, and then to sequester the gas in porous rock reservoirs below the seabed on the continental shelf. Since residual waste is for the most part plant-based, this process will also remove CO2 from natural cycles.

The aim of the recently established Climate Fund is to finance investigations into other concepts addressing the removal of CO2 gas that has already been emitted. The fund’s assets will be used to finance research that SINTEF is taking responsibility for carrying out. All the research will be peer-reviewed by international experts.

Backing from a major bank

Just before the fund’s launch in Glasgow, the Norwegian bank SpareBank 1 SMN has announced that it will be the first external investor here in Norway.

“It is a liberating feeling from our point of view to be able to put money into a fund that will be financing targeted climate change mitigation initiatives so close to home” says bank CEO Jan-Frode Janson. “It all serves to further strengthen our awareness and legitimacy. By being the first to invest in the Climate Fund, we hope that SpareBank 1 SMN will be helping to show the way and that we can encourage other companies, both in mid-Norway and across the country, to contribute. We choose to view this as a challenge”, he says.

Seaweed graveyards

The use of seaweeds in the fight to mitigate climate change forms part of three of the five projects that are already being financed by the fund, and which are looking into opportunities to create climate friendly ‘graveyards’ for the seaweeds.

“At SINTEF, we have already come a long way in the development of a technology for the cultivation of seaweeds in marine facilities”, explains Senior Researcher Jorunn Skjermo.

“Seaweeds are similar to other marine plants in that they absorb the CO2 that is dissolved in seawater. “However, if we are to remove these CO2 molecules from natural cycles, we also have to prevent their re-emission when the seaweed rots, is eaten or is uncontrollably burned.

Essential environmental studies of sea floor impacts

According to Skjermo, one way of achieving this is to lower the cultivated seaweeds to great depths, financed by climate quotas.

“We’re talking about depths greater than one thousand metres”, she explains. “Although even here the seaweeds will be broken down to release greenhouse gases. However, these will remain at depth because water in the deeper strata of the ocean does not mix with that in the upper layers. But before we can all start lowering seaweed into the ocean on a large scale, we must identify methods that are guaranteed not to cause local negative environmental impacts on the sea floor. It is this aspect of the process that we are currently studying”, says Skjermo.

Bio-coal for agriculture

In parallel with these studies, SINTEF is also looking into the potential of converting seaweeds into a biocoal similar to wood-derived coal. This coal can be dispersed on land, possibly in agricultural fields and meadows. But not simply just to lie there without releasing CO2. It can probably also be used to improve agricultural soils.

A wide range of technologies

SINTEF is also currently financing its own studies into other possibilities. These include the following:

* New uses of carbon from your household waste. SINTEF is looking into the possibility of using ash generated by energy recycling facilities similar to that at Klemetsrud to capture CO2. The ash is then made into concrete building blocks.

* Removal of CO2 from seawater. Indirectly, this is the same process as is used to remove CO2 from the air because seawater itself carries CO2 from the atmosphere in solution and because the oceans and the atmosphere are in equilibrium. The process that SINTEF is aiming to exploit is similar to that which takes place when a soda bottle is opened and the fizzy liquid inside starts to bubble. The idea involves the use of a vacuum and ultrasound to release the CO2, which is then sequestered in deeply buried geological reservoirs.

* Exploiting phytoplankton to promote carbon capture. Phytoplankton are single-celled plants that account for almost half of all photosynthesis that takes place on Earth. The idea here is to stimulate the accelerated growth of phytoplankton, either by providing them with nutrients using bag and pipe systems on land or at sea, or by bringing deep, nutrient-rich water up to the surface where the plankton are exposed to the sun. Both of these methods will boost CO2 capture. Afterwards the plankton can either be allowed to sink to the sea floor, or be collected for subsequent sinking or conversion into biocoal.

Contacts:

Alexandra Bech Gjørv

CEO, SINTEF

E-mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

Tel.: +47 918 06193

Jorunn Skjermo

Senior Research Scientist, SINTEF

E-mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

Tel.: +47 982 45 040

Jan-Frode Janson

CEO, SpareBank 1 SMN

E-mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

Tel.: +47 909 75183

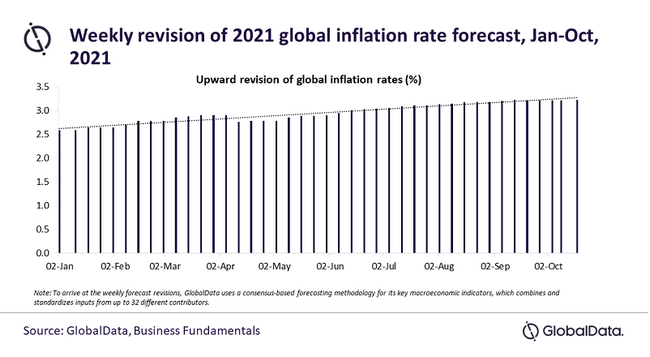

Higher energy prices to drive up global inflation to 3.23% in 2021, says GlobalData

The shortage of coal has resulted in higher production costs for manufacturing companies, and the global inflation rate is forecasted to rise from 2.50% in 2020 to 3.23% in 2021 as a result. GlobalData has also upwardly revised its 2021 global inflation rate forecast to 3.23% in October 2021. The leading data and analytics company notes that this is an upward revision of 0.22 percentage points when compared with the June 2021 projections.

Gargi Rao, Economic Research Analyst at GlobalData, comments: “With many countries reopening their economies, manufacturers in China are witnessing a surge in demand for their goods. Rising demand, coupled with soaring costs of raw materials amid production cuts of coal, is driving up global prices of goods. Further, China’s commitment to becoming carbon neutral by 2060 has added pressure on the reduction of coal production, thereby leading to a supply-demand mismatch. As a result, GlobalData has downwardly revised China’s GDP growth by 0.57 bps from its June 2021 forecast to 8.11% in October 2021.”

Rao continues: “Amid the global energy crunch, India is also facing a power crisis, with the country's power plants running on critically low coal stocks. Meanwhile, the UK witnessed many of its fuel pumps running dry due to poor logistics. Natural gas prices have also risen multifold in Europe.”

With China and India’s growth forecast downwardly revised, the Asia-Pacific (APAC) region’s economic recovery is ambiguous. Global economies are facing a perfect storm ahead of a cold winter, rising energy prices and a spike in commodity prices. In the short term, such a trend might deter consumer spending and impact post-pandemic recovery.

Rao adds: “Despite Asian industries dependence on coal, major countries including China, India and South Korea are focusing more on renewable energy.

“Technology already exists to enable the world to transition away from coal and other fossil fuels to green energy. Germany, which is one of the world’s biggest users of coal, is aiming to phase out coal by 2038. Eight other EU countries have also committed to similar targets. The recent crisis around coal has highlighted that countries have an opportunity to shift to green energy and reduce their dependence on coal.”

- Quotes provided by Gargi Rao, Economic Research Analyst at GlobalData

- The information is based on GlobalData’s Macroeconomic database.

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.

Granite River Labs partners with Rohde & Schwarz for new state-of-the-art high-speed digital compliance test laboratory in Germany

Granite River Labs (GRL), a global leader in engineering services and test solutions for connectivity and charging, has just announced the opening of its new lab in Karlsruhe, Germany. Located in a major technology hub about one hour from Stuttgart and Frankfurt, GRL’s new state-of-the-art lab supports the growing needs of the automotive, medical and industrial automation industries in Europe to validate and troubleshoot high-speed connectivity and charging interfaces. These interfaces include automotive Ethernet, HDMI, USB, MIPI and DDR, as well as USB Power Delivery and Qi wireless charging.

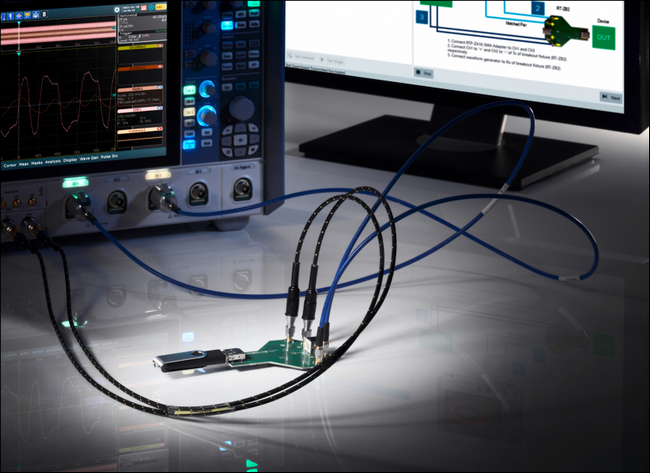

Industry-leading test solutions from the global supplier Rohde & Schwarz will be an integral component of GRL’s new compliance test and certification capabilities. With the recently launched R&S RTP164 oscilloscope, GRL’s enhanced European lab is able to offer de-bugging & standards-compliant certification of a wide range of established and future high-speed digital technologies, including 1000BASE-T1, MultiGigabit automotive Ethernet, USB 2.0 and SuperSpeed USB, HDMI, MIPI D-PHY, DDR and more. The R&S RTP high-performance oscilloscope combines unrivalled signal integrity analysis capabilities with the fastest acquisition rate for debugging in the market. Real-time functions such as the built-in 16 GHz serial pattern trigger with true hardware-based CDR and real-time de-embedding make this oscilloscope stand out in its class.

The R&S RTP164 oscilloscope will be an integral component of GRL’s new compliance test and certification capabilities. (Source: Granite River Labs)

The R&S RTP164 oscilloscope will be an integral component of GRL’s new compliance test and certification capabilities. (Source: Granite River Labs)

“Germany is the centre of innovation for Connected Car technologies for automotive networking, infotainment, charging and power management,” said Holger Kunz, President of Worldwide Services for Granite River Labs. “Additionally, medical equipment and industrial automation applications are rapidly adopting new connectivity and communications technologies to create the next generation of products and solutions. Rohde & Schwarz is an ideal partner that will enable GRL to leverage deep technical expertise and support the entire European product development ecosystem in adopting new technologies.”

“GRL’s European facility will enable us to accelerate the development of our chips that support the evolution of electronic devices to meet consumer demand,” said Dr. Amin Shokrollahi, CEO and Founder of Kandou. “We value our partnership with GRL whose expertise is helping us realize our goal as a leader in high-speed and energy efficient chip-to-chip link solutions that revolutionize wired connectivity.”

Dr. Nik Dimitrakopoulos, Market Segment Manager Automotive at Rohde & Schwarz said, “We are extremely pleased to partner with GRL, one of the leading test and engineering services companies worldwide, and empower them to offer first-class compliance test for existing and future high-speed digital communications. We are proud to contribute to this valuable testing resource serving the automotive and industrial community in Europe.”

The world’s leading Engineering Services and Test Automation Solutions firm for connectivity and charging, GRL helps engineers solve tough design and validation challenges. GRL began in 2010 with a vision to provide affordable test services to help hardware developers implement digital interface technologies as they become faster, more complex, and more challenging to test. Today, GRL has worked with hundreds of companies supporting the adoption of new and emerging technologies from our worldwide test facilities and R&D centers. GRL’s combination of market-leading technical expertise, broad capabilities across connectivity and charging technologies, and intense focus on quality and customer service excellence has led to rapid growth and recognition as the “go to” expert. For more information, visit www.graniteriverlabs.com

The Rohde & Schwarz technology group is among the trailblazers when it comes to paving the way for a safer and connected world with its leading solutions in test & measurement, technology systems, and networks & cybersecurity. Founded more than 85 years ago, the group is a reliable partner for industry and government customers around the globe. On June 30, 2020, Rohde & Schwarz had around 12,300 employees worldwide. The independent group achieved a net revenue of EUR 2.58 billion in the 2019/2020 fiscal year (July to June). The company is headquartered in Munich, Germany.

R&S® is a registered trademark of Rohde & Schwarz GmbH & Co. KG.