Super User

Akobo’s hits visible gold at new record depth

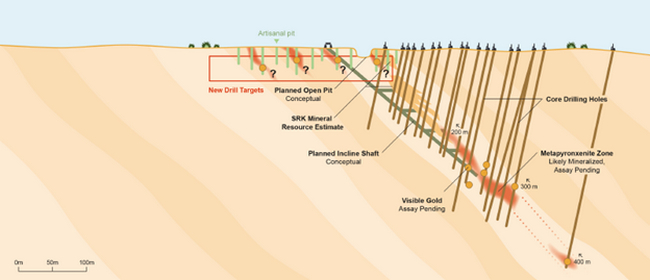

Akobo Minerals has just announced that it has intersected visible gold at 282 metres vertical depth, as well as seeing signs of further potential gold mineralisation in several sections along this latest hole. All indicators point to a belief that the Segele mine can be sustained for much longer than previously envisaged.

The previous deepest intersection of gold mineralisation was at 239 metres vertical depth. This new intersection is part of an ambitious wildcat resource extension hole and demonstrates that the Segele gold mineralisation is now greater than 400m ‘down plunge’ from the surface outcrops. In essence, this means that there seems to be more gold down to much greater levels than previously believed.

Visible gold mineralisation observed at 282m depth in SEDD99

Visible gold mineralisation observed at 282m depth in SEDD99

The success of this hole is testament to the excellent predictive skills and structural understanding developed by the company’s geologists. Their competence is allowing detailed prediction of the gold mineralisation for additional discoveries and will be critical to successful production.

Jørgen Evjen, CEO, Akobo Minerals, stated: “These latest results represent a remarkable success for us. And while this gives us good reason to be excited about the production potential of the Segele mine, equally important is the proof that we understand the local mineralization environment. Our geology team has shown that it can use advanced structural techniques to hit gold mineralization depths never before seen in Southwestern Ethiopia and I believe that we can be confident of considerable success in the future.”

Akobo’s mine development activities are based on its scoping study which envisages a 27-month mine life based purely on the first resource estimate from April 2021 determined by independent mining consultants, SRK. As announced previously, since the release of the scoping study, in addition to the visible gold observations the company has encountered bonanza grade intersections and numerous occurrences of potential host rocks which are demonstrably down-dip from the resource estimate.

The combination of the bonanza grade intersections, host rocks and visible gold is in-line with the general plunge of the mineralization as seen in the resource model. These indicators all point to a belief that the Segele mine can be sustained for much longer than previously envisaged.

This latest hole, number SEDD99, was planned to test for the presence of mineralisation at a much greater depth than before and represents a ‘step back’ of 100m from the previous drill fence, as opposed to a normal 25m as previously used.

An updated resource estimate for Segele is expected to be released by end of Q1 and will incorporate as much of the latest drill hole data as possible. The size of the resource estimate increase will be dependent on the estimation process and assay grades, width and thickness, in addition to down-plunge length. However, the result from SEDD99 will not be included in the next mineral resource update as additional drilling will be needed to support an understanding of the mineralization geometry.

About Akobo Minerals

Akobo Minerals is a Scandinavian-based gold exploration and mining company, currently with ongoing exploration and boutique mine development in the Gambela region and Dima Woreda, southwest Ethiopia. The Company has established itself as the leading gold exploration company in Ethiopia through more than 12 years of on-the-ground activity.

Akobo Minerals is transforming itself to support an increased pace of core drilling. At both its key targets - in Segele and Joru - the company has released exceptionally high-grade gold results in the Segele deposit, while core drilling and trenching at Joru have intersected both high-grade gold zones and large wide zones near the surface. The company has an excellent partnership with national authorities and places ESG at the heart of its activities – including a ground-breaking community program.

The company has built a strong local foothold based upon the principles of good ethics, transparency and communication, and is ready to take on new opportunities and ventures as they arise. Akobo Minerals is uniquely positioned to become a major player in the future development of the very promising Ethiopian mining industry.

Akobo Minerals has a clear strategy aimed at building a portfolio of gold resources through high-impact exploration and mining, while adhering to a lean business operation. The company is headquartered in Oslo and is listed on the Euronext Growth Oslo Exchange under the ticker symbol, AKOBO.

Update on Russia Ukraine conflict on Metso Outotec’s business

As a result of Russia’s military actions against Ukraine, the European Union, the United States and other countries have announced severe sanctions against Russia. While the mining industry is currently not directly targeted by the sanctions, sanctions against the banking sector and individuals as well as other restrictions may have an impact on Metso Outotec and our customers’ Russia related businesses. Due to the current unclear and changing sanction situation, Metso Outotec has temporarily ceased its deliveries to Russia.

As a result of Russia’s military actions against Ukraine, the European Union, the United States and other countries have announced severe sanctions against Russia. While the mining industry is currently not directly targeted by the sanctions, sanctions against the banking sector and individuals as well as other restrictions may have an impact on Metso Outotec and our customers’ Russia related businesses. Due to the current unclear and changing sanction situation, Metso Outotec has temporarily ceased its deliveries to Russia.

Metso Outotec’s customers in Russia operate in several mining and metals processing sites across Russia. Capital projects are typically long with deliveries taking place over the course of several years. Sales from Russia represented approximately 10% of Metso Outotec’s annual sales in 2021. Metso Outotec does not have own production in Russia, or any material procurement in the country.

Further information

Juha Rouhiainen, Vice President, Investor Relations, Metso Outotec Corporation, tel. +358 20 484 3253

Metso Outotec is a frontrunner in sustainable technologies, end-to-end solutions and services for the aggregates, minerals processing and metals refining industries globally. By improving our customers’ energy and water efficiency, increasing their productivity, and reducing environmental risks with our product and process expertise, we are the partner for positive change. Metso Outotec is committed to limiting global warming to 1.5°C with Science Based Targets.

Headquartered in Helsinki, Finland, Metso Outotec employs over 15,000 people in more than 50 countries and its sales for 2021 were about EUR 4.2 billion. The company is listed on the Nasdaq Helsinki. mogroup.com

Emerson Roadshow Tour Arrives in the UK, Monday 7th March

Emerson will kick off its Mobile Roadshow in the United Kingdom on 7th March 2022, featuring an interactive mobile service centre, which will run across various locations in the United Kingdom until 18th March. The event is also available virtually for those who cannot attend in person.

The Emerson Roadshow truck will roll into the United Kingdom beginning 7 March. The tour truck will feature an array of content-rich materials and videos highlighting the company’s advancements in digital transformation, machine safety and more

The Emerson Roadshow truck will roll into the United Kingdom beginning 7 March. The tour truck will feature an array of content-rich materials and videos highlighting the company’s advancements in digital transformation, machine safety and more

The mobile service centre is equipped with the latest advancements in digital transformation for machine safety, machine automation systems and fluid control. Both in-person visitors and virtual attendees will have access to materials and videos highlighting new products and solutions from Emerson.

The tour truck will make preplanned stops at numerous locations. Emerson will conduct safe practices in view of the pandemic. There will be a variety of informational videos offered in both the mobile service centre and virtually, including “Digital Transformation: Turning Data Into Actionable Insight With IIoT Applied Solutions” and “Machine Safety in Pneumatics Reduces Risks Without Compromising Productivity.” Local staff will be on hand to give expert technical advice and answer questions.

For more information on the Emerson Mobile Roadshow and to plan a visit go to our webpage

ANDRITZ to supply new batt forming line for stitchbonding to Romatex, South Africa

International technology group ANDRITZ has received an order from Romatex (Pty) Ltd., South Africa, to supply a new batt forming line.

The line will be dedicated to the production of Maliwatt products used in a wide range of applications, including home textiles. Start-up of the line is planned for the fourth quarter of 2022.

ANDRITZ crosslapper PRO 25-90 © ANDRITZ

ANDRITZ crosslapper PRO 25-90 © ANDRITZ

ANDRITZ will deliver dedicated batt forming equipment, mixing an aXcess card and an eXcelle crosslapper to achieve the technical characteristics Romatex requires in terms of product quality and line performance. This new stitchbonding line will enable Romatex to better serve the growing customer requirements in terms of availability of high-quality products.

This will be the third line supplied by ANDRITZ to Romatex in four years. Helmut Höck, General Manager Operations at Romatex, says: “We bought our first line from ANDRITZ in 2017, then another one in 2019. We have been very satisfied with the close collaboration between our companies, the flexibility and reliability of the machines, as well as the excellent service from ANDRITZ over all these years. The experience has been uncomplicated. This has given us the confidence to consider ANDRITZ for a further investment.”

ANDRITZ batt forming line in operation at Romatex, Cape Town © ANDRITZ

ANDRITZ batt forming line in operation at Romatex, Cape Town © ANDRITZ

ANDRITZ is one of the global market leaders for supply of nonwoven production technologies, including batt forming equipment for the stitchbonding processes used to make Maliwatt, Malivlies and Multiknit. This segment addresses a variety of applications, including automotive, household, bedding, footwear, wipes, and many others.

Romatex is the leader in Maliwatt stitchbonding in Africa. Its facility is located in Cape Town. One of the company’s key strengths is its product diversification. Today, the company offers a complete range of bed linen, duvets, pillows, and stitchbonded products.

Stitchbonded products made by Romatex, Cape Town © ANDRITZ

Stitchbonded products made by Romatex, Cape Town © ANDRITZ

ANDRITZ GROUP

International technology group ANDRITZ offers a broad portfolio of innovative plants, equipment, systems and services for the pulp and paper industry, the hydropower sector, the metals processing and forming industry, pumps, solid/liquid separation in the municipal and industrial sectors, as well as animal feed and biomass pelleting. Plants for power generation, flue gas cleaning, recycling, and the production of nonwovens and panelboard complete the global product and service offering. Innovative products and services in the industrial digitalization sector are offered under the brand name Metris and help customers to make their plants more user-friendly, efficient and profitable. The publicly listed group has around 26,800 employees and more than 280 locations in over 40 countries.

Dimerco Expands to Phoenix, AZ, USA with Completion of Joint Venture Agreement with Phoenix-based BC Logistics

Dimerco, a world-leading logistics and freight transportation company, has expanded its US freight forwarding network to Phoenix with the completion of its investment in Phoenix-based BC Logistics.

The new joint venture, is the latest in Dimerco’s continuing expansion of its US freight forwarding network, which now includes 19 offices in major markets, coast to coast. Globally, Dimerco has 166 company-owned forwarding offices in 17 countries, supplemented by 200 partner agents and 80+ contract logistics operations.

Founded in 2001, BC Logistics has provided global and domestic transportation services for companies in the semiconductor, power/energy, healthcare, and other industries requiring time-critical, service sensitive shipments. The new joint venture will supplement BC Logistics’ superb local market knowledge and transportation expertise with Dimerco’s global capabilities to provide customers with worldwide logistics solutions from a single source.

Founded in 2001, BC Logistics has provided global and domestic transportation services for companies in the semiconductor, power/energy, healthcare, and other industries requiring time-critical, service sensitive shipments. The new joint venture will supplement BC Logistics’ superb local market knowledge and transportation expertise with Dimerco’s global capabilities to provide customers with worldwide logistics solutions from a single source.

Arizona has become a very important logistics hub as its population and business base has grown. Phoenix is now the fifth-largest city in the U.S and Arizona has become an epicenter for technology manufacturing in the Southwest, with corporations attracted by the state’s business-friendly tax structure, knowledge-based workforce, and favorable weather. BC Logistics will capitalize on this growth to expand business across a wide range of services, including air & ocean freight, domestic air & ground, logistics planning, warehousing, crating & package, asset recovery/white glove services, and time-definite courier service.

About Dimerco

Founded in Taipei in 1971, Dimerco is a global third-party logistics company (3PL) that integrates air and ocean freight, trade compliance and contract logistics services to make global supply chains more effective and efficient. The company is strategically focused on global shipping projects that connect Asia’s logistics and manufacturing hubs with each other and with North America and Europe. Dimerco connects Asia with the world like no other global 3PL.

About BC Logistics

Founded in 2001 by Vicki Boisjolie and Jeff Carlson, BC Logistics is an asset-based global transportation provider that provides individualized transportation and storage solutions to customers, 24 hours a day, seven days a week. The company is a woman-owned business and a member of the Women’s Business Enterprise National Council.

Hexagon strengthens drill autonomy capabilities with exclusive partnership

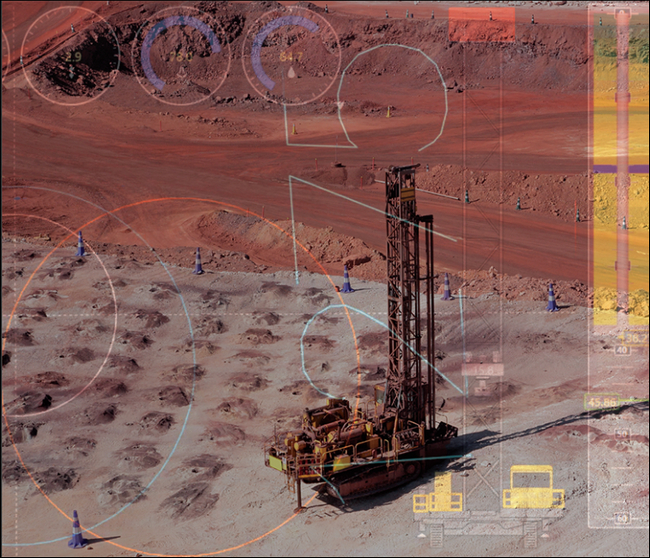

Hexagon’s Mining division today announced it has signed an exclusive partnership agreement with Phoenix Drill Control, a technology company specialized in implementing autonomous technology to the open-pit, blast-hole drilling process.

Applying artificial intelligence (AI) and machine control to drill automation, Phoenix Drill Control’s autonomous drill technology overcomes the constraints typically associated with traditional drill automation platforms, such as removal or replacement of existing machine controls, extensive operator training and reliance on operator input.

AI algorithms monitor all input signals and take dynamic corrective action, without operator input and before catastrophic hole failure or a stuck drill bit occurs. Phoenix’s autonomous drilling platform has a proven production track record demonstrating that it outperforms the industry’s existing automated drills.

Optimized drill operations have the potential to significantly improve a mine’s bottom line by protecting machine life, ensuring high-quality blast holes and reducing overall drill costs. Consolidating the necessary technology into one connected platform is how Hexagon is helping to empower its customers’ autonomous future.

Hexagon partners with Phoenix Drill Control

Hexagon partners with Phoenix Drill Control

“Partnership with Phoenix Drill Control will further enhance Hexagon’s autonomous capabilities,” said Ryan Hawes, COO, Hexagon’s Mining division. “Phoenix Drill Control’s simplified, scalable automation platform is commercially available immediately. It will bring profound benefits to customers, including faster decisions with greater accuracy, improved health and safety, greater efficiency by eliminating errors and a smaller environmental footprint.

“Like Hexagon, Phoenix Drill Control creates technology that is scalable and platform-agnostic. This ensures data is accurate, without operator induced noise, and does its best work, arming customers with a feedback loop that points the way to a safer, more productive and sustainable future,” said Hawes.

Mark Baker, President of Phoenix Drill Control said: “We’re excited to partner with Hexagon and believe our collaboration will benefit customers. The combination of Phoenix’s AI technology with Hexagon will propel autonomous drilling to the forefront of the industry. After all, drilling is at the beginning of the mining process, and when done right, the entire value chain benefits.”

About Hexagon

Hexagon is a global leader in digital reality solutions, combining sensor, software and autonomous technologies. We are putting data to work to boost efficiency, productivity, quality and safety across industrial, manufacturing, infrastructure, public sector, and mobility applications.

Our technologies are shaping production and people-related ecosystems to become increasingly connected and autonomous — ensuring a scalable, sustainable future.

Hexagon’s Mining division solves surface and underground mine challenges with proven technologies for planning, operations and safety.

Hexagon (Nasdaq Stockholm: HEXA B) has approximately 22,000 employees in 50 countries and net sales of approximately 5.1bn USD. Learn more at hexagon.com

Computing-in-Memory Innovator Solves Speech Processing Challenges at the Edge Using Microchip’s Analog Embedded SuperFlash® Technology

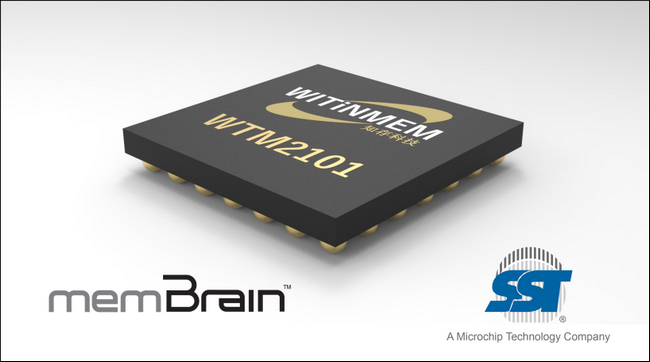

SuperFlash memBrain™ memory solution enables WITINMEN’s System on Chip (SoC) to meet the most demanding neural processing cost, power, and performance requirements

Computing-in-memory technology is poised to eliminate the massive data communications bottlenecks otherwise associated with performing artificial intelligence (AI) speech processing at the network’s edge but requires an embedded memory solution that simultaneously performs neural network computation and stores weights. Microchip Technology Inc. (Nasdaq: MCHP), via its Silicon Storage Technology (SST) subsidiary, today announced that its SuperFlash memBrain neuromorphic memory solution has solved this problem for the WITINMEM neural processing SoC, the first in volume production that enables sub-mA systems to reduce speech noise and recognize hundreds of command words, in real time and immediately after power-up.

Microchip has worked with WITINMEM to incorporate Microchip’s memBrain analog in-memory computing solution, based on SuperFlash technology, into WITINMEM’s ultra-low-power SoC. The SoC features computing-in-memory technology for neural networks processing including speech recognition, voice-print recognition, deep speech noise reduction, scene detection, and health status monitoring. WITINMEM, in turn, is working with multiple customers to bring products to market during 2022 based on this SoC.

“WITINMEM is breaking new ground with Microchip’s memBrain solution for addressing the compute-intensive requirements of real-time AI speech at the network edge based on advanced neural network models,” said Shaodi Wang, CEO of WITINMEM. “We were the first to develop a computing-in-memory chip for audio in 2019, and now we have achieved another milestone with volume production of this technology in our ultra-low-power neural processing SoC that streamlines and improves speech processing performance in intelligent voice and health products.”

“We are excited to have WITINMEM as our lead customer and applaud the company for entering the expanding AI edge processing market with a superior product using our technology,” said Mark Reiten, vice president of the license division at SST. “The WITINMEM SoC showcases the value of using memBrain technology to create a single-chip solution based on a computing-in-memory neural processor that eliminates the problems of traditional processors that use digital DSP and SRAM/DRAM-based approaches for storing and executing machine learning models.”

Microchip’s memBrain neuromorphic memory product is optimized to perform vector matrix multiplication (VMM) for neural networks. It enables processors used in battery-powered and deeply-embedded edge devices to deliver the highest possible AI inference performance per watt. This is accomplished by both storing the neural model weights as values in the memory array and using the memory array as the neural compute element. The result is 10 to 20 times lower power consumption than alternative approaches along with lower overall processor Bill of Materials (BOM) costs because external DRAM and NOR are not required.

Permanently storing neural models inside the memBrain solution’s processing element also supports instant-on functionality for real-time neural network processing. WITINMEM has leveraged SuperFlash technology’s floating gate cells’ nonvolatility to power down its computing-in-memory macros during the idle state to further reduce leakage power in demanding IoT use cases.

For information contact This email address is being protected from spambots. You need JavaScript enabled to view it. or visit the SST website.

About Silicon Storage Technology (SST)

Microchip Technology’s SST subsidiary is a leading provider of embedded flash technology. SST develops, designs, licenses and markets a diversified range of proprietary and patented SuperFlash memory technology solutions for the consumer, industrial, automotive and Internet of Things (IoT) markets. SST was founded in 1989, went public in 1995 and was acquired by Microchip in April 2010. SST is now a wholly owned subsidiary of Microchip, and is headquartered in San Jose, Calif. For more information, visit the SST website at www.sst.com.

About Microchip Technology

Microchip Technology Inc. is a leading provider of smart, connected and secure embedded control solutions. Its easy-to-use development tools and comprehensive product portfolio enable customers to create optimal designs which reduce risk while lowering total system cost and time to market. The company’s solutions serve more than 120,000 customers across the industrial, automotive, consumer, aerospace and defense, communications and computing markets. Headquartered in Chandler, Arizona, Microchip offers outstanding technical support along with dependable delivery and quality. For more information, visit the Microchip website at www.microchip.com.

About WITINMEM (Zhicun)

WITINMEM (Zhicun) technology Co. Ltd. is a leading provider of computing-in-memory chips and system solutions. WITINMEM designs computing-in-memory technology for high-efficient AI computation. Its SoC chips and development toolkit help customers to develop low-power AI system. Headquartered in Beijing, China. For more information, please visit the WITINMEM website at www.witintech.com.

HANetf: Investment comment on Ukraine/Russia crisis

Gold hit a 20 month high on Wednesday of $1940, driven mainly by the Russian invasion of Ukraine. There has been significant volatility since but gold is hovering around the $1,900 mark.

The price of gold often rallies during times of geopolitical uncertainty. For instance, following the killing of Iranian general Qasem Soleimani in early 2020, the price of gold hit levels it had not seen since 2013.

The price of gold often rallies during times of geopolitical uncertainty. For instance, following the killing of Iranian general Qasem Soleimani in early 2020, the price of gold hit levels it had not seen since 2013.

The war in Ukraine, however, has the potential to be much more destabilising to financial markets.

The conflict is potentially escalating and so too are the severity of sanctions placed on Russia. One economic historian has described the sanctions on Russia as “a declaration of all-out financial warfare against Russia.”

Therefore it is expected that conflict will continue to exert significant uncertainty on the equity and bond markets. As an insurance asset, gold comes into its own in periods of uncertainty such as this.

There is also pressure on energy markets and the likelihood of disruptions to supply. Higher energy prices were already the principle driver of inflation in Europe prior to the outbreak of the war. Energy prices have a significant weight of almost 10% in the European Harmonised Indices of Consumer Prices (HICP). Therefore higher energy prices will likely result in higher short and medium term inflation.

There is also the risk of higher inflation through agricultural prices. Russia and Ukraine combined make up 27.9% of global wheat exports. If there are supply disruptions, this would have an impact on prices and consequently on inflation. Together with the impact from energy prices, this could lead to significant inflationary pressure. This plays into the historic uses for gold as a hedge for inflation and also market uncertainty.

A final way potential impact is on the supply of gold itself. Russia was the world’s second largest supplier of Gold in 2021. Should they be unable or unwilling to export gold, this could have a negative impact on available supply and potentially impact gold prices.

The Royal Mint Physical Gold ETC – RMAU is a potential way to implement a gold investment. It has arguably the most secure way to hold physical gold as it is held by a sovereign mint versus similar Gold ETCs where the gold is held in custody at banks in London and New York.

ourstory

HANetf was founded by two of Europe’s leading ETF pioneers, Hector McNeil and Nik Bienkowski. Hector and Nik have been a dynamic force in the ETF industry for over 17 years, establishing and building successful companies including ETF Securities, Boost ETP and WisdomTree Europe.

In 2017, Hector and Nik started HANetf to provide a full white label operational, regulatory, distribution and marketing solution for asset managers who want to successfully launch and manage UCITS ETFs. Creating thematic ETF investing for modern portfolios.

Our clients gain access to a senior team with extensive ETF experience and a world class ecosystem of ETF service providers, working together to lower the barriers to entry, reduce costs and increase speed-to-market for asset managers looking to successfully launch UCITS ETFs.

HANetf is owned by employees and external investors with long-term experience in ETFs, trading and asset management including P72 Ventures (founded by Steve Cohen), Elkstone Partners, Jim Wiandt (Founder of ETF.com), Roger Hodenius (co-Founder of FlowTraders) and Blake Grossman (ex-CEO of Barclays Global Investors).

Chevron Announces Agreement to Acquire Renewable Energy Group

Chevron Corporation (NYSE: CVX) and Renewable Energy Group, Inc. (NASDAQ: REGI) (“REG”) announced today a definitive agreement under which Chevron will acquire the outstanding shares of REG in an all-cash transaction valued at $3.15 billion, or $61.50 per share.

The acquisition combines REG’s growing renewable fuels production and leading feedstock capabilities with Chevron’s large manufacturing, distribution and commercial marketing position.

“REG was a founder of the renewable fuels industry and has been a leading innovator ever since,” said Chevron Chairman and CEO Mike Wirth. “Together, we can grow more quickly and efficiently than either could on its own.”

“REG was a founder of the renewable fuels industry and has been a leading innovator ever since,” said Chevron Chairman and CEO Mike Wirth. “Together, we can grow more quickly and efficiently than either could on its own.”

The transaction is expected to accelerate progress toward Chevron’s goal to grow renewable fuels production capacity to 100,000 barrels per day by 2030 and brings additional feedstock supplies and pre-treatment facilities. After closing of the acquisition, Chevron’s renewable fuels business, Renewable Fuels - REG, will be headquartered in Ames, Iowa. In addition, CJ Warner is expected to join Chevron’s Board of Directors.

“This transaction delivers premium cash value to shareholders and will give us additional resources as we aim to accelerate growth and strengthen our collective ability to deliver the sustainable fuels our customers and the world need,” said CJ Warner, REG president & CEO. “Our employees’ hard work and dedication have built a fantastic renewable fuels company and made this transaction possible. We look forward to joining Chevron’s team.”

The transaction is expected to be accretive to Chevron earnings in the first year after closing and accretive to free cash flow after start-up of REG’s Geismar expansion.

Transaction Details

The acquisition consideration is 100 percent cash. Total enterprise value of $2.75 billion includes a net cash position around $400 million greater than debt.

The transaction has been approved by the Boards of Directors of both companies and is expected to close in the second half of 2022. The acquisition is subject to REG shareholder approval. It is also subject to regulatory approvals and other customary closing conditions.

The transaction price represents a premium of around 57% on a 30-day average based on closing stock prices on February 25, 2022.

Advisors

Goldman Sachs & Co. LLC is acting as financial advisor to Chevron. Paul, Weiss, Rifkind, Wharton & Garrison LLP is acting as legal advisor to Chevron. Guggenheim Securities, LLC is acting as financial advisor and Latham & Watkins LLP is acting as legal advisor to REG.

About Chevron

Chevron is one of the world’s leading integrated energy companies. We believe affordable, reliable and ever-cleaner energy is essential to achieving a more prosperous and sustainable world. Chevron produces crude oil and natural gas; manufactures transportation fuels, lubricants, petrochemicals and additives; and develops technologies that enhance our business and the industry. We are focused on lowering the carbon intensity in our operations and seeking to grow lower carbon businesses along with our traditional business lines. More information about Chevron is available at www.chevron.com.

About Renewable Energy Group

Renewable Energy Group is leading the energy and transportation industries’ transition to sustainability by converting renewable resources into high-quality, sustainable fuels. REG is an international producer of sustainable fuels that significantly lower greenhouse gas emissions to immediately reduce carbon impact. REG utilizes a global integrated procurement, distribution, and logistics network to operate 11 biorefineries in the U.S. and Europe. In 2020, REG produced 519 million gallons, or 1.7 million metric tons, of cleaner fuel delivering 4.2 million metric tons of carbon reduction. REG is meeting the growing global demand for lower-carbon fuels and leading the way to a more sustainable future.

Maritime electrification company Echandia starts branch office in Norway, recruits Roy Storeng to lead business development

The Swedish company Echandia, a leading developer of battery systems for maritime electrification, expands in the Norwegian market through the appointment of industry veteran Roy Storeng to lead the business development for Echandia in Norway. Roy has an extensive background from the maritime and transport industry in Norway and abroad.

Echandia is a leading developer of zero-emission energy solutions for heavy-duty maritime electrification. Echandia has customers in Europe, Asia, and Oceania, including Cochin Shipyards, building the world's largest fleet of electric ferries in Kochi, India, and the major global shipyard Damen Shipyard in the Netherlands.

Roy StorengThe appointment of Roy Storeng to lead business development for Echandia in Norway marks an important milestone for Echandia on its continued growth journey.

Roy StorengThe appointment of Roy Storeng to lead business development for Echandia in Norway marks an important milestone for Echandia on its continued growth journey.

Norway is a front-runner in maritime electrification. Of the total number of fully electrified vessels globally, as much as 36 percent is operating Norwegian waterways with no other countries coming close. As such, Norway is an important market and will continue to lead the way on the path to a zero-emission global fleet.

Roy brings extensive experience from the maritime industry, with leading business development positions at Wärtsilä, GE Transportation and Bertel O. Steen.

"We are pleased to welcome Roy to the Echandia team. Entering Norway is an important milestone for Echandia. Norway is an important shipping country with a rapidly growing market for electrification in the maritime sector. With Roy in charge of our expansion, we are in a great position to establish our presence and meet the demands on this market", says Magnus Eriksson, CEO and founder of Echandia.

"Cutting emissions in the maritime sector is one of the transport industry’s greatest challenges. Echandia is lowering the environmental footprint within the sector by providing world class technology in battery and fuel cell systems for maritime applications. I look forward to joining the Echandia team, and to contribute with my experience and expertise to develop Echandia’s solutions for a sustainable transport industry”, says Roy Storeng.

About Echandia

Echandia Group AB is leading the development of maritime electrification, with zero-emission energy solutions for maritime and industrial applications. Echandia delivers heavy-duty battery and fuel-cell systems and proprietary, lightweight battery racks and system architecture for complex and demanding environments. Echandia is based in Stockholm Sweden.