Administrator

Investment in growth market: MANN+HUMMEL acquires helsa Functional Coating

MANN+HUMMEL group has just announced the completion of the takeover of helsa Functional Coating on September 21st, 2020. This business unit of the helsa group, founded in 1947, complements MANN+HUMMEL’s portfolio particularly in the area of elastomer and activated carbon technology for special industrial applications. No information concerning the purchase price has been disclosed.

“The takeover will enable MANN+HUMMEL to position itself as a technology leader in this growth market and further set the company up for the future. This is a further step towards achieving our vision ‘Leadership in filtration’”, explained Emese Weissenbacher, Executive Vice President and CFO. “The helsa Functional Coating division has a similar corporate culture since it belonged to a family business also with a long history. We are very much looking forward to working with our new colleagues.”

“The takeover will enable MANN+HUMMEL to position itself as a technology leader in this growth market and further set the company up for the future. This is a further step towards achieving our vision ‘Leadership in filtration’”, explained Emese Weissenbacher, Executive Vice President and CFO. “The helsa Functional Coating division has a similar corporate culture since it belonged to a family business also with a long history. We are very much looking forward to working with our new colleagues.”

“For us, as a niche provider of intelligent premium solutions in molecular air filtration, the takeover holds great potential,” said Norbert Gregor, CEO of helsa Functional Coating and future Vice President & Managing Director Molecular Filtration at MANN+HUMMEL. “MANN+HUMMEL’s global infrastructure will enable us to accelerate our growth trajectory and step up our efforts in large-scale projects to reduce molecular emissions worldwide.”

Strengthening the workforce with highly qualified employees, particularly in the area of research and development, a broad product pallet and additional production capacity will help MANN+HUMMEL to increase its competitiveness and offer customers valuable additional benefits.

About MANN+HUMMEL

MANN+HUMMEL is a leading global expert in filtration. The Ludwigsburg-based group develops filtration solutions for vehicles, industrial applications, clean air in internal spaces in industry and the public sector, and the sustainable use of water. In 2019, over 22,000 employees at more than 80 locations worldwide generated a turnover of EUR 4.2 billion. Products include, amongst others, air filter systems, intake systems, liquid filter systems, technical plastic parts, filter media, cabin filters, industrial filters and membranes and modules for water filtration, sewage treatment and process applications.

You can find further information on MANN+HUMMEL at https://www.mann-hummel.com/

Europe power industry contracts rise by 23% in August 2020

Europe power industry contracts activity in August 2020 saw 194 contracts announced, marking a rise of 23% over the last 12-month average of 158, according to GlobalData’s power database.

Europe power industry contracts in August 2020: Ireland leads activity

Looking at contracts by country, Ireland led the activity in August 2020 with 84 contracts and a share of 43.3%, up 38.6% over the previous month and up 8300% when compared with the last 12 month-average, followed by the UK with 25 contracts and a share of 12.9% and Germany with 16 contracts and a share of 8.2% during the month.

Looking at contracts by country, Ireland led the activity in August 2020 with 84 contracts and a share of 43.3%, up 38.6% over the previous month and up 8300% when compared with the last 12 month-average, followed by the UK with 25 contracts and a share of 12.9% and Germany with 16 contracts and a share of 8.2% during the month.

Looking at the last 12-month average, France held the top spot with 46 contracts, followed by the UK with 14 and Spain with ten contracts.

Solar is top technology area for contracts in August 2020

Looking at contracts divided by the type of technology, solar accounted for the largest proportion with 90 contracts and a 56.3% share, followed by wind with 50 contracts and a 31.3% share and thermal with 12 contracts and a 7.5% share.

Looking at power industry contracts divided by segment in Europe as tracked by GlobalData, Power Plant was the most popular segment in August 2020, with 109 contracts, followed by Generation Equipment (35) and T&D Equipment (31).

The proportion of contracts by category tracked by GlobalData in the month was as follows:

- Project Implementation: 107 contracts and a 55.2% share

- Supply & Erection: 49 contracts and a 25.3% share

- Repair, Maintenance, Upgrade & Others: 19 contracts and a 9.8% share

- Power Purchase Agreement: ten contracts and a 5.2% share

- Consulting & Similar Services: seven contracts and a 3.6% share

- Electricity Supply: two contracts and a 1% share.

Power contracts in August 2020: Top issuers by capacity

The top issuers of contracts for the month in terms of power capacity involved in Europe were:

- Department of Communications, Climate Action and Environment (Ireland): 1,275.54MW from 82 contracts

- Danske Commodities (Denmark): 480MW from one contract

- Elektrocieplownia Stalowa Wola (Poland): 450MW capacity from one contract.

Power contracts in August 2020: Top winners by capacity

The top winners of contracts for the month in terms of power capacity involved in Europe were:

- Equinor (Norway) and SSE Renewables (United Kingdom): 480MW from one contract

- Zaklady Pomiarowo Badawcze Energetyki Energopomiar (Poland) and Energoprojekt-Katowice (Poland): 450MW from one contract

China Energy Construction Group (China): 270MW capacity from one contract.

All publicly-announced contracts are included in this analysis drawn from GlobalData’s Power database, which covers power plants, T&D projects, equipment markets, analysis reports, capacity and generation, and tracks tenders and contracts on a real-time basis.

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis, and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, technology, energy, financial and professional services sectors.

New Responsible Mining Foundation report: Mining and the SDGs - huge potential, limited action

Just 10 years are left to achieve the UN Sustainable Development Goals – and as one of the few sectors with links to all 17, the mining industry has a significant role to play in contributing to their achievement. But as the new report "Mining and the SDGs – a 2020 status update" reveals, the sector as a whole is falling short.

While most of the world's largest mining companies now mention the SDGs in their sustainability reporting, and while a few frontrunners have integrated the SDGs into their business strategies, most SDG-related reporting by mining companies is, the report finds, purely cosmetic – and there is little public reporting of firms' negative impacts on progress towards meeting the goals. There is a real risk of companies being accused of "SDG-washing" while reporting remains unbalanced.

And when looking for evidence that companies are taking practical actions to help deliver the goals, the results are very mixed.

Published by the Responsible Mining Foundation (RMF) and the Columbia Center on Sustainable Investment, the study bases its findings on the Responsible Mining Foundation's RMI Report 2020, which assesses the policies and practices of 38 large-scale mining companies around the world. It found that there are some examples of good practice within the sector, with relatively widespread action on SDG 4 (Quality Education) and SDG 17 (Partnerships for the Goals). However, the report also found that no one company is taking strong action to address all 17 goals, and the sector's action on four goals in particular – SDG 3 (Good Health and Wellbeing), SDG 5 (Gender Equality), SDG 6 (Clean Water and Sanitation) and SDG 14 (Life Below Water) – is especially weak.

Published by the Responsible Mining Foundation (RMF) and the Columbia Center on Sustainable Investment, the study bases its findings on the Responsible Mining Foundation's RMI Report 2020, which assesses the policies and practices of 38 large-scale mining companies around the world. It found that there are some examples of good practice within the sector, with relatively widespread action on SDG 4 (Quality Education) and SDG 17 (Partnerships for the Goals). However, the report also found that no one company is taking strong action to address all 17 goals, and the sector's action on four goals in particular – SDG 3 (Good Health and Wellbeing), SDG 5 (Gender Equality), SDG 6 (Clean Water and Sanitation) and SDG 14 (Life Below Water) – is especially weak.

There are multiple and striking mismatches between companies' rhetoric and action. The report found, for example, that SDG 3 (Good Health and Wellbeing) and SDG 6 (Clean Water and Sanitation) are two of the goals that many firms claim to be prioritising, yet they also account for some of the weakest levels of action. In a recent research article RMF highlighted the striking contrast between companies' materiality analyses and their actions on these SDGs.

Working towards the SDGs is about more than doing the right thing: there is a strong and well-established business case for companies to integrate the goals into their business strategies. As the report states, mining companies that embed the SDGs into their core operations will strengthen their ability to meet future challenges – and will build trust among all stakeholders, including an investment community increasingly concerned about sustainability matters. To that end, the report details nine practical steps companies can take to demonstrate their commitment to meeting the SDGs, and to responsible mining in general.

About the Responsible Mining Foundation

The Responsible Mining Foundation (RMF) is an independent research organisation that encourages continuous improvement in responsible extractives across the value chain by developing tools and frameworks, sharing public-interest data and enabling informed and constructive engagement between extractive companies and other stakeholders. The Foundation does not accept funding or other contributions from the extractive industry.

South Korea’s Green New Deal to create sustainable ecosystem with offshore wind and solar PV playing pivotal roles

South Korea, one of the top CO2 emitting countries in the world, proposed a ‘Green New Deal’ to help accelerate the country’s transition towards the creation of a sustainable ecosystem by attaining net-zero emissions by 2050 and mitigate the risk of climate crisis. The deal affirms South Korea’s desire to make big advancements in the renewable energy (RE) sphere, attaining at least 20% of green power generation in the mix, with solar PV power reaching more than 36GW and wind offshore capacity reaching 12GW by 2030, says GlobalData, a leading research and analytics company.

South Korea targeted the power generation sector first for transformation to tackle the growing emissions. The power generation sector, which has over 50% share in the country’s total carbon emissions, is set for a sustainable transformation with the share of coal in the generation mix diminishing from the current 45% to around 30% by 2030 and 10% by 2050.

Ankit Mathur, Practice Head of Power at GlobalData, comments: “In the third energy master plan, by 2040, South Korea desires to have renewables shape 30-35% of the generation blend. As per GlobalData estimates, the current transition will see the country’s generation mix having 19% of the generation from renewable sources (including hydropower) by 2030, very close to the 20% target by 2030. The country would need to create a plan of retiring the coal projects and installation of renewable projects to ensure the power demand is met without any major hiccups.”

Ankit Mathur, Practice Head of Power at GlobalData, comments: “In the third energy master plan, by 2040, South Korea desires to have renewables shape 30-35% of the generation blend. As per GlobalData estimates, the current transition will see the country’s generation mix having 19% of the generation from renewable sources (including hydropower) by 2030, very close to the 20% target by 2030. The country would need to create a plan of retiring the coal projects and installation of renewable projects to ensure the power demand is met without any major hiccups.”

South Korea is under increased scrutiny to reduce carbon emissions and the climate advocates are proposing a complete coal phase out by 2030 in line with the Paris Agreement. According to GlobalData, the current renewable (including hydropower) share in the capacity mix stands at 20%, and is likely to almost double by 2030. However, in order to faciliatate the sustainable transition, the government needs to implement an array of measures such as carbon tax, end to coal financing and focus on renewables to discourage coal usage.

Mathur concludes: “Due to the the country’s world-class marine plants and shipping construction infrastructure, there are significant opportunities in the floating offshore wind segment. International companies, in partnership with the local Korean companies and workforce, can support the government's Green New Deal strategy by stimulating the economic growth and create employment opportunities.

“GlobalData estimates the new capacity build of 48.5GW between 2020 and 2030 will be dominated by non-carbon emitting sources with 73% share, driven majorly by solar PV and wind installations. By 2030, the expansion of the offshore wind segment is anticipated to make it the larger performer in the overall wind segment, which would complement the massively strong solar PV segment to help the nation witness the green transition.”

- Comments provided by Ankit Mathur, Practice Head of Power at GlobalData

- This press release is written using data and information sourced from proprietary databases, primary and secondary research, and in-house analysis conducted by GlobalData’s team of industry experts

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.

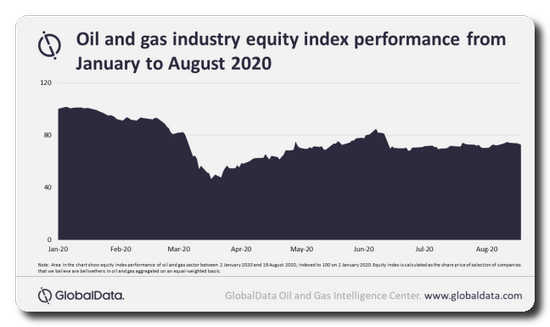

Deal activity in global oil and gas industry largely driven by themes, says GlobalData

Mergers and acquisitions (M&A) activity across the oil and gas sector reached US$224.4bn in deal value in 2019, reflecting growths of 29% and 159% compared to 2018 and 2017, respectively. The main themes that drove this activity were shale, emerging economies, China impact and subsea, according to GlobalData, a leading data and analytics company.

GlobalData’s theme report: ‘M&A in Oil & Gas (2017–Q1 2020)’ analyses the key themes that were influential in enabling M&A and asset transactions within the oil and gas sector from 2017 to Q1 2020.

Snigdha Parida, M&A Analyst at GlobalData, comments: “Deal activity was also influenced by the need to make strategic partnerships to overcome the regulatory challenges, gain access to IoT, cloud or other emerging technologies and diversify into renewable energy. The growing importance of sustainability, combined with volatile oil prices and diminishing resources resulted in M&A for diversification.

“The equipment and services industry witnessed most of the technology-driven deals in the sector. Tightening profit margins and resources that are increasingly difficult to reach have, in part, made investments into technologies a necessity.”

In 2020, the COVID-19 pandemic has emerged as a new theme that has adversely impacted the oil and gas sector. The pandemic is likely to impact deals’ activities in the short-term.

Parida adds: “Low prices coupled with a prospect of low demand will not augur well for the sector and force to rethink on project timelines and cost-cutting across value chain. Buyers are wary of M&A deals while conserving cash for the future and possible target companies may also be reluctant to sell off at depressed prices.”

In Q1 2020, a total of 14 M&A deals with a transaction value of US$50m or more were announced in the global oil and gas space. These deals had a combined transaction value of US$4.2bn, which was down by 80% when compared to Q4 2019 and 95% down when compared to Q1 2019.

In Q1 2020, GlobalData’s oil and gas index fell by 43%. The index remains 28% below January 2020 levels, turning many oil and gas companies into attractive bid targets.

Parida concludes: “Presently, the COVID-19 pandemic has created uncertainties in global energy demand that has compelled the oil and gas companies to evaluate their capital discipline and refrain from M&As. However, in the medium-term, the market correction could create attractive M&A opportunities in the sector.”

- Comments provided by Snigdha Parida, M&A Analyst at GlobalData

- Information based on GlobalData’s report: M&A in Oil & Gas (2017 to Q1 2020)

- This report was built using data and information sourced from proprietary databases, primary and secondary research, and in-house analysis conducted by GlobalData’s team of industry experts

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, technology, energy, financial and professional services sectors.

Outokumpu – Duplex stainless steel’s popularity grows as it turns 90

Outokumpu is celebrating 90 years since duplex stainless steel made its debut on the world market. The global leader in stainless steel is using the opportunity to highlight the growing role of duplex grades in supporting sustainability. This is made possible by their superior corrosion resistance and high strength. Thanks to this combination of properties, engineers can create lightweight components and structures that provide a long life and require minimum maintenance – delivering excellent value for money and minimizing use of raw materials. As the inventor of duplex stainless steel, Outokumpu is committed to carry this legacy forward.

Duplex grades have been used widely over the last nine decades in chemical processing, oil and gas, pulp and paper, and food and beverage industries. Additionally, today’s requirements for sustainable solutions make duplex stainless steel a long-lasting alternative to traditional painted or coated carbon steel for bridges and infrastructure.

Peder Claesson, Head of Project Sales at Outokumpu, said: “While duplex stainless steel is now 90 years old, it is proving to be an ideal material for the 21st century. It is strong and durable for industrial environments, but it also looks great and has huge potential to save cost and minimize environmental footprint.”

The first duplex grades were introduced by Outokumpu’s Avesta steelworks in September 1930 as a breakthrough that combined the two most common types of stainless steel, austenitic and ferritic. This enabled metallurgists to create a new material that offered the best properties of both.

Since then, a whole family of duplex grades has been developed for specific industrial applications. For example, we have launched a new formable duplex grade to increase strength and efficiency of complex mechanical components such as heat exchanger plates.

Learn more about duplex stainless steel at www.outokumpu.com/duplex90.

Outokumpu is the global leader in stainless steel. We aim to be the best value creator in stainless steel through customer orientation and efficiency. The foundation of our business is our ability to tailor stainless steel into any form and for almost any purpose. Stainless steel is sustainable, durable and designed to last forever. Our customers use it to create civilization’s basic structures and its most famous landmarks as well as products for households and various industries. Outokumpu employs 10,000 professionals in more than 30 countries, with headquarters in Helsinki, Finland and shares listed in Nasdaq Helsinki. www.outokumpu.com

Sappi encourages innovation by supporting one of the first Graphic Arts Industry Hackathons

Sappi has joined forces with VIGC (Flemish Innovation Center for the Graphic Communication) and EY in their endeavor to launch one of the first Graphic Arts Industry Hackathons. A Hackathon is a method of creative problem solving designed to boost disruptive innovation. The target of this event is to create synergies, foster innovation and trigger ideas that will future-proof the print industry by tackling and contributing solutions to its most pressing challenges.

These categories being covered are: Commercial Print, Packaging & Labels, Publishing and Industrial Printing. The hackathon will take place on 12th and 13th of October, 2020, in a virtual format, thus enabling global participation. Startups, scale-ups, students, creatives and all industry enthusiasts are encouraged to join. Registrations can be done here: https://vigc.thefactory.works

Winners of this innovation contest will gain exposure in VIGC´s Het Congress event on October 15th, 2020, where they will have the opportunity to showcase their Minimum Viable Product/s to experts and industry decision-makers. Furthermore, they will receive €3,000, sponsored by Sappi, as well as 3 months of mentorship by Sappi experts to help them materialize their idea.

Sappi has already taken its own steps in digital innovation with OctoBoost, Sappi´s internal startup, which develops digital solutions for the print industry. “Innovation and digitization will be the catalysts of the print industry´s prosperity”, says Anna Oñate, Sappi´s Intrapreneur, Co-Founder of OctoBoost and Mentor at the VIGC Hackathon, “A Hackathon is the perfect platform to bring bright, creative minds together, willing to contribute to the industry´s transformation”

“One of the key pillars of our Digital Transformation Strategy is to create an ecosystem of digital innovators around us. We want to be closer to innovative players within and outside of our industry”, says Kouris Kalligas, Head of Digital Transformation in Sappi Europe and Mentor at the VIGC Hackathon. “A Hackathon is a celebration of Open Innovation and we want to enable as many as we can, as much as we can.”

About VIGC

VIGC: VIGC (Flemish Innovation Center for the Graphic Communication) is the independent knowledge center for graphic communication in the Benelux. The VIGC is at the service of the printing industry, its customers and its suppliers. It consists of a multidisciplinary team of seasoned domain experts and project leaders with extensive practical experience in graphic communication.

About EY:

EY is a global service provider with more than 250,000 professionals. EY The Factory, enables innovation within EY, in startups and scale-ups and inside larger corporations. EY is committed to building a better working world — with increased trust and confidence in business, sustainable growth, development of talent in all its forms, and greater collaboration. It wants to build a better working world through its own actions and by engaging with like-minded organizations and individuals.

About Sappi

Sappi is a leading global provider of sustainable woodfibre products and solutions, in the fields of Dissolving wood pulp, Printing papers, Packaging and speciality papers, Casting and release papers, Biomaterials and Bio-energy. As a company that relies on renewable natural resources, sustainability is at our core. Sappi European mills hold chain of custody certifications under the Forest Stewardship Council™ (FSC™ C015022) and the Programme for the Endorsement of Forest Certification™ (PEFC/07-32-76) systems. Our papers are produced in mills accredited with ISO 9001, ISO 14001, ISO 50 001 and OHSAS 18001 certification. We have EMAS registration at 5 of our 10 mills in Europe.

Sappi Europe SA is a division of Sappi Limited (JSE), headquartered in Johannesburg, South Africa, with 12,500 employees and 19 production facilities on three continents in nine countries, 37 sales offices globally, and customers in over 150 countries around the world.

Learn more about Sappi at www.sappi.com.

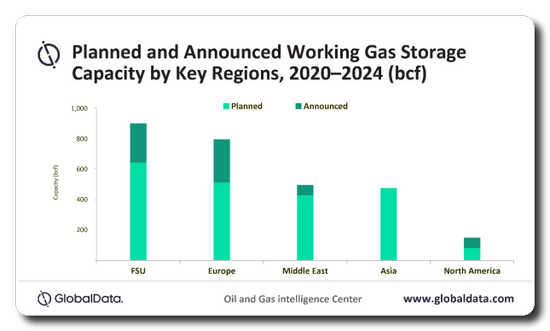

FSU to spearhead global working gas capacity additions through 2024

The Former Soviet Union (FSU) is expected to witness the highest global working gas capacity additions, contributing around 32% of the global gas storage capacity additions by 2024, says GlobalData, a leading data, and analytics company.

The company’s report, ‘Global Capacity and Capital Expenditure Outlook for Underground Gas Storage, 2020−2024 – Russia Leads Global Working Gas Capacity Additions’, reveals that the FSU is likely to witness a total working gas storage capacity additions of 899 billion cubic feet (bcf) by 2024. Of this, the capacity of planned projects that have received necessary approvals for development accounts for nearly 639 bcf.

Haseeb Ahmed, Oil and Gas Analyst at GlobalData, comments: “The FSU is expected to witness the start of operations of 11 new-build gas storage sites by 2024. Of these, nine are planned and the remaining two are announced sites. Uzbekistan’s Gazli II and Russia’s Stepnovskoe II are the largest upcoming gas storage sites in the region, with respective capacities of 247 bcf and 199 bcf by 2024.”

GlobalData identifies Europe as the second-highest contributor to the global working gas storage capacity additions contributing around 28% or 792 bcf by 2024. The region is expected to witness the start of operations of 27 planned projects and 21 announced projects. Deborah in the UK is the largest upcoming gas storage site in the region with a capacity of 174 bcf by 2024. Golianovo in Slovakia and Galata in Bulgaria are joint second-largest upcoming gas storage sites, each with a capacity of 53 bcf.

Ahmed continues: “The Middle East ranks third across the globe contributing roughly 17.5% of the world’s working gas storage capacity additions between 2020 and 2024. The region has nine upcoming projects, of which six are planned projects and the remaining three are announced projects. Turkey’s Tuz Golu II is the largest upcoming gas storage site in the region, with a capacity of 148 bcf by 2024.”

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis, and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, technology, energy, financial and professional services sectors. PR10308.

Offshore wind capable to support Norway’s power export while it remains majorly dependent on hydropower

Norway has majorly been a net electricity exporter and is amongst the top 10 electricity exporting nations in Europe. Primarily reliant on hydropower, the country is an open electric market and its grid is well integrated with the other Nordic countries namely Sweden, Denmark, Germany and the Netherlands. To further support its electricity export, Norway looks to diversify into offshore wind. Building on the experience and strengths of the offshore oil and gas industry, the offshore wind segment stands as a perfect synergy to be developed and the power generated can enhance the country’s electricity export capacity, says Globaldata, a leading data and analytics company.

Somik Das, Senior Power Analyst at GlobalData, comments: “Hydropower fulfills Norway’s own electricity needs and caters to its exports. However, the country found itself as a net importer of the electricity in 2019 as hydro reservoirs remained low during the year. The analysis further suggests that for the past few years, exports have been decreasing, wherein 2019 saw Norway’s electricity exports declining by 33% over 2018. Offshore wind in Norway is in its incipient stage, but has strong potential, and can cater to the export-oriented approach of the nation. Norway has one of the world’s richest offshore wind resources, with wind speeds averaging 10m/s.”

To encourage expansion, the Norwegian government declared NOK25m (approximately US$2.8m) for an offshore wind venture and the foundation of a research center for renewable energy (RE). The RE research center is anticipated to focus on the challenges to the nation’s offshore wind segment. The team also has the additional support of another NOK10m (US$1.1m) to develop the supply chains and delivery models for offshore wind.

To encourage expansion, the Norwegian government declared NOK25m (approximately US$2.8m) for an offshore wind venture and the foundation of a research center for renewable energy (RE). The RE research center is anticipated to focus on the challenges to the nation’s offshore wind segment. The team also has the additional support of another NOK10m (US$1.1m) to develop the supply chains and delivery models for offshore wind.

Das concludes: “Norway has opened two areas for offshore wind power developments in the North Sea, citing the possibility of developing upto 4,500MW of capacity. As the global offshore wind development costs decline over technological advancements, it will complement the country’s export strategy well to feed the neighboring countries at the time of peak demand.

“Good wind resources, combined with Norway’s strong position in maritime, offshore and land-based industrial sectors, indicate that Norwegian offshore wind power segment has it all to become noteworthy in the Norwegian locale. GlobalData’s forecasts suggest that the country will have about 1.5GW of offshore wind capacity by 2030.”

- Comments provided by Somik Das, Senior Power Analyst at GlobalData

- This insight was based upon data and information sourced from proprietary databases, primary and secondary research, and in-house analysis conducted by GlobalData’s team of industry experts

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.

Nidec ASI takes water into the desert and wins 5 contracts in Saudi Arabia worth more than $50 million

Water is the new oil for Saudi Arabia and Nidec ASI - head of the Nidec Industrial Solutions platform belonging to the Nidec Group - which has always been committed to creating and supplying innovative, sustainable and customized solutions, has been awarded work orders for motors and drives needed to create 5 pipeline systems for transporting water in the Arabian Peninsula. These projects will ensure greater volumes of water for over 12 million people, helping to improve the quality of life for everyone living in this geographical area characterized by a hostile climate while at the same time supporting its economic growth.

The 5 projects being supplied by Nidec ASI are part of SWCC’s (Saline Water Conversion Corporation - a Saudi Government Corporation responsible for the desalination of seawater and supplying fresh water to its citizens) ambitious growth program and will transport salt water to the desalination plants and then convoy the treated water along a network of pipelines to a number of Saudi cities. The pipeline network will take water to the cities of Arafat, Jeddah, Jubail, Rabigh, Riyadh, Al Shuqaiq and Taif.

The 5 projects being supplied by Nidec ASI are part of SWCC’s (Saline Water Conversion Corporation - a Saudi Government Corporation responsible for the desalination of seawater and supplying fresh water to its citizens) ambitious growth program and will transport salt water to the desalination plants and then convoy the treated water along a network of pipelines to a number of Saudi cities. The pipeline network will take water to the cities of Arafat, Jeddah, Jubail, Rabigh, Riyadh, Al Shuqaiq and Taif.

Nidec ASI motors and drives will be installed along the extensive route connecting the coast to the treatment plants and from there to the various cities, making it possible to take fresh water to inhabitants, hospitals and all public and private facilities in the various regions concerned. Nidec ASI's solutions have also been designed with environmental sustainability in mind, in fact they contribute to energy savings for the entire system, minimizing the use of electricity and reducing the environmental impact thanks to a reduction in the use of non-recyclable raw materials.

Specifically, Nidec ASI is supplying 124 motors and 85 drives produced in its Italian plants in Monfalcone and Cinisello Balsamo.

“We are particularly proud of these work orders: our motors and drives will help bring the precious commodity of water to over 12 million people who are currently struggling to have access to this life-giving resource. The pipeline systems will also have important benefits for the economic development of the areas concerned", said Dominique Llonch, CEO of Nidec ASI and Chairman of Nidec Industrial Solutions. "Operating in a country of huge economic ferment like Saudi Arabia, serving such an important client as SWCC, once again confirms the success of our approach based on offering solutions which are innovative, made-to-measure and above all designed to save energy and raw materials.”

For over 150 years, Nidec ASI has been a market leader thanks to its ability to innovate and offer technologies capable of meeting all the needs and requirements of ambitious projects throughout the world. The technical specifications of Nidec ASI solutions make it possible to adjust them to the most extreme design and climate conditions, without ever forgetting about environmental protection and always with the aim of contributing to creating an increasingly green and sustainable future.