Administrator

VIEWPOINTS - Internet of Things to be a game-changer in 2014

Process Industry Trends: Viewpoint from Gareth Dean, UK sales director, Rockwell Automation:

It’s an exciting time for anyone involved in industrial automation – and I’m looking forward to seeing how the most disruptive technologies are applied by the most forward thinking companies in 2014

I firmly believe some of the developments will be game-changers. In an industry full of buzz-words and phrases, one particular phrase has risen to the top and encompassed many of the trends of recent years.

The Internet of Things (IoT) is far from simply the summit of progress in convergent technologies and connected components and the like. Rather, it is the beginning of almost limitless opportunities for those able to harness the power of mobile, cloud, big data and ‘smart things’ (connected devices and components) in a secure way to improve output, throughput or efficiency.

Our global CEO Keith Nosbusch presented a keynote speech to the Cisco Internet of Things World forum last October, which gave a more detailed view of what IoT means, especially from a manufacturing perspective, and Paul Brooks, our global business development manager, recently spoke on the same topic at Cisco Live! in Milan.

At Rockwell Automation we talk about IoT within the context of The Connected Enterprise. So why is The Connected Enterprise2 an important trend for 2014 and beyond? The context is important, as is the understanding that sustainability is an inherently global consideration in a competitive world of finite resources.

The global consumer population is growing. With more than 70 million people crossing to the middle class every year, emerging market consumerism is set to increase global appetite to the tune of 30% more water, 100% more vehicles, 80% more steel and 150% more energy by 2020 (source McKinsey).

This incredible growth will lean heavily on manufacturing and industrial processes to deliver – and to deliver more efficiently than ever before. It’s a time of great growth and opportunity for global industry and IoT principles and technology will be central to delivering it all in a sustainable way.

Industry must accelerate the adoption of the key IoT technologies such as mobile, cloud, big data and ‘smart things’ to deliver lower cost of ownership, better asset utilisation through predictive maintenance, improved reliability and quality, better lifecycle management, more effective operators, improved energy management and easier technology migration.

We are just scratching the surface of what is possible as the applications of Internet of Things technology and principles are limitless and will continue to unfold throughout 2014 and beyond.

More than a trend worth watching in 2014, IoT will be the nervous system of the industry of tomorrow.

For more information from Rockwell Automation about the IoT and related developments see the company's Connected Enterprise resource (external website link).

TECHNOLOGY - Big data providing new insights

PIM Technology Trends: Viewpoint from Tristan Jones, regional marketing engineer, industrial & embedded systems, at National Instruments UK & Ireland:

In industrial monitoring and control applications, engineers and scientists can collect vast amounts of data in short periods of time to address reliability, availability, serviceability and manageability (RASM) of costly assets.

Large gas turbine manufacturers report that test data, from instrumented electricity generating turbines, generate over 10 terabytes of data per day.

In one asset monitoring application cited in the October 2013 Automation World article, “Big Data: Sweat the Little Stuff,” 152,000 sensor samples are taken every second, accumulating up to 4 trillion samples in a single year.

But the amount of data is not the only trait of big data.

In general, big data is characterised by a combination “Vs”—volume, variety, velocity and value. An additional “V,” visibility, is emerging as a key defining characteristic. That is, a growing need among global corporations for geographically dispersed access to business, engineering and scientific data.

For example, process engineers at plants in South America and China may need access to each other’s data to conduct comparative analysis. This results in demand for network and cloud-based IT systems, to be closely coupled to DAQ systems.

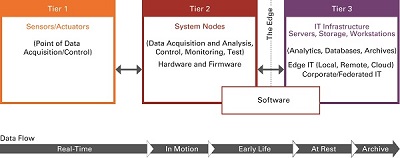

Specifically, engineers are looking at three-tier architectures, as depicted in the figure below, to create a single, integrated solution that adds insight from the real-time capture at the sensors to the analytics at the back-end IT infrastructures.

The data flow starts in tier 1 at the sensor and is captured in tier 2 system nodes. These nodes perform the initial real-time, in-motion, and early-life data analysis. In the tier 3 IT infrastructure, servers, storage and networking equipment manage, organise and further analyse the early-life or at-rest data.

Through the stages of data flow, the growing field of big data analytics is generating never-before-seen engineering and business insights and solving problems in key application areas such as machine condition asset monitoring.

For more information about Big Analog Data solutions visit ni.com/biganalogdata and more top technology trends at ni.com/trendwatch (external websites).

Pumps help food waste-to-energy business to expand

As potato and arable crop farmers who diversified into cold storage, bioenergy and recycling, Mike and Tim Roe’s journey into anaerobic digestion shows the value of selecting the right type of equipment at energy-from-waste facilities.

The father and son team, who are based in Bridgwater, Somerset, first ventured into cold storage in 1997, growing their business from around 200 pallets of cheese and fruit juice to over 3500 pallets stored per week.

This eventually brought about the need to move to a much larger site, with today over 10,000 tonnes of fruit juice and food ingredients stored at -14C to ambient temperatures. These quantities, however, led to much higher energy bills, which as with the global trend, have been rising steadily, year-in, year-out.

“Addressing an annual electricity bill in the region of a quarter of a million pounds became a big priority”, said Tim Roe, managing director at Cannington Enterprises, the parent company of Cannington Cold Stores, Cannington Bio Energy and Cannington Recycling Services.

“We thought there had to be a way of generating electricity from our farm land. Agricultural commodity prices were very low at the time and wind/solar tariffs weren’t around. Facing an energy gap, we had to do something, so we decided to take charge of our own destiny by building an AD plant”.

Tim remembers that with little AD knowledge around in the services industry, planning in 2008 proved pretty fraught to say the least. He says that people tended to form their own ‘uninformed opinions’ – and still do to some extent.

When planning did go through, Tim and Mike initially installed two digesters - a third six months later - in 2009, using corn silage from their farm as feedstock, plus some limited liquid waste.

Different feedstocks

“At first we were producing around 700kW”, added Tim, “which was certainly encouraging against the 300kW of power needed at the time to run the site.

"We designed our process so that it would have the flexibility for different feedstocks, installing a Landia POP-I mixer at the front end to keep solids in suspension for the main reception tank, and later a submersible Landia chopper pump feeding out of that into a feedstock holding tank.

"We’ve always been willing to test different pumps, so this Landia unit actually replaced our initial choice from a different pump manufacturer, which proved ineffective in handling the corn”.

Cannington’s AD process was working more than adequately, but in 2011 Tim and Mike chose to raise the stakes by switching exclusively from corn to food waste, which decomposes twice as quickly to produce the all-important gas much faster.

They installed two additional CHP engines to boost AD output to 1.3MW. Food waste now arriving at Cannington is shredded and de-packaged before liquids are added en route to the reception tank where the Landia POP-I mixer first handles the material (17-20% dry matter content).

Unlike many other biogas operations, there is a post-pasteurisation process at the end of the system, whereby organic waste must be heated to 70 degrees for at least one hour.

For Cannington’s pasteuriser there is also a wall-mounted POPTR-I mixer that Landia managed to install using the existing man-way, which removed the need for any additional refurbishment work. There is also a dry-mounted high-pressure MPTK-I chopper pump from Landia that has proved a key part of the operation by significantly accelerating batch times.

Tim Roe continued: “The first pump we had could manage the 35-metre head required to make the final discharge to our digestate lagoons, but it would take 24 hours and suffer from significant wear and tear.

"The Landia MPTK chopper, which also has to pump 250m horizontally as well as 35m vertically, is far more resilient and does the same job in just two and a half hours, which has created major benefits all the way back down the production line”.

Cannington have carried out 99% of the AD work themselves, making considerable savings and allowing fine tuning to their own particular requirements. Over 600,000 tonnes of dirt has been moved to facilitate the AD plant, which is very well screened from the road.

From truckloads of bulk material from food processors to collecting single wheelie bins form schools, restaurants and pubs, Cannington now process 60,000 tonnes of food waste a year. The company’s flexibility and willingness to help as an almost third party disposal/recycling center has created very good relationships with an increasingly wide customer base.

Income from waste and the AD-generated electricity that’s sold onto the UK’s National Gird now accounts for about half of Cannington’s income. 2.3MW is generated, with around 1.35MW exported to the grid after approximately 700kW is used to power the site. But it doesn’t end there.

“By the end of this year we will have a further three digesters”, added Tim. “These will mainly be for storage to stabilise and strengthen the quality and quantity of our continuous process – and we can also harness more gas from them.

Digestate from the end of the AD process also presents Cannington Enterprises with opportunities beyond renewable energy generation, with Tim and Mike, ever looking for improvement, hoping to set up their own on-site laboratory in the not too distant future to further monitor the quality of the final product.

“We’ve been using the digestate on our farm land to great effect,” said Tim, “but we’re now in a position where we have farmers queuing up for it because the nutrients in it make such a good organic fertiliser. This is another expanding part of our business and part of the joined up environmental thinking that we’re proud of”.

Mexico issues power plant contract tender

Mexico's state-owned power utility CFE has issued a major international tender on the power sector, UKTI has signalled. The response deadline is 17 April.

The winning company will be in charge of developing a combined cycle power plant and to deliver design, engineering, material and equipment supply, construction, installation, trials, technical support, freight, insurance, taxes, and customs fees and manage customs relationship.

All deliverables will aim for a secure and efficient operation of the power plan to be named 298 CC Valle de Mexico.

The power plant will have a net guaranteed capacity of 543.26 +/- 15% MW, summer conditions design, use natural gas a fuel, include 2-3 gas/combustion turbo generators, 2-3 heat recuperators, a steam turbine, cooler system, and all needed equipment of develop a combined cycle plant.

The project will also include underground electrical cable to connect to a 230kV substation. This substation will be launched in a separate tender.

Can growth in US shale gas be sustained?

Article by Ryan Clark, senior business manager, Progressive Global Energy & Natural Resources:

With the US oil and gas market taking centre stage over the past five years, the US continues to be a driving force within the industry.

Due in large part to the dramatic development of unconventional oil & gas across the region, technological advancements and the exploration of new resources have led to a shift in the global landscape of the industry.

But with the US shale revolution expected to require investment in excess of $5 trillion over the next 20 years is this growth sustainable?

With a mixed backdrop that has seen a dip in the gas rig-count, but continued investment in CAPEX projects in key strategic areas such as the Gulf of Mexico, the market remains buoyant with a positive outlook. Private Equity investment in SME oil and gas firms has created further stability and an influx of new jobs as a result.

The shale gas revolution is undoubtedly the biggest driver of growth across the region. Showing no signs of abating, and with much of the 19 recognised basins still in early exploratory or development stages, the volume of shale gas is set to rise exponentially. With many firms turning from dry gas to the production of liquid shale gas in order to increase profitability we've seen demand grow for specialists within this area.

Building workforces for long-term

Whilst the outlook for the sector looks positive, the industry faces a new potential threat - a lack of labour and skills to meet long-term resourcing requirements. A lack of mid-senior level specialists created by previous boom and bust oil cycles, and a subsequent lack of investment in career planning and training has led to an impending skills shortage.

Organisations now face the dilemma of balancing short-term operational and strategic needs with the long-term requirement to bring in new generations of specialists with the view to creating a sustainable workforce that will counter-balance the loss of valuable talent as they reach retirement age.

The shortage of mid-career level specialists has driven salaries up to unsustainable levels in some areas, which has resulted in organisations looking for other solutions to plug the shortfall of talent.

This has included organisations looking to international markets in order to bring in the additional resources required, however, with tight mobilisation restrictions changes to government legislation will be required if this is to prove a viable solution over the long-term.

Canada also offers a potential untapped market for talent and may well be an option to be considered if the US is to sustain its projected growth.

With measures to address the skills shortage including new college courses and re-training programmes, the industry is already implementing actions that could soon see a pipeline of new talent coming through that could serve the region for generations to come.

The outlook for specialists

Post-Macondo the industry has and will continue to become much more heavily regulated, which is creating new opportunities across the HSEQ discipline. Demand for specialists has remained high across the sector, particularly across key strategic roles that drive oil company performance such as geo-science and drilling.

On the whole the market outlook is bouyant with project pipelines extending beyond 12 months and many of the largest organisations still investing in CAPEX. This continued investment, coupled with the high demand for specialists means there are substantial opportunities for professionals across the industry, particularly contractors as organisations look to manage project requirements.

Serious about European competitiveness? Go for shale gas

Opinion piece by Cefic director general Hubert Mandery, published on the EurActiv policy news site:

Competitiveness now attracts as much attention here in Brussels as climate and environment policy. For the first time, the European Council will hold a summit devoted exclusively to industrial competitiveness, and rightly so.

The debate over shale gas will be a part of that. The European Commission is poised to release a framework for the extraction of unconventional gas locked in the region’s sub-strata. Getting the right answers on these issues is crucial to re-energizing a continent paralysed by feeble growth.

Across the Atlantic, a shale gas revolution is sweeping the United States, helping re-vitalise an economy where gross domestic product (GDP) expanded at an annualised rate of 2.8 per cent in the third quarter and unemployment has eased to 7.3 per cent.

Pioneering exploitation of unconventional gas reserves has put the New World back on course for energy self-sufficiency, lowered the cost of energy and industrial feedstock, and unleashed $100 billion of investment in new chemical industry capacity, not to mention the billions worth of investment in other sectors.

Meantime the European economy is only now slowly emerging from recession. Eurostat predicts no growth in 2013 and an uptick of only 1.4 per cent in 2014, whilst unemployment hovers at 11 per cent.

Chemicals are the start-point for a swathe of industrial value chains, from automotive to construction and cleaning products. Hampered by high energy and feedstock costs, there is a growing risk that to stay competitive, European producers will be obliged to invest where inputs are cheaper, or watch others gobble their markets, destroying European jobs.

Europe needs to give itself a chance to compete. Exploration of Europe’s undoubted shale gas potential has been hesitant, held back by environmental concerns, the reluctance of citizens to have drilling rigs for neighbours, and legal regimes that fail to reward landowners and communities for aiding the development of reserves.

Yet, a newly-completed study by independent consultants for the International Association of Oil & Gas Producers suggests that extracting shale gas could add 1.1 million new jobs in Europe by 2050 and bolster GDP by up to €3.8 trillion. Shale gas could replace declining output from Europe’s conventional fields, reducing dependence on imports, improving security of supply and putting downward pressure on prices.

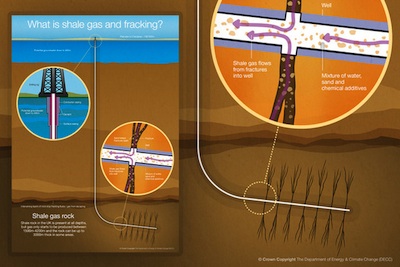

Sceptics argue that pumping chemical-laced water into bedrock to fracture it and release gas can pollute ground-water, trigger minor seismic shocks, and blight the lives of those who live near wells. Such concerns are not to be taken lightly. But each can be addressed. At EU and national level, we have sound regulations already in place and best industry practices that build on decades of US experience.

In reality, though much water is used, fracking 100 wells, as being talked about in the United Kingdom, would require a volume of water equal to just 0.03 per cent of that used there annually. Seismic shocks can be contained by prudent operation. The volumes of chemicals used are tightly-controlled. And consents can require protection of aquifers and the wellbeing of neighbours.

The economic health of Europe and its citizens should not, as so often in the past, be sacrificed to fear. The commission’s shale gas framework must require high standards, but it must also be enabling.

José Manuel Barroso, president of the commission, has promised recommendations on competitiveness to the European Council in February. For jobs and growth to be delivered, industrial competitiveness must be integrated within every policy initiative whether it concerns the environment, climate, energy or any other field.

Renewing Europe’s industrial competitiveness, like everything in the political and business world, will take resolution and courage. It is up to European leaders to take the lead and show they are serious about competitiveness. What they do with shale gas will show whether they are willing to walk – or merely talk.

Dresser-Rand's demos small-scale LNG unit

Dresser-Rand Group Inc. has recently started up its first small-scale LNG plant, known as LNGo is said to allow for very small stand-alone plants that can be moved to support changing needs.

Standard LNGo plants are sized to produce around 6,000 gallons of LNG per day.

There is substantial Dresser-Rand scope potential in this offering including its newly introduced MOS reciprocating compressor, Guascor engines, Enginuity control systems, and project management to integrate all of these and the process components into compact, portable packages.

"Our development process began in earnest less than one year ago," explained Dresser-Rand president & CEO Vincent Volpe. "Our organisation has taken the process and designed, built and commissioned an entire plant, with a target capacity of 6,000 gallons per day."

On the commercial front, Volpe said the company has lined up many potential clients, with over 90 qualified leads for plants that would either be for sale or for lease."

In the "for sale" category, the company would provide the liquefaction process and, depending upon the plant configuration, potentially also include the associated ancillary gas processing equipment, a power module and full turn-key installation and commissioning.

In the "rental" or "lease" space, the company is evaluating several market strategies, including potential market channel partners, and expects that, over the coming weeks, it will determine which approach is expected to create the greatest shareholder value.

For all users, Dresser-Rand said it can provide full turn-key installation and commissioning services as well as routine operations, monitoring, and maintenance contracts to ensure ongoing reliable and available operations.

"Now that we have produced LNG with our demonstration plant, we are in the enviable position of imminent market launch," said Volpe. "As such, we expect orders to be placed for the first several units either late in 2013 or early next year.

"Given the short cycle times that we embedded into our production plans, we believe that anticipated orders booked in the next several months will convert to shipments in 2014. As those units are placed into service and gain operating experience and run time, we believe that the incoming stream of orders will then progressively grow over time."

Target upstream applications include, to increase revenues for oil companies seeking to monetise flared gas and reduce its environmental impact; the production of stranded natural gas fields, which are not close to existing pipeline infrastructure; on-site fuel supply for drilling and hydraulic fracturing equipment converted to run on LNG, and applications for coal bed methane for fuelling mining vehicles.

Downstream applications include the production of vehicle-grade LNG, allowing LNG to compete effectively with diesel fuel on a cost-per-energy-content (BTU) basis.

As LNGo plants enable the "distributed" production of LNG on a small-scale, the technology eliminates the need for the costly trucking of LNG long distances from large, centralised plants to LNG fueling depots, as is the practice today.

Dresser-Rand predicts that the market for distributed, small-scale LNG production plants will grow from early adopters in North America to a broad market for users around the world.

North America is the most rapidly growing market and the substantial price disparity between diesel fuel and low priced natural gas has oil-field service operators, oil and gas companies, shipping and delivery companies, and downstream fuel distributors/marketers across the region converting drilling rigs, industrial mining equipment, transportation fleets and retail fueling stations along the US interstate highway system to LNG fuel.

Triple boost for UK shale gas sector

Development of the UK's huge shale resources is set to gather much needed momentum following a major licencing move by Total, and new UK government support and incentives for drilling projects around the country.

Companies in the UK supply chain is also to benefit from a UK Onshore Operators Group (UKOOG) study to guide them in meeting the requirements of this potentially enormous industry.

Total E&P UK said, 13 Jan, that it had acquired a 40% interest in two shale gas exploration licences in an area of the East Midlands of England. The interests are in Petroleum Exploration & Development Licences 139 and 140 in the Gainsborough Trough area.

Stakeholder Island Gas Ltd (IGas) will be the operator of the initial exploration programme, with Total subsequently taking over operatorship as the project moves towards development.

The group is already involved in shale gas projects in the US, Argentina, China, Australia and in Europe in Poland and in Denmark.

"This opportunity is an important milestone for Total E&P UK and opens a new chapter for the subsidiary in a promising onshore play," said Patrice de Viviès, Total's senior vice president for Northern Europe.

On completion of the transaction, Total's partners in the project will be GP Energy Ltd (part of Dart Energy Europe) (17.5%); Egdon Resources UK Ltd (14.5%), IGas (14.5%) and eCorp Oil & Gas UK Ltd (13.5%).

Total's move coincided with an announcement by prime minister David Cameron that councils can keep all business rates collected from shale gas sites, instead of the usual 50%. This incentive, it said, could be worth up to £1.7 million a year for a typical site and will be directly funded by central government.

Last year, tit was announced that local communities would receive £100,000 when a test well is fracked – and a further 1% of revenues if shale gas is discovered. This could be worth £5 to £10 million for a typical producing site over its lifetime.

The industry is now to further consult on how this money can best be shared with the local community, with options including direct cash payments to people living near the site, plus the setting up of local funds directly managed by local communities.

"A key part of our long-term economic plan to secure Britain’s future is to back businesses with better infrastructure. That’s why we’re going all out for shale. It will mean more jobs and opportunities for people, and economic security for our country," said Cameron.

A recent Institute of Director report, “Getting Shale Gas Working”, identified potential for 74,000 jobs being created in the industry, peak investment of £3.7bn per year and the potential to reduce gas imports by approximately 50%.

With development now likely to ramp up in the UK, attention is turning to opportunities and challenges for the UK supply chain in supporting an emerging UK shale gas industry.

The UKOOG has launched a major supply chain and skills study to understand the needs of industry as it enters the next phase of its development.

This study which will build on work undertaken by individual onshore oil and gas operators at a regional level, will be conducted by EY (formerly Ernst & Young) and funded by the Department of Business Skills & Innovation (BIS) and UKOOG.

The study is to identify what the industry requires in terms of skills, materials and equipment to construct and operate a single pad site in production and will include all associated requirements such as water treatment facilities, transport requirements and rigs.

The findings, said UKOOP, will be extrapolated to look at the potential requirements on a UK basis and will provide a detailed inventory. It will also look at the nature of jobs that could be created – both directly in engineering, geology associated technical services, IT, construction and transport, as well as indirectly.

Chris Lewis, EY partner, commented: “EY hopes that the report will prove to be a crucial step in realising the opportunities associated with the burgeoning onshore sector.

"Engaging with suppliers and operators and assessing their capabilities and requirements will help UKOOG map out a development path that demonstrates how value can be maximised for the benefit of the wider UK economy."

A recent IHS Global Insight study found that unconventional gas activity in the US supports more than 1 million jobs currently and is projected to support a total of more than 2.4 million US jobs by 2035.

“We have a huge opportunity of creating that supply chain here in the UK, this study is the first plank in ensuring that this happens and that the UK fully benefits from the natural resources below our feet in terms of investment and jobs,” said Ken Cronin, chief executive of the UKOOG

“We want to ensure that the UK is ready to grow its supply chain and develop the necessary skills so that local communities benefit from jobs and investment," added Michael Fallon, UK business and energy minister.

“This study, which we are part-funding, will establish the UK's capability and help support the on-going work of the oil and gas industrial strategy to create new jobs, encourage investment and increase exports,” said Fallon.

Plant equipment suppliers tackle new challenges

The process equipment sector's ability' to overcome challenges and improve efficiency with pumping, mixing and compressor technologies has been highlighted by application reports emerging over the past month or so.

First up, Chemineer is supplying four top-entry Helix mixers to Cynar for an agitator application at a waste plastics-to-diesel facility in southern Spain.

The challenging mixer application involves taking molten plastics which flows into the tank sitting in a furnace at around 450 deg C. As the process proceeds there is a phase change, leaving a powdered char that needs to removed from the vessel by a specially designed impeller.

The application, added Chemineer, required a precision-engineered solution to provide off-wall clearance for the mixers serving a thermal chamber within a furnace.

According to a spokesman, the equipment company managed to achieve the required wall clearance of less than 10mm. The work, he said, involved close collaboration between Chemineer and the vessel supplier.

The Cynar plant in Spain can process up to 20 tonnes of waste plastics per day, producing around 19,000 litres of liquid fuels at a conversion rate of 95%. Annual throughput is said to be up to 6,000 tonnes.

Chemineer has previously supplied mixers to a Cynar plant in Avonmouth near Bristol, UK where it now has four custom-made top-entry agitators in operation.

Equipment breakdowns were the challenge faced by Alkane Energy - a UK producer of energy-from-coal-mine-methane - which needs to keep pumps running in deep-mine conditions.

Alkane operates mid-sized 'gas to power' electricity plants providing fast response capacity to the grid. It has a total of 81MW of installed generating capacity and an electricity grid capacity of 100MW.

The company had used VSDs to control the vacuum pumps on new sites but wanted to see if they could be retrofitted to existing sites, where pumps are run direct-on-line and operate at full capacity all the time. This causes extreme wear on pumps, which tend to fail after only a few months.

"As we pump gas deeper from the mine, the pumps need to work even harder,"explains Keith Mitchell of Alkane. "A failed pump can cost around £10,000 to repair. We can also lose generation revenue, as well as the cost to remove the failed pump, so it is important we know that retrofits of drives are possible on existing sites."

Henkel Central Eastern Europe (CEE) in Vienna has saved energy at its production facility for laundry detergents by establishing three air networks fed by Atlas Copco compressors with different operating pressures for various applications throughout its plant premises.

The 230 kilotonnes per annum plant operates many oil-injected screw compressors from Atlas Copco. These include its GA 160 model with variable speed drive (VSD), as well as oil-free low-pressure Class 0 ZA/ZR screw compressors.

Demand for compressed air varies depending on the application. For loading and unloading tank trucks, a low-pressure network of 3 bar is required. The control air to drive the units on the plant premises requires 7 bar working pressure, and an operating pressure of 11 bar is used in an area producing PET bottles by stretch blow moulding.

The varied requirements prompted Henkel to set up three compressed air networks with different operating pressures to achieve cost efficiencies and energy savings.

“Operating the entire network using 11 bar would mean wasted energy because each 1-bar reduction leads to an energy saving of 7 percent,” explained Di Hannes Dengg, technical director of Henkel CEE at the Vienna site.

According to Atlas Copco, the VSD on its GA and ZA/ZR compressor lines further reduces energy costs by up to 35% on average by automatically adjusting the air supply to meet demand.

At the Vienna plant, the drive outputs vary between 75 and 315 kW respectively. In addition, when speed-controlled compressors are used in the winter months, the waste heat from the air-cooled compressors is used to heat the high rack.

Cold-air absorption dryers and compressed air filters are used to ensure clean and safe production. This is critical in the production of laundry detergents, and the Class 0 certification of the ZA/ZR compressors means zero risk of oil contamination to Henkel’s products, said Atlas Copco.

ABB drives supplier Inverter Drive Systems (IDS) already supplied Alkane with VSDs for the new sites so was asked to investigate the possibility of retrofits, with a trial to be carried out at the Old Mill Lane site in Nottinghamshire.

"The existing set up uses soft starts to slowly start the pumps," said Phil Nightingale of IDS. "When the pump is at full speed, the soft start is bypassed with a contactor. The pressure was then controlled with a by-pass valve. The inverter installation does away with this valve and modulates the pump to keep the pressure constant and saves the wasted by-pass energy."

The drive chosen was a 75 kW ABB industrial drive. IDS designed a bespoke door as well as a back panel to fit the existing cabinet so that the drives' switches and connections could be accommodated.

One of the major challenges of the project was the small space available at the site, Nightingale noting: "We needed to fit the drives and panel into the space previously occupied by the soft starters and added fans to cool them. We also had only one day to fit the drive panels so we did all work off-site to minimise disruption and ensure that Alkane could achieve maximum gas pumping."

At Alkane, Mitchell reported that the VSDs allowed a fine control of the gas pumping, compared to the coarse control of the soft starts.

"As well as the money saved from cutting the number of pump repairs and the lost production, the VSDs also save around 12 kW an hour in energy that we can sell to the grid. We also now know that the older sites can be successfully retrofitted with VSDs," he added.

IDS have so far completed two retrofits, with another three to do and a potential to complete more in the future.

Engineering houses getting in order for year ahead

The UK engineering sector has seen the arrival of the long awaited judgement in the dispute over the dismissal of Redhall Engineering Servces Ltd as mechanical and pipework contractor at Vivergo's Saltend Chemicals Park Site in Hull.

Given that Vivergo's decision, back in March 2011, was due to project delays during the building of its new bioethanol plant, it was ironic that it took the Technology and Construction Court so long to reach a verdict in the case.

As announced on 16 Dec, the Court found that the contract had been "unlawfully terminated" and that RESL had been entitled to an overall extension of time on the contract of 24 days.

"Whilst the overall extension of time is below our expectations it provides a framework to quantify our claim and the award precludes Vivergo from making any claim against RESL for the additional costs associated with the termination of RESL’s contract," said parent Redhall Group plc.

For its part, Vivergo - a JV between BP, British Sugar and DuPont - said the Court had decided that Redhall had been "in material breach of contract" and responsible for the majority of the delays to its works.

The company further stated that the Court had reduced Redhall's extension of time claim from an initial position of 158 days to around 15 working days.

Following the ruling, Redhall said it would enter into discussions with Vivergo with the objective of reaching a financial settlement arising from the judgement as soon as possible.

Business prospects

Among recent contract announcements, Capula is to carry out a site survey at Severn Trent Water's Goscote wastewater treatment works, near Walsall in the West Midlands. The aim is to identify areas for operational improvement around the site's SCADA systems.

The survey team will look at system security, supportability and obsolescence management for a SWOT (strengths, weaknesses, opportunities & threats) analysis report of the system, Capula said 19 Dec.

The findings are to be reviewed with Severn Trent Water in early 2014 and used to guide the client’s business plan for AMP6.

Capula was selected to provide these consultancy services based on its role as ICA&T Framework Partner to Severn Trent Water for AMP6, said Neil White, business development manager at Capula.

“The success of this survey could lead to similar ones being rolled out across further sites in the client’s portfolio,” White commented.

Elsewhere, process technology, energy and environment consultancy Stopford Projects Ltd has secured £1 million from the North West Fund to help fund its UK global expansion plans.

Part of the funding will be used to help Stopford start a JV in Abu Dhabi to create a centre offering services for the environmental technology, training and multi-disciplinary consultancy sectors in the Middle East and North Africa.

The company said it will also use the investment to support new projects and initiatives in China centred on the energy from waste, commodity recovery and remediation sectors.

Meanwhile, a newly-developed innovation centre, in Ellesmere Port, is to serve as Stopford's UK hub to provide bespoke training and technology demonstration to overseas delegations.

Back at Redhall, the group reported that trading for its financial year ended 30 Sept 2013 was broadly in line with market expectations, despite some earlier delays to projects in manufacturing and a dip in the volumes of work from the two key nuclear framework contracts.

With an order book standing at £115 million ,the group anticipated converting some high level prospects during the first quarter of calendar 2014. Redhall also expects to secure significant work the UK’s nuclear new build programme through its JV arrangements with ACPP and Baumert from 2015.

To take advantage of the opportunities within the UK nuclear new build programme, Redhall has set up strategic alliances with French companies ACPP and Baumert.

The ACPP-Redhall JV primarily focuses on the design, manufacture and installation of the stainless-steel pond liners, tanks and sumps required.

The commercial agreement between Redhall and Baumert – part of Groupe Gorgé – is designed to facilitate a turnkey package offering that includes design, manufacture and installation for shield and security doors used in nuclear power stations.

She replaces Rob Mietelski who has retired. A chartered engineer and associate member of the Chartered Management Institute, McMahon has 18 years' experience in both technical and managerial roles - mostly at K Home.

PM Group has appointed Liam Foley, MD of its US operations, and John C O’Connell operations director for its Cork and UK operations, to its board.

With PM Group since 1989, Foley has worked in roles including engineering, project management and business development. Foley has a chemical engineering degree from University College Dublin and holds a H. Dip in Marketing & Management from UCC.

O’Connell has been with PM Group since 1999 and has worked in design, project management and operations management roles. A chartered engineer (civil) with both a bachelor and masters degree from University College Cork (UCC), O'Connell also holds a H. Dip in management & marketing from UCC.