Displaying items by tag: Akobo Minerals

Akobo Minerals announces the commencement of OTCQX trading

Akobo Minerals AB (Euronext and Frankfurt: AKOBO) (OTCQX:AKOBF), the Scandinavian-based Ethiopian gold exploration and boutique mining company, has just announced that its shares will now trade on the OTCQX Best Market under the ticker symbol of AKOBF.

The OTCQX Best Market is the highest market tier of OTC Markets on which 12,000 U.S. and global securities trade. Trading on OTCQX will enhance the visibility and accessibility of the Company to U.S. investors. Akobo Minerals' shares will continue to trade on the Euronext Growth in Oslo under the symbol AKOBO, and on the Frankfurt Stock Exchange under the symbol AKOBO.

The OTCQX Best Market provides value and convenience to U.S. investors, brokers and institutions seeking to trade AKOBF. The OTCQX Best Market is OTC Markets Group's premier market for established, investor-focused U.S. and international companies. To be eligible, companies must meet high financial standards, follow best practice corporate governance, demonstrate compliance with U.S. securities laws, be current in their disclosure, and have a professional third-party sponsor introduction.

Akobo Minerals has positioned itself as the leading mining and exploration company in Ethiopia – a country with vast untapped resources. In terms of mining, Akobo is nearing the complete construction of the Segele gold mine, a uniquely high-grade asset. In terms of exploration, Akobo has a rapidly expanding portfolio of exploration targets with high grade intersections at depth and at surface. The Segele mine has an Inferred and Indicated Mineral Resource of 68,000 ounces yielding a world-class gold grade of 22.7 g/ton, combined with an estimated all-in sustaining cost (AISC) of USD 243 per ounce. The gold mineralised zone at the Segele Mine continues at depth, this and the exploration targets have good potential to have a positive impact on future resource estimates and mine-life. The company plans a strategic expansion of the exploration licence in order to open a new gold province.

Jørgen Evjen, CEO of Akobo Minerals, said: “I am pleased to reach the milestone of trading on OTCQX, as this will make it easier for U.S. investors to invest in Akobo. After 13 years of hard work, the timing is right for new investors to invest in this great adventure. We are establishing the first new commercial mine in Ethiopia since 1994, with first pour of gold in sight. And from our exploration work we see the potential in discovering a possible million-ounce deposit. This is just the beginning, and we welcome all new shareholders on board. Ethiopia is going to be the new hot spot for mining in Africa over the next 10 years. We have a head start and are first movers”.

About Akobo Minerals

Akobo Minerals is a Scandinavian-based gold exploration and boutique mining company, currently holding an exploration license covering 182 km2 and a 16 km 2 mining license with an ongoing mine development in the Gambela region and Dima Woreda, Ethiopia. The company has established itself as the leading gold exploration company in Ethiopia through more than 13 years of on-the-ground activity.

Akobo Minerals has an excellent relationship with local communities all the way up to national authorities and we place environment and social governance (ESG) at the heart of our activities – as demonstrated by a planned industry-leading extending shared value program.

Akobo Minerals has built a strong local foothold based upon the principles of sound ethics, transparency, and communication, and is ready to take on new opportunities and ventures as they arise. The company is uniquely positioned to become a major player in the future development of the very promising Ethiopian mining industry.

Akobo Minerals has a clear strategy aimed at building a portfolio of gold resources through high-impact exploration and mining, whilst adhering to a lean business operation.

The company is headquartered in Oslo and is listed on the Euronext Growth Oslo Exchange and Frankfurt Stock Exchange under the ticker symbol, AKOBO.

Akobo Minerals AB (OTCQX: AKOBF) trades on the OTCQX Best Market. Companies meet high financial standards, follow best practice corporate governance, demonstrate compliance with U.S. securities laws, and have a professional third-party sponsor introduction. Investors can find current financial disclosure and Real-Time Level 2 quotes for the Company on www.otcmarkets.com.

Akobo Minerals fully meets and complies with all parts of the JORC code, 2012. For further information, see https://www.jorc.org/

About OTC Markets Group Inc.

OTC Markets Group Inc. (OTCQX: OTCM) operates regulated markets for trading 12,000 U.S. and international securities. Our data-driven disclosure standards form the foundation of our three public markets: OTCQX® Best Market, OTCQB®Venture Market and Pink® Open Market. Our OTC Link® Alternative Trading Systems (ATSs) provide critical market infrastructure that broker-dealers rely on to facilitate trading. Our innovative model offers companies more efficient access to the U.S. financial markets. OTC Link ATS, OTC Link ECN and OTC Link NQB are each an SEC regulated ATS, operated by OTC Link LLC, a FINRA and SEC registered broker-dealer, member SIPC.

Akobo’s hits visible gold at new record depth

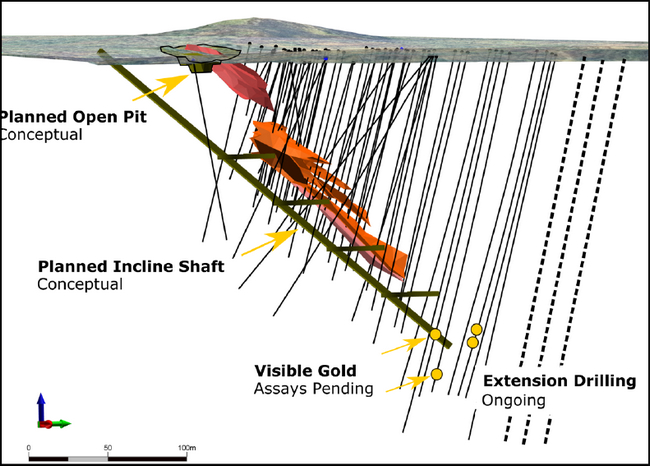

Akobo Minerals has just announced that it has intersected visible gold at 282 metres vertical depth, as well as seeing signs of further potential gold mineralisation in several sections along this latest hole. All indicators point to a belief that the Segele mine can be sustained for much longer than previously envisaged.

The previous deepest intersection of gold mineralisation was at 239 metres vertical depth. This new intersection is part of an ambitious wildcat resource extension hole and demonstrates that the Segele gold mineralisation is now greater than 400m ‘down plunge’ from the surface outcrops. In essence, this means that there seems to be more gold down to much greater levels than previously believed.

Visible gold mineralisation observed at 282m depth in SEDD99

Visible gold mineralisation observed at 282m depth in SEDD99

The success of this hole is testament to the excellent predictive skills and structural understanding developed by the company’s geologists. Their competence is allowing detailed prediction of the gold mineralisation for additional discoveries and will be critical to successful production.

Jørgen Evjen, CEO, Akobo Minerals, stated: “These latest results represent a remarkable success for us. And while this gives us good reason to be excited about the production potential of the Segele mine, equally important is the proof that we understand the local mineralization environment. Our geology team has shown that it can use advanced structural techniques to hit gold mineralization depths never before seen in Southwestern Ethiopia and I believe that we can be confident of considerable success in the future.”

Akobo’s mine development activities are based on its scoping study which envisages a 27-month mine life based purely on the first resource estimate from April 2021 determined by independent mining consultants, SRK. As announced previously, since the release of the scoping study, in addition to the visible gold observations the company has encountered bonanza grade intersections and numerous occurrences of potential host rocks which are demonstrably down-dip from the resource estimate.

The combination of the bonanza grade intersections, host rocks and visible gold is in-line with the general plunge of the mineralization as seen in the resource model. These indicators all point to a belief that the Segele mine can be sustained for much longer than previously envisaged.

This latest hole, number SEDD99, was planned to test for the presence of mineralisation at a much greater depth than before and represents a ‘step back’ of 100m from the previous drill fence, as opposed to a normal 25m as previously used.

An updated resource estimate for Segele is expected to be released by end of Q1 and will incorporate as much of the latest drill hole data as possible. The size of the resource estimate increase will be dependent on the estimation process and assay grades, width and thickness, in addition to down-plunge length. However, the result from SEDD99 will not be included in the next mineral resource update as additional drilling will be needed to support an understanding of the mineralization geometry.

About Akobo Minerals

Akobo Minerals is a Scandinavian-based gold exploration and mining company, currently with ongoing exploration and boutique mine development in the Gambela region and Dima Woreda, southwest Ethiopia. The Company has established itself as the leading gold exploration company in Ethiopia through more than 12 years of on-the-ground activity.

Akobo Minerals is transforming itself to support an increased pace of core drilling. At both its key targets - in Segele and Joru - the company has released exceptionally high-grade gold results in the Segele deposit, while core drilling and trenching at Joru have intersected both high-grade gold zones and large wide zones near the surface. The company has an excellent partnership with national authorities and places ESG at the heart of its activities – including a ground-breaking community program.

The company has built a strong local foothold based upon the principles of good ethics, transparency and communication, and is ready to take on new opportunities and ventures as they arise. Akobo Minerals is uniquely positioned to become a major player in the future development of the very promising Ethiopian mining industry.

Akobo Minerals has a clear strategy aimed at building a portfolio of gold resources through high-impact exploration and mining, while adhering to a lean business operation. The company is headquartered in Oslo and is listed on the Euronext Growth Oslo Exchange under the ticker symbol, AKOBO.

Akobo Minerals enters into partnership with Oromia Bank

Akobo Minerals (Euronext Oslo – “AKOBO”), the Scandinavian-based Ethiopian gold exploration and mining company, has just announced that it has signed a memorandum of understanding (MOU) with the Ethiopian commercial bank, Oromia Bank.

Under the terms of the MOU, Akobo Minerals and Oromia Bank, as leaders in their respective fields, will cooperate to develop domestic services related to financing new exploration and mining projects, in accordance with international standards. Together, these services can support the advancement of Ethiopia’s domestic mining industry.

Through their collaboration, Akobo Minerals and Oromia Bank hope to become the leading industry mining partner offering operational and financial services, respectively, for new ventures and projects in Ethiopia. Significantly, this co-operation goes beyond general corporate funding facilities and will also encompass community funding opportunities and the rollout of services to rural areas which do not presently have access to modern financial technologies and services.

Through their collaboration, Akobo Minerals and Oromia Bank hope to become the leading industry mining partner offering operational and financial services, respectively, for new ventures and projects in Ethiopia. Significantly, this co-operation goes beyond general corporate funding facilities and will also encompass community funding opportunities and the rollout of services to rural areas which do not presently have access to modern financial technologies and services.

Jørgen Evjen, CEO of Akobo Minerals, stated: “By bringing our combined mining and banking competences and experience to the table, I believe we can together offer substantial and innovative services that can further the development of the Ethiopian mining industry and local communities.”

He added: “This agreement follows our corporate objective of doing business locally and supporting the Ethiopian banking industry to become competitive in its own backyard against foreign financial institutions.”

Faysel Yassin, Chief Officer, corporate banking and international trade at Oromia Bank, said: “We are impressed with the endeavour and commitment that Akobo Minerals has shown in building a strategic model for both national and regional success. Our own philosophy mirrors theirs and is why we are sure that by working together we can do great things for other mining companies that want to succeed in Ethiopia.”

In the coming months, Akobo Minerals and Oromia Bank will work together to put in place the aspects necessary to build a range of ground-breaking Ethiopian mining services, as set out in the MOU. However, the commitment of the parties to fulfil the roles and responsibilities of the MOU does not constitute a legally binding agreement.

Separate to the domestic mining services MOU, Akobo Minerals is also in negotiations with Oromia Bank to agree a corporate funding package. This will be used to underpin a range of future activities including local community-based environment, social and governance (ESG) initiatives, as well as capital requirements to support Akobo’s mining operations before the end of 2022. Further details will be made available once any final agreement is reached.

About Oromia Bank

Oromia Bank S.C is a private Commercial Bank established in accordance with 1960 Commercial Code of Ethiopia, by the Licensing and Supervision of Banking Proclamation No. 592/2008 and started operation in 2008 G.C. Initially, number of shareholders is 5,000 and now more than 14,000. The main purpose of its establishment is improving financial accessibility and providing full-fledged and best quality commercial banking services. Oromia Bank SC was first established by trade name of Oromia International Bank SC, and rebrands itself to ‘Oromia Bank SC’ by changing both trade mark and its trade name in December 2021.

About Akobo Minerals

Akobo Minerals is a Scandinavian-based gold exploration company, with ongoing exploration and boutique mining developments in the Gambela region and Dima district of southwest Ethiopia. Operations were established in 2009 by people with long experience from both the public mining sector in Ethiopia and the Norwegian oil service industry. Following mineral discoveries, the company is engaged in mining studies to advance the project to production, alongside exploration core drilling.

Akobo Minerals is transforming itself to support an increased pace of core drilling. At both its key targets - in Segele and Joru - the company has released exceptionally high-grade gold results in the Segele deposit, while core drilling and trenching at Joru have intersected both high-grade gold zones and large wide zones near the surface. The company has an excellent partnership with national authorities and places ESG at the heart of its activities – including a ground-breaking community program.

Akobo Minerals has a clear strategy aimed at building a portfolio of gold resources through high-impact exploration and mining, while adhering to a lean business operation. The company is headquartered in Oslo and is listed on the Euronext Growth Oslo Exchange under the ticker symbol, AKOBO.

Akobo Minerals maintains its fast development pace at Segele with ongoing successful extension drilling

Akobo Minerals maintains its fast development pace at Segele with ongoing successful extension drilling, hints of new mineralisation targets and production planning well underway

During the first part of 2021, the Segele project was accelerated by the resource estimate, award of the mining licence and the scoping study. Since receiving the mining licence, resource extension drilling, surface exploration and multidisciplinary project development work has been ongoing to advance the project towards gold production. The fast pace of development has continued since, resulting in a need to release a summary of all the results achieved;

- The Segele project has so far an Inferred Mineral Resource of 52,410 ounces gold with an average world class grade of 20.9 gram gold per ton – industry avg. of 2-4 g/t

- The Segele scoping study envisages a very high-margin operation with an operating cost (AISC) estimated to be 243 USD per ounce of gold produced – industry avg. of 1,000 USD/oz

- Ground breaking mining license agreement awarded with right to hold funds offshore and repatriate profits from the same accounts

- Since the SRK Resource Estimate a total of 4,739 meters in 28 holes of deep core drilling has been completed

- Holes range from 123m in depth to 250m in depth

- Visible gold seen in 15 of 28 holes

- A total of 1044 samples from Segele and 1171 samples from Joru are pending assays

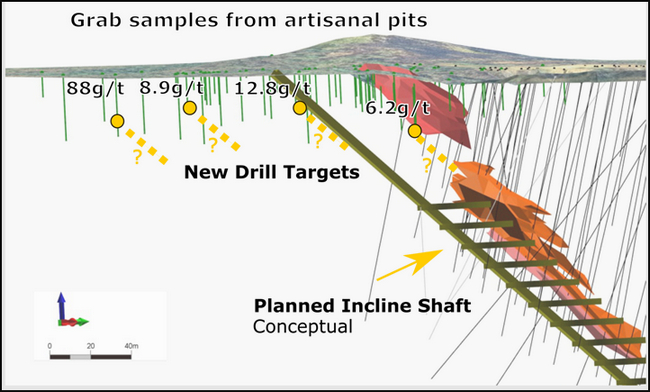

- High assay results from 370 samples from artisanal pits around the resource estimate have shown 88.0g/t, 8.9g/t, 12.9g/t and 6.15g/t. New drilling is planned to follow up these results

- Request for Expressions of Interest sent out to potential contract mining firms

- Quotes for processing plants being collected

- Gold production planning ongoing including:

- Infill drilling to allow detailed mine planning

- Sourcing a geotechnical specialist

- Sourcing a tailings storage facility designer

- Assessments of manpower and training requirements

- Environmental and Social baseline study fieldwork completed

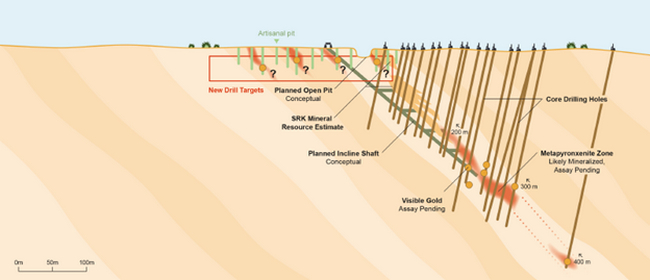

From the ongoing core drilling we continue to intersect visible gold deeper than the samples used in the Mineral Resource Estimate. Also mine planning is underway to establish optimum ways to extract the mineralisation. From the illustration below we see a conceptual design of the planned mine shaft and also an indication of where the latest visible gold has been found.

Figure 1: Looking West at the Segele Mineral Resource Estimate (Orange and Red)

Figure 1: Looking West at the Segele Mineral Resource Estimate (Orange and Red)

The April 2021 inferred resource estimate was calculated using a total of 32 holes of a total length of 3,159m of drilling at relatively shallow depths. Because the extension drilling campaign now targets mineralisation at much greater depths, the current resource extension drilling requires longer holes to reach the same mineralisation. Going forward the focus will be more on exploring new and shallower mineralized targets instead of only drilling deeper holes. Newly analysed data from artisanal pits indicates possible new targets to the South of the Segele Mineral Resource estimate. See illustration below for an overview;

Figure 2: Looking West at the Segele Mineral Resource Estimate (Orange and Red)

Figure 2: Looking West at the Segele Mineral Resource Estimate (Orange and Red)

The positive assay results from artisanal pits is an exciting development for the company geologists who have been anticipating the discovery of new gold mineralisation. The reliability of these grab sample results is relatively diminished when compared to the drilling. To upgrade our understanding of these new targets, scout drilling has been scheduled for drilling within the next 2-3 months. If the scout drilling and related mining studies is found to be successful, these new targets may provide additional ore to the planned Segele processing plant.

In an important step towards production, Akobo Minerals has started the selection and contracting process for potential contract mining firms. It is anticipated that the contract will be awarded in two stages; underground access and stoping (ore extraction). The first process plant quote has been received and it is anticipated that additional quotes will be received before the end of the calendar year.

Looking forward it is anticipated that there will be two rigs working on Segele extension drilling and infill drilling, and a third rig drilling at new Segele mineralisation. Upon receipt of infill drilling results, resource estimation and mine planning will be carried out – major parts of the delivery of the Prefeasibility study. Within Q1 of 2022, the company intends to award contracts for mining activities and processing plant production.

With regards to Joru, the current drill program has just been completed, and assays are on their way to be analysed at ALS Ireland. More update will be given as soon as the results are ready.

For more information contact

Jørgen Evjen, CEO

Mob.: (+47) 92 80 40 14

Mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

About Akobo Minerals:

Akobo Minerals, is a Norway-based gold exploration company, currently with ongoing exploration and small-scale mine development in the Gambela region and Dima Woreda, southwest Ethiopia. The operations were established in 2009 by people with long experience from the public mining sector in Ethiopia and from the Norwegian oil service industry. Akobo Minerals holds a mining licence and an exploration license over key targets in the area. Economic mineralisation was discovered and the company is engaged in mining studies to advance the project to production, alongside exploration core drilling. Akobo Minerals is transforming its organisation to support an increased pace of core drilling. At both the key targets Segele and Joru the company has so far released exceptionally high-grade gold results including the Segele deposit with an Inferred Mineral Resource of 78ktons at 20.9g/t. A scoping study for Segele includes an up-front capital expenditure of USD $8m and all-in sustaining cost of USD $243 per ounce of gold produced. Core-drilling and trenching at Joru have intersected both high-grade gold zones and large wide zones near surface. The company has an excellent partnership with national authorities and places ESG at the heart of its activities - a ground-breaking community program is being planned.