Super User

Choosing the right harmonic filter

The range and complexity of electrical and electronic equipment used in manufacturing environments has increased dramatically over the last few years. Here, John Mitchell, global business development manager of supply, repair and field service specialist CP Automation explains how to manage the increasing harmonic levels in the modern industrial landscape.

The introduction of variable speed drives, fluorescent lighting and transformers has brought a rise in the number of non-linear loads. One of the unwanted consequences of non-linear loads is the creation of harmonic currents, which can cause voltage distortion and quality problems.

To address the issues caused by high harmonics levels, including motor vibration, voltage notching, electromagnetic interference and overheating, companies can use harmonic filters.

Active or passive?

When choosing a harmonic filter, the first thing to consider is whether you need a passive or an active one. The traditional choice is a passive filter, used to minimise power quality problems in the network. These filters operate mainly on a fixed basis and are tuned to a harmonic order close to the order to be eliminated. One drawback of passive filters is that they are most efficient when the load is operating above 80 per cent and they cannot adapt the amount of compensation current they inject into the system.

On the other hand, active harmonic filters are the most flexible solution on the market. They monitor the network and inject the necessary amount of compensation current at any given time, which restores current waveform and lowers current consumption. This makes them ideal for installations in which current load changes constantly.

Regardless of what type of harmonic filter you decide to use, make sure it has the relevant UL certifications for the environment in which it is going to run. If unsure, you should always refer to an expert.

Another option is a mixed solution. You could use a passive filter on some applications and add a smaller active filter overall, which will help you save costs in the long run.

Excess heat?

Another thing to consider when choosing a harmonic filter is that harmonic currents can induce additional heating in generators. Harmonics can also lead to heating of busbars, cables and equipment, cause thermal damage to induction motors and generators and thermal tripping of safety devices, like fuses or sensors in breakers. These relatively minor issues can have a negative effect on the entire system and can increase maintenance costs.

Luckily, some active filters produce up to a third less heat than competitor products due to the switching techniques of the insulated-gate bipolar transistors (IGBTs). Equally, the REVCON RHF Series of passive filters offer up to 99.5 per cent efficiency.

When comparing filters, active or passive, you should look closely at the total cost of ownership for the end user. After all, heat loss is a direct cost in energy bills. This is particularly important on the shop floor, in marine and offshore applications or any other environments where space and heat is particularly precious.

Before choosing a harmonic filter, it is important to assess the entire system and size the right solution for your specific needs. It is not enough to look at one troublesome application individually. Instead, you should have an accurate representation at the entire operation as a whole. Often what looks like the cause of a problem can actually be an effect.

CP Automation suggests performing a plant survey and collecting data over several days. After the initial analysis, we can recommend the most appropriate product and install it without significant disruptions.

Once the harmonic filter has been live for a few weeks, another survey is necessary to check if all problems have been resolved. This ensures the product is appropriate and it gives companies real peace of mind.

Unfortunately, harmonics are not going anywhere, so businesses can’t afford to just ignore them. Instead, the best solution is to tackle the problem head on and if you are unsure of anything, always consult an expert.

About CP Automation: CP Automation is a specialist in the repair and replacement of automation equipment including electronic boards, PLCs and Ac and DC drives. It was established to provide an independent maintenance service, without exclusive ties to any manufacturer. However, it does have strong relationships with the principal inverter, encoder, resistors and motor manufacturers.

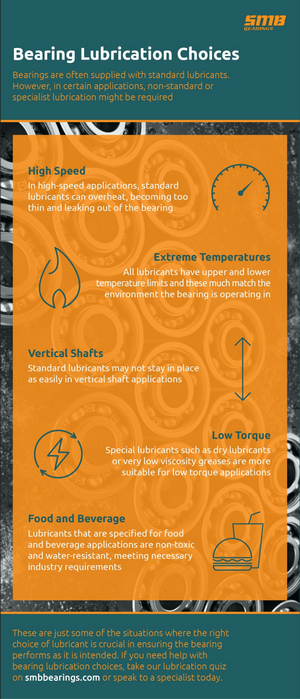

Bearing specialist releases new infographic on lubrication choices

~ SMB Bearings on how to make the right lubrication choices for bearings ~

Specialist bearings supplier, SMB Bearings, has produced a new infographic illustrating some of the key considerations that need to be made when choosing lubricants for bearings. Bearings are often supplied with standard lubricants. Yet there are many applications where specialist or non-standard lubrication is required. Knowing what considerations matter and what is appropriate for your application can help make the right decision when choosing lubricants.

Whatever industry you are working in, chances are you rely on bearings for your equipment to work effectively. According to one study, up to 80 percent of bearing failures can be attributed to problems with lubrication. Getting this decision right will save you and your facility money.

Whatever industry you are working in, chances are you rely on bearings for your equipment to work effectively. According to one study, up to 80 percent of bearing failures can be attributed to problems with lubrication. Getting this decision right will save you and your facility money.

The lubrication choices infographic identifies some of the priority factors to consider when choosing lubricants. It identifies five key areas where standard lubrication will not suffice: high-speed applications. extreme temperatures, vertical shaft applications, low torque applications and applications in the food and beverage sector.

‘‘Our new infographic highlights some of the key factors that are relevant in choosing the right lubricant and can serve as a quick way of guiding your choices,’’ explained Chris Johnson, director of SMB Bearings. ‘‘However, should you require more detailed information, a specialist bearing supplier like ourselves is always willing to offer advice on what lubricants are best for your application.

SMB Bearings has always sought to be more than a standard supplier of bearings. The company also offers its own inhouse relubrication service. ‘‘Many customers have asked us to supply non-standard lubricants such as food grade, high temperature or military specification greases and oils,’’ added Johnson. Since successfully launching its own relubrication facility over 25 years ago, SMB Bearings has grown this part of its business further, with an additional processing room, additional staff and specialist relubrication equipment.

The experience of providing this service has strengthened the company’s expertise in this area, which it is keen to share with customers. The company has made available a host of free educational resources, including its series of downloadable guides and whitepapers on different bearing-related subjects. ‘‘For me, a key part of what we do is not just sell bearings – we solve problems too,’’ offered Johnson.

The infographic is intended to serve as an accompaniment to the SMB Bearings’ ‘‘Choose your grease’’ quiz. The quiz is free to access and can be completed on the company’s website. By correctly answering the questions, participants are guided to the appropriate choice of lubricant for their application.

About SMB Bearings: SMB Bearings originally specialised in miniature bearings, thin-section bearings and stainless steel bearings. By natural progression, the company expanded the range to include other corrosion resistant bearings such as plastic bearings, 316 stainless bearings and ceramic bearings.

Remaining a specialist business, SMB Bearings provide a high level of product knowledge, providing bearing and lubrication solutions to existing or potential customers, whether individuals or large corporations. SMB Bearings does not just sell bearings, but helps to solve your problems.

For further information please visit http://www.smbbearings.com/

BASF achieves strong earnings growth in full year 2021

BASF Group significantly increased sales and earnings in the 2021 business year. “It was a strong and successful year for BASF,” said Chairman of the Board of Executive Directors, Dr. Martin Brudermüller, who presented the BASF Report 2021 together with Chief Financial Officer Dr. Hans-Ulrich Engel.

- Sales: €78.6 billion (plus 33 percent)

- EBIT before special items: €7.8 billion (plus 118 percent)

- Cash flows from operating activities: €7.2 billion (plus 34 percent);

- Free cash flow: €3.7 billion (plus 63 percent)

- Proposed dividend of €3.40 per share for the 2021 business year

- (2020: €3.30 per share)

Outlook 2022:

- Sales of between €74 billion and €77 billion expected

- EBIT before special items of between €6.6 billion and €7.2 billion expected

- ROCE projected to be between 11.4 percent and 12.6 percent

- Anticipated CO2 emissions of between 19.6 million metric tons and 20.6 million metric tons

“We increased sales prices by 25 percent and volumes by 11 percent. All segments achieved price and volume growth in 2021,” said Brudermüller. BASF Group’s sales amounted to €78.6 billion in 2021, 33 percent higher than in the previous year.

EBITDA before special items of €11.3 billion in 2021 was higher by €3.9 billion and EBITDA of €11.4 billion exceeded the prior-year figure by €4.9 billion.

EBITDA before special items of €11.3 billion in 2021 was higher by €3.9 billion and EBITDA of €11.4 billion exceeded the prior-year figure by €4.9 billion.

At €7.8 billion, income from operations (EBIT) before special items more than doubled compared with 2020. This represented an increase of 67 percent compared with the pre-pandemic level in 2019. BASF’s positive earnings development was mainly driven by the Chemicals and Materials segments. The Surface Technologies and Industrial Solutions segments also contributed considerably to the strong recovery.

Return on capital employed (ROCE) was 13.5 percent, after 1.7 percent in the previous year, and was significantly above the cost of capital rate of 9 percent. The increase in ROCE resulted mainly from the higher EBIT of €7.7 billion in 2021, which was considerably above the prior-year level.

Additional costs due to rising energy prices in Europe

BASF’s automotive-related businesses continued to be negatively impacted by the semiconductor shortage. In 2021 and particularly in the fourth quarter, higher raw materials prices and increased energy and logistics costs also burdened the earnings development in all segments. For BASF’s European sites, the additional costs due to further increased natural gas prices in 2021 amounted to around €1.5 billion. The fourth quarter of 2021 alone accounted for €0.8 billion of this amount.

Brudermüller announced: “We will implement further substantial price increases in the coming months to pass on the significantly higher costs and improve our margins in the downstream businesses.” The established pricing procedures in these businesses lead to a delay in passing on costs.

BASF Group’s cash flow in full year 2021 and fourth quarter 2021

Cash flows from operating activities in 2021 amounted to €7.2 billion, compared with €5.4 billion in the previous year. The considerable increase was primarily due to the improvement in net income, which came in at €5.5 billion. Free cash flow increased to €3.7 billion in 2021 from €2.3 billion in the previous year.

In the fourth quarter of 2021, cash flows from operating activities increased by €1.2 billion to €3.3 billion. Free cash flow came in at €1.8 billion, an increase of 84 percent compared with the fourth quarter of 2020.

Sales and earnings development of BASF Group in fourth quarter 2021

BASF Group’s sales in the fourth quarter of 2021 rose by 24 percent versus the prior-year quarter to reach €19.8 billion. “Despite the comparison with the strong prior-year quarter, BASF was able to increase volumes in all segments except for Materials in the fourth quarter of 2021,” said Chief Financial Officer Engel.

EBITDA before special items increased by around €100 million to €2.2 billion. EBITDA amounted to €2.3 billion, compared with €2.0 billion in the fourth quarter of 2020.

EBIT before special items was €1.2 billion, compared with €1.1 billion in the fourth quarter of 2020. EBIT came in at €1.2 billion in the fourth quarter of 2021, compared with €932 million in the fourth quarter of 2020.

Proposed dividend of €3.40 per share

At BASF’s Annual Shareholders’ Meeting this year, the Board of Executive Directors and the Supervisory Board will propose to pay a dividend of €3.40 per share, an increase of 10 cents. In total, BASF would pay out €3.1 billion based on the number of shares at the end of the year. “With our dividend proposal, the BASF share offers an attractive dividend yield of 5.5 percent based on the share price at the end of 2021,” Brudermüller said.

Achievement of nonfinancial goals

BASF aims to reduce its absolute CO2 emissions by 25 percent by 2030 compared with the baseline 2018. In 2021, the CO2 emissions amounted to 20.2 million metric tons – a decrease from the 20.8 million metric tons emitted in 2020. “This decline is remarkable given the strong growth in volumes,” said Brudermüller.

Much earlier than planned, BASF achieved its target of €22 billion in sales by 2025 with products that make a substantial sustainability contribution in the value chain. Sales of these Accelerator products amounted to €24.1 billion in 2021. “We will therefore adjust this portfolio steering target in the course of 2022,” Brudermüller said.

Investments in growth projects

BASF’s planned capital expenditures of €25.6 billion between 2022 and 2026 are €2.7 billion higher than in the previous planning period from 2021 to 2025. “The main reasons for this are our two major growth projects: the new Verbund site in Zhanjiang and our battery materials activities,” said Hans-Ulrich Engel. “These two projects are key to drive BASF’s future growth,” he added.

Investments in BASF’s existing business remain stable at an average level of €2.6 billion per year. Engel announced BASF would be very disciplined with the investments required to maintain and profitably grow these businesses. “This will enable us to fund the growth projects with an average of also roughly €2.6 billion per year. Capex for our growth projects will peak in 2024,” said Engel. For 2022, BASF plans total capital expenditures of €4.6 billion, compared with €3.4 billion in 2021. The annual budget for research and development activities amounts to around €2.1 billion.

BASF Group outlook for 2022

“We have had a very strong start to the year, with January 2022 figures above the prior-year month,” said Martin Brudermüller looking ahead to the current business year.

BASF expects global economic growth of 3.8 percent to be somewhat more moderate in 2022 following the very strong recovery in 2021. “As order backlogs in industry are high, we expect global industrial production to grow by 3.8 percent and chemical production by 3.5 percent,” Brudermüller said. BASF anticipates an average oil price of $75 for a barrel of Brent crude and an exchange rate of $1.15 per euro.

Based on these assumptions, BASF is forecasting sales of between €74 billion and €77 billion for 2022. The company expects the BASF Group’s income from operations (EBIT) before special items to be between €6.6 billion and €7.2 billion. ROCE should be between 11.4 percent and 12.6 percent. CO2 emissions are expected to be between 19.6 million metric tons and 20.6 million metric tons in 2022.

BASF’s forecast ranges take into account uncertainty resulting in particular from the effects of ongoing supply chain disruptions, the further course of the coronavirus pandemic and the development of energy prices.

About BASF

At BASF, we create chemistry for a sustainable future. We combine economic success with environmental protection and social responsibility. Around 111,000 employees in the BASF Group contribute to the success of our customers in nearly all sectors and almost every country in the world. Our portfolio comprises six segments: Chemicals, Materials, Industrial Solutions, Surface Technologies, Nutrition & Care and Agricultural Solutions. BASF generated sales of €78.6 billion in 2021. BASF shares are traded on the stock exchange in Frankfurt (BAS) and as American Depositary Receipts (BASFY) in the U.S. Further information at www.basf.com.

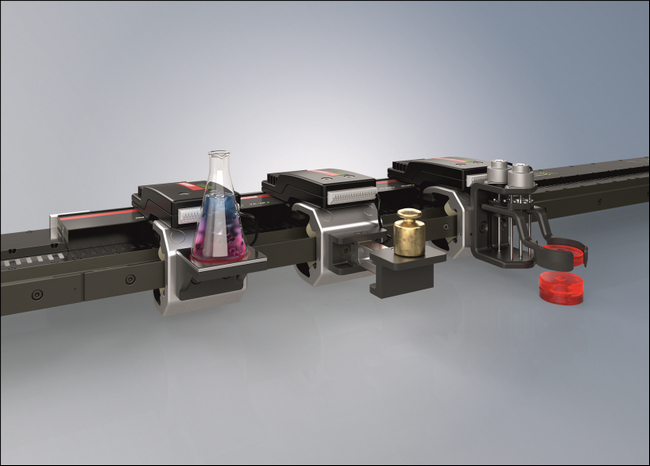

Cable-free technology extends transport system capabilities

~ Beckhoff’s latest XTS features No Cable Technology to integrate more mobile handling and processing functionality ~

The next generation of machinery can now benefit from No Cable Technology (NCT) to enhance mobile handling and processing performance of transport systems, presenting more opportunities for in-line measurement or processing of products. This enhanced functionality comes with the launch of the XTS intelligent transport system with NCT, which Beckhoff UK is now offering to companies across the UK.

The XTS with NCT features a specially developed compact motor module and electronics mounted directly on the XTS movers, with all required NCT hardware embedded within the module to maintain a compact footprint. The modules deliver contactless power supply and real-time synchronous data communication wirelessly to the XTS movers, allowing for more advanced processing and monitoring functionality in each mover without the need for additional cabling or wiring.

The TwinCAT control system powering the XTS provides microsecond precision to synchronise movements with other parts of the system. Machine builders can use this synchronicity and NCT to develop even more flexible equipment that meets demanding applications, such as automatic alignment or manipulation of products to ready them for quality assurance stations.

“The XTS was developed to provide greater machine flexibility for increasingly complex expectations of automation,” explains Stephen Hayes, managing director of Beckhoff UK. “Many companies globally have benefitted from being able to precisely synchronise movers with processing stations. However, cabling technology has traditionally limited what was possible in the transport system itself. Beckhoff is changing that and opening previously unattainable opportunities in machine flexibility.

“With NCT, power can be wirelessly distributed to the mover’s motor module. This allows for different CNC motion sequences to be assigned to the mover, making it an active part in mobile processing and streamlining production times. For example, instead of a mover transporting a pharmaceutical item to a station for mixing and then removing it to go elsewhere, movers can be programmed to rotate and mix product during transport. This on-the-move processing can make systems more efficient.”

Beckhoff’s NCT can also be integrated into wider data management systems via an open interface and direct linking to the TwinCAT control system. This allows standardised devices such as sensors to be connected for enhanced product control, as well as unambiguous identification of individually programmed movers during operation.

For more information on the XTS with NCT, visit the Beckhoff UK website or call +44 (0)1491 410 539.

About Beckhoff: Beckhoff Automation implements open automation systems based on PC Control technology. The product range covers Industrial PCs, I/O and Fieldbus components, drive technology and automation software, and all products can be used as separate components or integrated into a complete and seamless control system are available for all industries. Its New Automation Technology philosophy represents universal and open control and automation solutions that are used worldwide in a wide variety of different applications, ranging from CNC-controlled machine tools to intelligent building automation.

ArcelorMittal announces that its Significant Shareholder has decided not to further participate in its $1 billion share buyback program

In its announcement of 11 February 2022 regarding a new $1 billion share buyback program, ArcelorMittal noted the declared intention of its Significant Shareholder to sell shares to it in proportion to shares purchased on the market to maintain its percentage shareholding.

ArcelorMittal has since been informed by the Significant Shareholder that it has decided not to make such sales; accordingly its percentage holding of issued and outstanding shares (which stood at 36.3% as of January 31, 2022) will increase as the share buyback program is implemented.

About ArcelorMittal

ArcelorMittal is the world's leading steel and mining company, with a presence in 60 countries and primary steelmaking facilities in 17 countries. In 2020, ArcelorMittal had revenues of $53.3 billion and crude steel production of 71.5 million metric tonnes, while iron ore production reached 58.0 million metric tonnes. Our goal is to help build a better world with smarter steels. Steels made using innovative processes which use less energy, emit significantly less carbon and reduce costs. Steels that are cleaner, stronger and reusable. Steels for electric vehicles and renewable energy infrastructure that will support societies as they transform through this century. With steel at our core, our inventive people and an entrepreneurial culture at heart, we will support the world in making that change. This is what we believe it takes to be the steel company of the future. ArcelorMittal is listed on the stock exchanges of New York (MT), Amsterdam (MT), Paris (MT), Luxembourg (MT) and on the Spanish stock exchanges of Barcelona, Bilbao, Madrid and Valencia (MTS). For more information about ArcelorMittal please visit: http://corporate.arcelormittal.com/

http://corporate.arcelormittal.com/Chevron Announces Investment in Carbon Clean CO2 Capture Technology Business

Chevron U.S.A. Inc., a subsidiary of Chevron Corporation (NYSE: CVX), announced it has made a new investment in Carbon Clean, a global leader in cost-effective industrial carbon capture.

The size and cost of installing carbon capture technology has been a barrier to adoption. Carbon Clean’s technology is designed to reduce the costs and physical footprint required for carbon capture compared with many existing approaches. Carbon Clean’s technology and fully modular construction also aims to reduce site disruption and facilitate faster permitting.

“We look forward to partnering with Carbon Clean to help advance Chevron’s pursuit of lower carbon solutions,” said Chris Powers, vice president of Carbon Capture, Utilization, and Storage (CCUS) with Chevron New Energies (CNE). “Chevron has a long history of supporting innovation. We strive to apply our internal capabilities and longstanding partnership approach toward developing and commercializing breakthrough technologies, including those that enable lower carbon solutions in the marketplace.”

“We look forward to partnering with Carbon Clean to help advance Chevron’s pursuit of lower carbon solutions,” said Chris Powers, vice president of Carbon Capture, Utilization, and Storage (CCUS) with Chevron New Energies (CNE). “Chevron has a long history of supporting innovation. We strive to apply our internal capabilities and longstanding partnership approach toward developing and commercializing breakthrough technologies, including those that enable lower carbon solutions in the marketplace.”

Chevron Technology Ventures made an initial investment in Carbon Clean in 2020. In 2021, Chevron launched CNE to accelerate lower carbon business opportunities in CCUS, hydrogen, and offsets and emerging energies, as well as support Chevron’s ongoing growth in biofuels.

“Chevron’s investment demonstrates interest in our technology, business strategy and rapidly expanding order book. We are seeking to deliver a revolution in carbon capture driven by our modular technology and are thrilled that Chevron shares our vision for the sector,” said Aniruddha Sharma, Co-founder and CEO of Carbon Clean. “We are working to remove the biggest barriers to the adoption of widespread industrial carbon capture. It is vital that we decarbonise hard-to-abate sectors while developing new low-carbon technologies. This latest investment and our work with partners, such as Chevron, will provide us with the opportunity to deliver exponential growth in carbon capture and meet ever rising demand.”

As part of the new investment, Chevron and Carbon Clean are seeking to develop a carbon capture pilot for Carbon Clean’s CycloneCC technology on a gas turbine in San Joaquin Valley, California. Carbon capture will play a crucial role in reducing emissions in hard-to-abate energy intensive industries such as refining, cement, and steel. Chevron is targeting 25 million tonnes of CO₂ per year in equity storage by the end of this decade, with a focus on developing regional hubs that leverage its existing and emerging partnerships with customers, governments, and industry.

About Chevron

Chevron is one of the world’s leading integrated energy companies. We believe affordable, reliable and ever-cleaner energy is essential to achieving a more prosperous and sustainable world. Chevron produces crude oil and natural gas; manufactures transportation fuels, lubricants, petrochemicals and additives; and develops technologies that enhance our business and the industry. We are focused on lowering the carbon intensity in our operations and seeking to grow lower carbon businesses along with our traditional business lines. More information about Chevron is available at www.chevron.com.

About Carbon Clean

Carbon Clean is a global leader in carbon capture solutions for hard-to-abate industries such as cement, steel, refineries and energy from waste. The company’s patented technology significantly reduces the costs of carbon capture when compared to existing solutions.

The company is leading innovation in the CCUS market and has developed a fully modular technology – CycloneCC – that is set to disrupt the sector. The company’s solutions will help deliver the necessary scaling up of carbon capture to achieve global net zero targets. The technology has been proven at scale in over 44 sites around the world, including plants in the UK, U.S., Japan, Germany, India, Norway and the Netherlands. It has delivered the world’s largest industrial-scale carbon capture and utilisation plant for Tuticorin Alkali Chemicals & Fertilizers Ltd, India.

The UK-based company has received funding and grant support from the British and U.S. governments and has established partnerships with industry leaders including CEMEX and Veolia. It is also an investor in the Swedish eMethanol shipping fuel company, Liquid Wind. Carbon Clean has been a Global Cleantech 100 company three times, most recently in 2022, features in the inaugural PwC Net Zero Future50 and was chosen as one of CEMEX Ventures Top50 ConTech Startups. For further information: www.carbonclean.com.

Energy efficient bearing design

~ Three bearing design considerations to reduce friction ~

It is estimated that a ten per cent reduction of friction in all large bearings in use would provide an energy saving equal to the output of 18 large power stations. Cutting friction in bearings of any size is a key method to improve energy efficiency. Here Chris Johnson, managing director at miniature bearings supplier SMB Bearings explores the bearing design possibilities for increased efficiency in industrial applications.

In recent years, bearing manufacturers have increasingly focused on creating energy-efficient bearings — making use of new materials, lubrication techniques and advanced geometry designs to reduce losses without sacrificing the load carrying capacity.

However, energy losses in bearings are not considered the primary focus of plant optimisation efforts because they are already considered a high efficiency component. On the other hand, some argue that bearings are so ubiquitous — with a huge number of installed bearings in industry — that this overall energy consumption and potential energy savings should not be ignored. Let’s take a closer look at three bearing design considerations to decrease friction and increase efficiency.

Advanced materials

Energy-efficient bearing designs focus primarily on reducing the contact between the rolling elements and the raceways or the cage. By reducing the roughness of the contacting elements, friction will be reduced. Furthermore, the osculation of the bearing at both the inner and at outer rings significantly effects the friction by reducing the contact area and thus the microsliding of the contact.

According to a 2021 study, friction-optimised designs can have a significant impact on the reduction of the global energy losses of bearings. Based on the design of one bearing manufacturer, a preliminary estimation of this reduction is about 0.15 – 0.20 per cent of global energy consumption.

Traditionally, steel has been the material of choice in bearing design, but polymer-based materials, such as PTFE and nylon, offer many benefits when used in less demanding environments. These benefits include corrosion resistance, reduced need for lubrication and a reduced weight.

Geometry

Geometry considerations such as special cage designs and the number of balls in a bearing influences the amount of friction generated, as this determines the number of frictional contacts during operation. The geometry, as well as the process by which the retainer is manufactured, have an influence on the friction generated. For example, opting for a 3D printed retainer in nylon (PA66) or another polymer material can help to reduce the weight of the whole bearing.

In some cases, ceramics offer a feasible alternative to metal. They have properties that offer similar benefits to metal, but they’re much lighter too.

Carbon-fibre reinforced nylon is one of the most popular combinations for nylon-printed materials. It offers many of the same benefits as standard nylon including high strength and stiffness, but it produces significantly lighter components. Surface coatings can have a significant effect on bearing friction reduction. Coatings such as molybdenum disulphide and tungsten disulphide increase wear resistance, fatigue durability, and reduce friction during bearing motion.

Lubrication

A proper lubricant will reduce friction between the internal sliding surfaces of the bearing’s components and reduce or prevent metal-to-metal contact of the rolling elements within their raceways. While this is a good way of reducing wear and preventing corrosion, there are new materials that, when used on bearings, dramatically reduce friction compared to the lubrication and surface treatment options that are currently on the market. The material in question is graphene.

The process of adding a graphene coating to bearings would be relatively simple and similar to adding a traditional lubricant. When graphene becomes readily available, we will examine this form of lubrication more closely.

As well as not being harmful to the environment, graphene flakes that are added to the surface of a bearing can last a considerable amount of time, due to the ability of the flakes to reorient themselves during the initial wear cycles, providing a very low coefficient of friction (COF).

In a study on the potential of graphene as a new emerging lubricant, researchers estimated that the reduced loss of energy to friction offered by new materials would yield potential energy savings of 2.46 billion kilowatt-hours per year, equivalent to 1.5 million barrels of oil.

By optimising each element of a bearing’s design to consider friction, it is possible to reduce bearing friction. By multiplying this saving for each bearing in a machine, plant or industry, significant energy savings can be realised.

For further information about SMB Bearings’ range of products and services visit the website

About SMB Bearings:

SMB Bearings originally specialised in miniature bearings, thin-section bearings and stainless steel bearings. By natural progression, the company expanded the range to include other corrosion resistant bearings such as plastic bearings, 316 stainless bearings and ceramic bearings.

Remaining a specialist business, SMB Bearings provide a high level of product knowledge, providing bearing and lubrication solutions to existing or potential customers, whether individuals or large corporations. SMB Bearings does not just sell bearings, but helps to solve your problems.

For further information please visit http://www.smbbearings.com/

Snow lake lithium to develop world’s first all-electric lithium mine, supplying north american electric vehicle industry

Snow Lake Lithium Ltd (Nasdaq:LITM) has outlined plans to develop the world’s first all-electric Lithium mine in Manitoba, Canada developing a domestic supply of this critical resource to the North America electric vehicle industry.

With demand for electric vehicles growing rapidly, the global automotive and energy storage industries will be competing to access raw materials, especially lithium, that are a crucial component of batteries.

North American automotive manufacturers have committed manufacturing capacity to meet the demand for electric vehicles, but the future of the North American automotive industry relies on sourcing lithium hydroxide on the continent rather than importing it from China and Asia as well as creating an integrated domestic supply chain.

To enable the seamless integration of the supply chain, Snow Lake Lithium plans to establish a joint venture to create a lithium hydroxide processing plant and is seeking a partnership with an automotive OEM or a battery manufacturer to deliver this.

Philip Gross, CEO of Snow Lake Lithium said, “We are facing a once-in-a-century industrial pivot as North America accelerates towards an electrified future. If we don’t act now to secure a seamless lithium supply chain from rock to road, the North American car industry will not exist in 10 years’ time.

“Our ambition is to become the first fully integrated, carbon neutral lithium hydroxide provider to the North American electric vehicle industry. We are developing the world’s first all-electric lithium mine, operated by renewable power, and are currently looking for a joint venture partner to create a lithium hydroxide processing plant in the region.”

Based in Manitoba, Canada, Snow Lake Lithium is ideally located to serve the North American automotive industry with access to the US rail network via the Artic Gateway railway, which reduces transportation from thousands of miles by road and boat to just several hundred by train.

Snow Lake Lithium’s 55,000 acre site is expected to produce 160,000 tonnes of 6% lithium spodumene a year over a 10 year period. Currently, Snow Lake Lithium has explored around 1% of its site and is confident that this will expand over the course of the next year. Snow Lake Lithium’s mine will be operated by almost 100% renewable, hydroelectric power to ensure the most sustainable manufacturing approach.

The Manitoba region has a rich history of mining giving Snow Lake Lithium access to some of the most talented and experienced miners in North America.

Philip Gross continued, “Mining runs through Manitoba’s DNA, the evolution of the electric vehicles supply chain offers a once in a generation opportunity to deliver economic growth and secure a sustainable future for mining for the province. We are working closely with Manitoba Province to develop the right conditions to make the most of this opportunity.”

Over the coming months, Snow Lake Lithium will continue its engineering evaluation and drilling programme across its Thompson Brothers Lithium Project site, with the expectation that the mine will transition to commercial production in late 2024.

About Snow Lake Resources Ltd.

Snow Lake Lithium is committed to creating and operating a fully renewable and sustainable lithium mine that can deliver a completely traceable, carbon neutral and zero harm product to the electric vehicle and battery markets. We aspire to not only set the standard for responsible lithium mining, but we intend to be the first lithium producer in the world to achieve Certified B Corporation status in the process.

Our wholly owned Thompson Brothers Lithium Project now covers a 55,318-acre site that has only been 1% explored and contains an identified-to-date 11.1 million metric tonnes indicated and inferred resource at 1% Li2O.

UK Government grants consent for Vattenfall’s Norfolk Vanguard Offshore Wind Farm

The UK Government has awarded planning consent for Vattenfall’s Norfolk Vanguard Offshore Wind Farm. Consent for Norfolk Vanguard follows consent for sister project Norfolk Boreas.

The decision completes consent for the entire Norfolk Offshore Wind Zone. The 3.6 GW Norfolk Zone boosts Government plans for 40GW of offshore wind by 2030. Both projects in Vattenfall’s proposed Norfolk Offshore Wind Zone have now been approved.

The decision completes consent for the entire Norfolk Offshore Wind Zone. The 3.6 GW Norfolk Zone boosts Government plans for 40GW of offshore wind by 2030. Both projects in Vattenfall’s proposed Norfolk Offshore Wind Zone have now been approved.

The zone will produce enough power annually for the equivalent of 3.9million UK homes, with Norfolk Vanguard and Norfolk Boreas providing up to 3.6GW of renewable electricity capacity once operational.

Helene Biström, Head of Business Area Wind at Vattenfall, said:

“Norfolk Vanguard and Norfolk Boreas are industry leading projects, with their designs coordinated to minimise the impact on the environment and communities. We are very pleased to receive consent for Norfolk Vanguard. Although the decision was unfortunately made too late to enable us to bid this project in to the current CfD auction round 4, we will now look into potential opportunities to progress this project, working closely with the supply chain and local communities.”

About the Norfolk Zone

- 3.6 GW installed capacity

- £15 million community benefit fund

- Part of industry plans to create 70,000 jobs by 2026, with 10% of these in the East of England

- First power expected: Mid 2020s

- Homes powered equivalent per annum: 3.9 million

- Amount of CO2 saved: 6 million tonnes per year

- Equivalent cars removed: 3.2 million

- Geographical scale of offshore site area: 1,307 km2

- Distance of the nearest turbine from the shore: 47 km

- Length of cabling onshore: 60 km

- Number of turbines: Between 180 and 312

Vattenfall is a leading European energy company, which for more than 100 years has electrified industries, supplied energy to people’s homes and modernised our way of living through innovation and cooperation.

We now want to make fossil-free living possible within one generation. That's why we are driving the transition to a sustainable energy system through initiatives in renewable production and climate smart energy solutions for our customers.

We employ approximately 20,000 people and have operations mainly in Sweden, Germany, the Netherlands, Denmark and the UK.

Vattenfall is owned by the Swedish state.

For more information: www.vattenfall.com

Chevron, Iwatani Announce Agreement to Build 30 Hydrogen Fueling Stations in California

Chevron U.S.A. Inc. (Chevron), a subsidiary of Chevron Corporation (NYSE: CVX), and Iwatani Corporation of America (ICA), a wholly owned subsidiary company of Iwatani Corporation (TYO: 8088), have just announced an agreement to co-develop and construct 30 hydrogen fueling sites in California by 2026.

As part of the agreement, Chevron plans to fund construction of the sites, which are expected to be located at Chevron-branded retail locations across the state. The stations will initially fuel light-duty vehicles while retaining the flexibility to service heavy-duty vehicles over the long term. Iwatani will operate and maintain the hydrogen fueling sites and provide hydrogen supply and transportation logistics services. Chevron plans to supply a portion of the fueling sites with excess hydrogen production capacity at its Richmond Refinery and future hydrogen production from pilot projects in Northern California.

“Chevron believes that hydrogen has the potential to assist in lowering the carbon emissions of the transportation sector and other hard-to-decarbonize industries,” said Andy Walz, president of Americas Fuels & Lubricants for Chevron. “We are excited to work with Iwatani to advance the entire hydrogen transportation value chain from production to consumer purchase in order to help our customers lower their lifecycle transportation carbon intensities.”

“Chevron believes that hydrogen has the potential to assist in lowering the carbon emissions of the transportation sector and other hard-to-decarbonize industries,” said Andy Walz, president of Americas Fuels & Lubricants for Chevron. “We are excited to work with Iwatani to advance the entire hydrogen transportation value chain from production to consumer purchase in order to help our customers lower their lifecycle transportation carbon intensities.”

“This extensive collaboration between Iwatani and Chevron demonstrates our shared vision and commitment to support the decarbonization of transportation,” said Joseph S. Cappello, chairman and CEO of Iwatani Corporation of America. “Together, Chevron and Iwatani will establish one of the most robust, vertically integrated supply and infrastructure ecosystems in California and is a model that can be replicated to other markets.”

About Chevron

Chevron is one of the world’s leading integrated energy companies. We believe affordable, reliable and ever-cleaner energy is essential to achieving a more prosperous and sustainable world. Chevron produces crude oil and natural gas; manufactures transportation fuels, lubricants, petrochemicals and additives; and develops technologies that enhance our business and the industry. We are focused on lowering the carbon intensity in our operations and seeking to grow lower carbon businesses along with our traditional business lines. More information about Chevron is available at www.chevron.com.

About Iwatani

Since 1941, Iwatani has regarded hydrogen as the ultimate clean energy source and has consistently engaged in initiatives to encourage its widespread use. Under the corporate slogan “A world where all enjoy true comfort – this is Iwatani’s desire,” Iwatani strives to solve environmental concerns with the aim of achieving a carbon- free society through the use of hydrogen.

Iwatani is Japan’s only fully integrated supplier of hydrogen and presently supplies its extensive base of light and heavy-duty hydrogen refueling stations and industrial customers via five liquid and ten gaseous hydrogen production plants throughout the country. Leveraging its parent company’s expertise, Iwatani Corporation of America (ICA) has embarked on an ambitious growth program to establish a vertically integrated hydrogen business in the US, which includes hydrogen supply, distribution and logistics services as well as operations & maintenance services to hydrogen refueling station owners. ICA also owns and operates a growing network of Iwatani-branded hydrogen refueling stations in California.

Iwatani Corporation of America has headquarters offices in Houston, Texas and Santa Clara, California.