Super User

Warning: Apparent installation of non-original and unauthorized parts in Hauschild SpeedMixer® equipment previously sold by FlackTek Inc. and/or by its affiliates

In May 2020 Hauschild and FlackTek terminated their collaboration. Since then, Hauschild Engineering no longer supplies original spare parts for any of its equipment to US-based FlackTek Inc. or to its affiliates, but only directly to users of Hauschild equipment. SpeedMixer® with unauthorized modifications and unauthorized spare parts may be identified by checking labels.

Hauschild GmbH & Co. KG (Hauschild Engineering) is the sole manufacturer of the Hauschild SpeedMixer® equipment since 1974. The original Hauschild SpeedMixer® offers perfect mixing results from a few grams or milliliters up to ten kilograms or ten liters for laboratories mixing substances in their R&D work as well as for companies that require small batch mixes for quality assurance.

In May 2020 Hauschild and US-based FlackTek terminated their collaboration. Since then, Hauschild Engineering no longer supplies original spare parts for any of its equipment to FlackTek Inc. or to its affiliates in the US or Europe, but only directly to users of Hauschild equipment.

The quality of the parts designed by Hauschild Engineering is critical to ensure the high-quality standards and, equally importantly, the safety of the equipment. None of Hauschild’s current or former partners has ever been authorized to install spare parts other than those produced by Hauschild Engineering for use in Hauschild SpeedMixer® machines. Any modification to Hauschild machines made with non-original parts may not have the same quality, the same high performance or the same safety standards that users of Hauschild equipment have come to expect from Hauschild equipment.

User of Hauschild SpeedMixer® should carefully check the labels.

User of Hauschild SpeedMixer® should carefully check the labels.

New label on the left side of SpeedMixer

Hauschild SpeedMixer machines with unauthorized modifications may display a new, unauthorized label on the left side of the equipment. The original labels (see upper photo) are thin, they are made of plastic and they usually have text in German. The unauthorized labels (see photo below) are thicker, made of aluminum and they are only in English.

Not knowing exactly which and how many Hauschild SpeedMixer machines may have been altered, Hauschild invites its customers that have acquired one of its machines from FlackTek Inc. or from its affiliates Synergy Devices Ltd. (UK), CosSearch GmbH (Switzerland), CosSearch SLU (Spain) and RohChem (The Netherlands) to contact Hauschild Headquaters in Hamm/Germany or their distributor in Dallas/Texas. Hauschild will make available all possible resources to clarify any doubts and provide clear information about the quality and safety of the equipment.

Fabio Boccola, CEO of Hauschild says: “What we recently discovered in the US left me almost speechless. I want to reassure our customers that Hauschild will do everything in its power to support them and to make sure that they can safely continue working with our equipment. Although Hauschild has never authorized the use of non-original parts, I apologize to our customers in the name of our company and of its shareholders for any inconvenience that this might cause.”

User of Hauschild SpeedMixer® may write to This email address is being protected from spambots. You need JavaScript enabled to view it. or This email address is being protected from spambots. You need JavaScript enabled to view it..

About Hauschild Engineering:

The family-owned company employs around 40 people and has been developing and producing the Hauschild SpeedMixer®, which are sold worldwide, at the company headquarters in Hamm/Germany since 1974.

The original Hauschild SpeedMixer® offers perfect mixing results from a few grams or milliliters up to ten kilograms or ten liters for laboratories mixing substances in their R&D work as well as for companies that require small batch mixes for quality assurance.

Within minutes and without the use of stirring tools, different liquids are mixed with pastes/powders, pastes with powders, powders with powders as well as substances with different chemical and physical properties. The Hauschild SpeedMixer® including all components are manufactured following a high-quality approach - made in Germany.

ANDRITZ to supply electro-mechanical equipment and maintenance service for one of the world’s first co-located solar pumped storage plants in Australia

International technology group ANDRITZ has received an order from the EPC contractors McConnell Dowell and John Holland to supply the electro-mechanical equipment for the 250-MW Kidston pumped storage plant in North Queensland, Australia.

Kidston will not only be Australia’s first pumped storage plant for more than 40 years, but also one of the world’s first to be co-located with a solar plant. The owner and developer of Kidston is Genex Power. Commissioning of the plant is expected in 2024.

Open pits from an abandoned gold mine © Genex Power Ltd

Open pits from an abandoned gold mine © Genex Power Ltd

The ANDRITZ scope of supply comprises design, manufacturing, supply, transportation, erection, and commissioning of two 125-MW reversible pump turbine units as well as full operation and maintenance services for more than 10 years.

The pumped storage plant was developed in a unique location by utilizing two open pits from an abandoned gold mine. Once filled up with water, it will operate as a closed-loop system and generate, store and dispatch renewable energy on demand during peak periods, capable of supplying enough sustainable and clean electrical energy for more than 280,000 Australian households. Additionally, the plant can be operated in a synchronous condenser mode to provide grid services such as reactive power management and synchronous inertia.

This order not only confirms once again ANDRITZ’s strong position in the Australian hydropower market, but also for pumped storage technology, which plays an important role in providing grid stability to cope with volatile solar and wind power supplies. The combination of hydro equipment supplies with state-of-the-art asset management services is also strong proof of ANDRITZ’s well diversified product and service portfolio for all applications and demands in the hydropower business.

ANDRITZ GROUP

International technology group ANDRITZ offers a broad portfolio of innovative plants, equipment, systems and services for the pulp and paper industry, the hydropower sector, the metals processing and forming industry, pumps, solid/liquid separation in the municipal and industrial sectors, as well as animal feed and biomass pelleting. The global product and service portfolio is rounded off with plants for power generation, recycling, the production of nonwovens and panelboard, as well as automation and digital solutions offered under the brand name of Metris. The publicly listed group today has around 26,950 employees and more than 280 locations in over 40 countries.

ANDRITZ HYDRO

ANDRITZ Hydro is one of the globally leading suppliers of electromechanical equipment and services for hydropower plants. With over 180 years of experience and an installed fleet of more than 470 GW output, the business area provides complete solutions for hydropower plants of all sizes as well as services for plant diagnosis, refurbishment, modernization and upgrade of existing hydropower assets. Pumps for irrigation, water supply and flood control are also part of this business area’s portfolio.

A paradigm shift in the making for renewable energy demand?

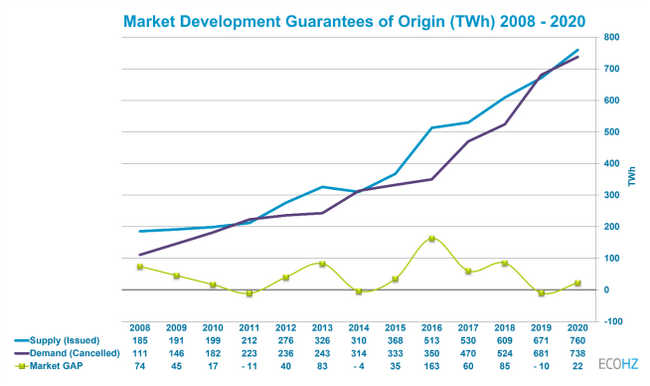

“Renewable energy demand has grown by an impressive 8% from 2019 to 2020, during a year where energy consumption and industry output has slumped across most of Europe,” says Tom Lindberg, Managing Director at ECOHZ – commenting on new statistics from the Association of Issuing Bodies (AIB). Lindberg suggests that a paradigm shift can be in the making, with reductions in the year-over-year surplus of renewable energy a likely reality.

Demand growth continues

Despite alarming predictions, the market demand for renewables has continued to grow at a steady pace during 2020. The impact of lower industrial activity as a result of COVID-19 has been limited, and the European thirst for renewables seems unstoppable. This is reflected directly in the annual market figures of Guarantees of Origin (GO), produced by the Association of Issuing Bodies (AIB).

The overall tendency in the GO market is a robust and growing market demand, coupled with a somewhat stable supply situation. The market demand has grown by an impressive 8% from 2019 to 2020. This during a year when energy consumption and industry output has slumped across most of Europe. Annual growth (CAGR) from 2008 to 2020 is a solid 17%.

Forces behind the growth

“The corporate sector’s need for more renewable power is still the main thrust behind the continued increase in demand. But national energy policy change is also making a positive impact. Specifically, the implementation of full disclosure (various models) in countries like the Netherlands, Switzerland and Austria has contributed significantly. Especially in the Netherlands, with its “best practice” implementation of Full Consumption Disclosure, impacts the market in a positive fashion,” says Lindberg.

It is worth noting that the Netherlands with a growing demand reaching 54.4 TWh in 2020, is only able to cover around 50% of the demand from locally originated production. It is in need of importing the rest from other European renewable sources.

Pent up surplus decreases – expiry numbers falling

Although 2020 still shows a slight aggregate surplus of GOs in the market, the trend is clearly that the market is moving toward a better balance between supply and demand. This is also supported by the falling number of GO’s expiring (after 12-month validity) – three years in a row. As the market slowly moves from an annual market to monthly and daily, we may expect expired volumes to grow again. This increased market complexity and shorter matching periods may result in less buyers being matched with correct supply.

The relative share of expired GOs compared to Issued certificates during the same periods has shrunk from 8.3%, to 5.2% to 3.4% in 2020. “This is a very clear indication that the historical surplus in the market is about to disappear,” states Lindberg.

Some other observations

- The AIB now includes most European countries with significant volumes of renewables – having included markets like Portugal, Serbia, and Slovakia in 2020. The number of countries still outside the AIB and aspiring to join in the next few years is limited. Their aggregate production, and thus potential new renewable supply (GO issuing) is comparably low as well.

- Technology-wise, the main trend is that the growth in wind continues to outpace all other technologies related to issuing. Hydro is still the largest single source of renewable supply, providing more than twice the volume than wind.

- Norway seemingly has a sharp increase in demand the last 2-3 years, but most of this increase is related to exports of GOs to the UK market, through the Norwegian registry. When Norway’s figures are corrected for this export, Norway has a flat demand development of around 26 TWh.

- Increasingly, we have seen that countries are issuing GOs from non-renewable (fossil and nuclear) sources, but we now also see significant demand for (cancellations) for non-RES GOs. This figure reached almost 90 TWh in 2020, primarily driven by the Netherlands, Austria, Switzerland, Spain and Sweden.

Outlook for 2021 - looking promising

“The outlook for 2021 is promising in terms of market robustness. Summarized, there are four key indicators that clearly can fuel the market toward an equilibrium, or even a situation with demand outpacing supply for periods of time,” says Lindberg.

- A likely economic and industrial rebound from the current “COVID-19 situation” will spur a sharp upturn in corporate demand for renewables.

- The hydrological situation in the Nordic region is likely to result in lower power production levels in 2021 than in 2019 and 2020. This may result in an overall drop in the supply of Nordic GOs, with as much as a 10-15 TWh reduction just from the Norwegian market.

- The move away from annual reporting schemes, towards monthly or even shorter reporting periods – coming from policy makers in a select number of countries, as well as influential corporate buyers – can change the market dynamics significantly.

- Future supply growth is likely to taper off, and will come from new renewable production, and related GO issuing, and less from growth in new AIB memberships. Few potential AIB members have renewable production of such a size that it can influence the aggregate demand significantly.

A “wild-card” in the described market scenario is Brexit. The UK will limit the import of European GOs in 2021, and the total volume is likely to drop from the 59 TWh imported in 2020. As with many issues related to Brexit, the final outcome is not clear yet, but it does mean that a certain surplus volume will need to be transacted in Europe, if not allowed access to UK buyers. Given that the surplus volume is limited to 30-40 TWh, it is realistic to expect this to be negated by higher overall demand growth in Europe.

About ECOHZ

ECOHZ offers global renewable energy solutions to businesses, organisations and electricity providers – providing access to renewable electricity from a wide range of sources, regions and qualities. ECOHZ works with ca 20% of RE100 companies committed to 100% renewable electricity. ECOHZ provides various impact solutions such as corporate PPA facilitation, long-term EAC contracts as well as GO² - a solution combining renewable energy purchases with financing of new renewable power generation. Renewable electricity is documented with Guarantees of Origin in Europe, RECs in North America and International RECs (I-RECs) in a growing number of countries in Asia, Africa, the Middle East and Latin America. ECOHZ is among the leading independent suppliers in Europe and has offices in Norway and Switzerland. ECOHZ plays an active role in the current energy transition through its vision of “Changing Energy Behaviour”. ecohz.com

Latham & Watkins and Vinson & Elkins top M&A legal advisers by value and volume in oil & gas sector for Q1 2021, finds GlobalData

Latham & Watkins and Vinson & Elkins were the top mergers and acquisitions (M&A) legal advisers in the oil & gas sector for Q1 2021 by value and volume, respectively. Latham & Watkins advised on six deals worth US$14.6bn, which was the highest value among all the advisers. Meanwhile, Vinson & Elkins led in the volume terms having advised on 11 deals worth US$12.8bn. A total of 352 M&A deals were announced in the sector during Q1 2021, according to GlobalData, a leading data and analytics company.

According to GlobalData’s report, ‘Global and Oil & Gas M&A Report Legal Adviser League Tables Q1 2021’, deal value for the sector increased by 66.7% from US$39bn in Q1 2020 to US$65bn in Q1 2021.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Latham & Watkins and Vinson & Elkins were among the only five advisors that managed to surpass the US$10bn mark, while Vinson & Elkins was the only firm to advise on more than 10 deals.

“Both these firms also advised on some of the high-value transactions but Vinson & Elkins LLP advised on two billion-dollar deals while Latham & Watkins managed to advise on three billion-dollar deals, which also helped it occupy the top position by value.”

Baker Botts occupied the second position in terms of value with six deals worth US$14bn followed by Burnet Duckworth & Palmer with three deals worth US$13.2bn. Vinson & Elkins occupied the fourth position by value.

Kirkland & Ellis occupied the second position by volume with eight deals worth US$1.4bn. Latham & Watkins occupied the third position by volume followed by Baker Botts.

- Quotes are provided by Aurojyoti Bose, Lead Analyst at GlobalData

- The information is based on GlobalData’s Financial Deals Database

- This press release was written using data and information sourced from proprietary databases, primary and secondary research, and in-house analysis conducted by GlobalData’s team of industry experts

Methodology for League Tables

GlobalData league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions from leading advisers, through an adviser submission forms on GlobalData, which allows both legal and financial advisers to submit their deal details.

For league tables, we have considered M&A including asset transactions, venture capital and private equity deals where advisors were involved.

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.

Allianz: Emerging hydrogen industry can help tackle climate change. Managing complex risks is key

Promoted by governmental funding programs worldwide, hydrogen is predicted to play a leading role in the energy transition towards a low-carbon economy. As an alternative to fossil fuels like oil and coal, hydrogen solutions could be key for tackling climate change in future, helping many industries to reduce their carbon emissions. While hydrogen technology has been in use for decades, currently planned mega projects require a scaling up of risk management. A new bulletin from Allianz Global Corporate & Specialty (AGCS) highlights some of the opportunities and challenges of the emerging hydrogen industry, stressing that potential risks around the production, storage and transportation of hydrogen – most notably fire and explosion but also technical failure and business interruption – need to be proactively managed.

- Driven by climate change, the possibilities of energy storage, use as a fuel and the long-term intention to replace reliance on coal and oil, hydrogen has the potential to morph from a niche power source into big business.

- New bulletin from Allianz Global Corporate & Specialty (AGCS) highlights operational risks that need to be addressed in hydrogen projects, including fire and explosion hazards, impact of embrittlement and business interruption exposures.

- AGCS sees increasing demand for insurance coverage for hydrogen solutions in future.

“Hydrogen (produced from low-carbon or even renewable energies) is of growing importance for the substitution of fossil fuels in the fields of energy, supply, mobility and industry,” says Chris van Gend, Global Head of Energy and Construction at AGCS. “It has the potential to morph from a niche power source into big business, with countries committing billions to scale up their infrastructure and with projects being introduced around the globe. Despite these successes, there are challenges to overcome for hydrogen to become a major part of the energy transition, such as the cost of production, supply chain complexity and a need for new safety standards.”

“Hydrogen (produced from low-carbon or even renewable energies) is of growing importance for the substitution of fossil fuels in the fields of energy, supply, mobility and industry,” says Chris van Gend, Global Head of Energy and Construction at AGCS. “It has the potential to morph from a niche power source into big business, with countries committing billions to scale up their infrastructure and with projects being introduced around the globe. Despite these successes, there are challenges to overcome for hydrogen to become a major part of the energy transition, such as the cost of production, supply chain complexity and a need for new safety standards.”

Backed by governments: Over 30 countries have produced hydrogen roadmaps

The global shift toward decarbonization has triggered strong momentum in the hydrogen industry. Hydrogen offers several options for the transition towards a low-carbon economy: as an energy carrier and storage medium for conversion back to electricity, as a fuel for all means of transport and mobility and as a potential substitute for fossil hydrocarbons in industries such as steel production or petrochemicals.

Around the world, there is strong governmental commitment for hydrogen initiatives, backed by financial support and regulation: As of the beginning of 2021, over 30 countries have produced hydrogen roadmaps and governments worldwide have committed more than $70bn in public funding, according to McKinsey. There are more than 200 large-scale production projects in the pipeline. The UK government has said it will unveil a hydrogen strategy in 2021 to help reach its 2050 net-zero goal, and the European Commission’s “hydrogen strategy for a climate-neutral Europe”, released in July 2020, includes an ambitious target of 40 gigawatts (GW) of European electrolyzer capacity to produce “green” hydrogen by 2030.

Assessing the risk environment

Many of the technologies used for the generation of hydrogen or energy from hydrogen are well known in principle. AGCS risk consultants have considerable experience with handling hydrogen projects in a number of different areas. “Today the vast majority of hydrogen is produced and used on site in industry. What is new is that the type and scale of its adaption is changing fundamentally, with the expected rapid growth of plants in future. We see the advent of giga-scale projects in many countries with various new players entering the market and established players sizing up – and risk management has to keep pace”, says Thomas Gellermann, an AGCS risk consultant and expert at Allianz Center for Technology. From a technology perspective, the following operational risks are highlighted in the AGCS bulletin:

- Fire and explosion hazards: The main risk when handling hydrogen is of explosion when mixed with air. In addition, leaks are hard to identify without dedicated detectors since hydrogen is colorless and odorless. A hydrogen flame is almost invisible in daylight. Industry loss investigation statistics show approximately one in four hydrogen fires can be attributed to leaks, with around 40% being undetected prior to the loss.

“Fire and explosion protection needs to be considered on three different levels,” explains Gellermann. “Preventing the escape of flammable gases as much as possible. Ensuring safe design of electrical and other installations in areas where ignition sources cannot be excluded and constructing buildings and facilities to withstand an explosion with limited damage. Proper handling of hydrogen gas is critical, and any emergency situation requires appropriate fire safety equipment.”

An AGCS analysis of more than 470,000 claims across all industry sectors over five years shows how costly the risk of fire and explosion can be. Fire and explosions caused considerable damage and destroyed values of more than €14bn ($16.7bn) over the period under review. Excluding natural disasters, more than half (11) of the 20 largest insurance losses analyzed were due to this cause, making it the number one cause of loss for businesses worldwide.

- Material embrittlement: Diffusion of hydrogen can cause metal and steel (especially high-yield steels) to become brittle and a wide range of components could be affected, for example, piping, containers or machinery components. In conjunction with embrittlement, hydrogen-assisted cracking (HAC) can occur. For the safety of hydrogen systems, it is important that problems such as the risk of embrittlement and HAC are taken into account in the design phase. This is ensured by selecting materials that are suitable under the expected loads as well as considering appropriate operating conditions (gas pressure, temperature, mechanical loading). High-yield strength steels are particularly at risk of hydrogen-related damage.

- Business interruption exposures: Hydrogen production or transport typically involves high-tech equipment and failure to critical parts could result in severe business interruption (BI) and significant financial losses. For example, in case of damage to electrolysis cells (used in water electrolysis) or heat exchangers in liquefaction plants it could take weeks, if not months to replace such essential equipment, resulting in production delays. In addition, business interruption costs following a fire can significantly add to the final loss total. For example, AGCS analysis shows that across all industry sectors, the average BI loss from a fire incident is around 45% higher than the average direct property loss – and in many cases the BI share of the overall claim is much higher, especially in volatile segments such as oil and gas.

Significant increase in demand for insurance expected

While standalone hydrogen projects have been rare in the insurance market to date, hydrogen production as part of integrated refining and petrochemical facilities, and as a part of AGCS’ coverage of industrial gas programs in its property book, has long been a staple of AGCS’ insurance portfolio. Given the numerous projects planned around the world, insurers can expect to see a significant increase in demand for coverage in future to construct and operate electrolysis plants or pipelines for hydrogen transportation.

“As with any energy risk, fire and explosion is a key peril. Business interruption and liability exposures are also key as are transit, installation and mechanical failure risks,” van Gend explains. He expects a significant ramp up in opportunities to which AGCS aims to respond in a proactive manner. “We are developing a more detailed underwriting approach for hydrogen projects, ensuring that we can serve clients globally. There is rightly great enthusiasm around hydrogen solutions as a key driver towards a low-carbon economy, but we shouldn’t overlook that these projects involve complex industrial and energy risks and require high levels of engineering expertise and insurance know-how in order to be able to provide coverage. We will apply the same rigor in risk selection and underwriting for hydrogen projects that we do on our existing energy construction and operational business.”

For the full overview of loss prevention measures for the hydrogen economy download here.

About Allianz Global Corporate & Specialty

Allianz Global Corporate & Specialty (AGCS) is a leading global corporate insurance carrier and a key business unit of Allianz Group. We provide risk consultancy, Property-Casualty insurance solutions and alternative risk transfer for a wide spectrum of commercial, corporate and specialty risks across 10 dedicated lines of business.

Our customers are as diverse as business can be, ranging from Fortune Global 500 companies to small businesses, and private individuals. Among them are not only the world’s largest consumer brands, tech companies and the global aviation and shipping industry, but also satellite operators or Hollywood film productions. They all look to AGCS for smart answers to their largest and most complex risks in a dynamic, multinational business environment and trust us to deliver an outstanding claims experience.

Worldwide, AGCS operates with its own teams in 31 countries and through the Allianz Group network and partners in over 200 countries and territories, employing over 4,400 people. As one of the largest Property-Casualty units of Allianz Group, we are backed by strong and stable financial ratings. In 2020, AGCS generated a total of €9.3 billion gross premium globally.

Alfa Laval to pioneer ground-breaking, sustainable heat exchanger recycling

Alfa Laval – a world leader in heat transfer, centrifugal separation and fluid handling – in partnership with Stena Recycling, leading in recycling and circular solutions, is to launch a ground-breaking business model for sustainable and environmentally efficient recycling of heat exchangers, enabling up to 100 percent metal regeneration. The partnership is a first step towards a circular approach to the company’s product portfolio, and an important part of Alfa Laval’s commitment to become carbon neutral by 2030.

The goal of this new initiative is twofold: Firstly, to encourage replacement of less energy-efficient plate heat exchangers by new modern products. This will lead to significant energy savings and reduced CO2 emissions in customers’ processes. Secondly, plate heat exchangers contain large amounts of valuable metals that can be recycled and reused in new Alfa Laval products; Stena Recycling’s innovative technology enables up to 100 percent metal regeneration.

The goal of this new initiative is twofold: Firstly, to encourage replacement of less energy-efficient plate heat exchangers by new modern products. This will lead to significant energy savings and reduced CO2 emissions in customers’ processes. Secondly, plate heat exchangers contain large amounts of valuable metals that can be recycled and reused in new Alfa Laval products; Stena Recycling’s innovative technology enables up to 100 percent metal regeneration.

“This is an important step towards a more circular and sustainable approach when sourcing material, manufacturing and supplying our products,” says Susanne Pahlén Åklundh, President of the Energy Division. “Starting in the Nordic region, the recycling initiative will include three types of heat exchangers. However, we see great opportunities to expand the scope to other product groups and geographical areas in the future. This initiative is a win-win, to the benefit of our customers as well as to society.”

“The collaboration with Alfa Laval shows once again what effective circular solutions we can create when we work together. Simultaneously, as the industry receives help with significant energy efficiencies, we ensure a high recycling rate of older and inefficient plate heat exchangers in Sweden. These materials can be used as circular quality raw materials for new products, including new products that Alfa Laval manufactures ", says Fredrik Pettersson, Managing Director of Stena Recycling Sweden.

Did you know that… Alfa Laval has the ambition of becoming carbon neutral by 2030 throughout the value chain – from material production and transportation to product manufacturing and delivery – and circularity of this kind is a key step?

The collaboration is inspired by the Circular Initiative, a business-driven event in circularity led by Stena Recycling.

About Stena Recycling

Stena Recycling makes recycling a sustainable business. With 3,000 committed employees in Sweden, Denmark, Norway, Finland, Poland, Germany and Italy, Stena Recycling creates long-term solutions every day for both customers and society as a whole. In addition to efficient and value-creating recycling, Stena Recycling offers services such as Design for Recycling to increase the recycling rate of products already in the design stage. Stena Recycling is part of the Stena Metall Group.

This is Alfa Laval

Alfa Laval is active in the areas of Energy, Marine, and Food & Water, offering its expertise, products, and service to a wide range of industries in some 100 countries. The company is committed to optimizing processes, creating responsible growth, and driving progress – always going the extra mile to support customers in achieving their business goals and sustainability targets.

Alfa Laval’s innovative technologies are dedicated to purifying, refining, and reusing materials, promoting more responsible use of natural resources. They contribute to improved energy efficiency and heat recovery, better water treatment, and reduced emissions. Thereby, Alfa Laval is not only accelerating success for its customers, but also for people and the planet. Making the world better, every day.

Alfa Laval has 16,700 employees. Annual sales in 2020 were SEK 41.5 billion (approx. EUR 4 billion). The company is listed on Nasdaq OMX.

AFRY as an engineering partner in Kühtai Pumped Storage Plant hidden in the Tyrolean Alps of Austria

A green battery increasing the annual net energy production of the power plant complex by 260 GWh

The Kühtai storage power plant project, another storage lake and a pumped storage power plant are being built as the second upper stage of the existing Sellrain-Silz power plant group. With this upper stage the overall efficiency of the power plant group in electricity generation can be sustainably increased. The additional storage volume increases the flexibility and functionality of the overall system. More available water enables electricity to be produced over a longer period of time. In phases with a lot of generation from solar and wind power, more energy potential is therefore stored in the large lakes at high altitude.

The Kühtai storage power plant project, another storage lake and a pumped storage power plant are being built as the second upper stage of the existing Sellrain-Silz power plant group. With this upper stage the overall efficiency of the power plant group in electricity generation can be sustainably increased. The additional storage volume increases the flexibility and functionality of the overall system. More available water enables electricity to be produced over a longer period of time. In phases with a lot of generation from solar and wind power, more energy potential is therefore stored in the large lakes at high altitude.

The planned Kühtai storage facility will not only store water for pump circulation. By capturing water in the rear of the Stubai Valley and in the Sulz and Winnebach valleys, an additional 260 million kWh of electricity can be generated from natural inflow alone.

Key figures of the Kühtai storage power plant:

- Kühtai storage capacity: around 31 million m3.

- Kühtai 2 power plant: average capacity of 130 MW in turbine mode and 140 MW in pump mode

- Length of the bypass system: around 25 km from the rear Stubai Valley to Kühtai

- Catchment area: around 68 km2

- Electricity generation from nat. Inflow: 260 GWh / year

The Kühtai 2 power plant, including the headrace, connects the Finstertal and Kühtai reservoirs. The cavern excavated for this purpose is located at a depth of 174 m below the surface. The power plant is designed for combined turbine and pump operation. Up to 90 m3 of water per second will flow through the two machine sets.

The cavern has connections to the outside via an access tunnel and a drainage tunnel. Only the portals of these two tunnels are visible in the area.

AFRY's assignment covers the execution design of the main caverns including structural calculations, coordination with electro-mechanical (EM) parts, preparation of formwork and reinforcement drawings and a 3-D coordination model of the main structures of the pumped storage power plant (PSPP). The 3-D Model forms the basis for the incorporation of the system in Building Information Modeling (BIM).

The overall schedule for AFRY's services is about 66 months.

This is a continuation of AFRY's outstanding experience in the development and design of PSPP globally.

“We are very pleased to continue our good cooperation with TIWAG in executing this important project. This award further strengthens our leading position in the development of pumped storage power plants worldwide with the goal to become No 1 in Design of PSPP,” says Ernst Zeller, Regional Director of AFRY Austria GmbH.

AFRY is a European leader in engineering, design, and advisory services, with a global reach. We accelerate the transition towards a sustainable society.

We are 16,000 devoted experts in infrastructure, industry, energy and digitalisation, creating sustainable solutions for generations to come.

Making Future

BASF and Omya enter global partnership on hollow glass microspheres for cementing and drilling applications in the oil and gas industry

BASF and Omya are joining forces in the advancement and commercialization of BasoSphere™ hollow glass microspheres for cementing applications in the oil and gas industry.

- Hollow glass microspheres are applied in the oil and gas industry as lightweight material for the cementing of boreholes

- Unique combination of shape with controllable size and lower density at higher compressive strength enables innovative application benefits

- Partnership combines BASF´s technology and application expertise in cementing with Omya´s vast expertise in minerals and lightweight solutions

With unique combinations of shape and size, as well as lower density and higher compressive strength, BasoSphere is a product family of engineered hollow glass microspheres which offer superior strength to density ratios and prevent fluid loss and formation damage during well completion. It will be exclusively commercialized by BASF.

With unique combinations of shape and size, as well as lower density and higher compressive strength, BasoSphere is a product family of engineered hollow glass microspheres which offer superior strength to density ratios and prevent fluid loss and formation damage during well completion. It will be exclusively commercialized by BASF.

The innovative hollow glass microspheres combine BASF's chemical and application expertise for cementing products in the oil and gas industry with Omya's experience in the production of fillers. “We are thrilled to partner with Omya for this lightweight cementing solution which enhances our offering to the global oil and gas industry,” says Damien Caby, Senior Vice President, BASF Oilfield Chemicals and Mining Solutions. “By reducing the amount of cement required, BasoSphere hollow glass microspheres also contribute to the reduction of CO2 emissions during the completion of oil and gas wells.”

“Omya is proud to partner with BASF and establish a solid cooperation to make the next generation of lightweight materials available for applications in the oil and gas industry,” says Herlinde Wauteraerts, CEO Omya Region Europe.

More information on the BASF Oilfield Chemicals cementing portfolio can be found on www.oilfield-chemicals.basf.com

About BASF Oilfield Chemicals

With innovative products, global field support and industry leading technical expertise, BASF Oilfield Chemicals provides sustainable solutions which increase productivity, recovery and flexibility of oilfield operations in cementing, drilling, stimulation and production. Further information can be found at www.oilfield-chemicals.basf.com.

BASF Oilfield Chemicals is part of BASF’s Performance Chemicals division. The division’s portfolio also includes Fuel and Lubricant Solutions, Plastic Additives, as well as Mining Solutions and Kaolin Minerals. Customers from a variety of industries including Chemicals, Plastics, Consumer Goods, Energy & Resources and Automotive & Transportation benefit from our innovative solutions. To learn more, visit www.performancechemicals.basf.com.

About Omya

Omya is a leading global producer of industrial minerals – mainly derived from calcium carbonate, dolomite and perlite – and a worldwide distributor of specialty chemicals. The company provides a wealth of innovative product solutions that contribute to its customers' competitiveness and productivity in multiple industries such as Construction, Paper & Board, Polymers, Food and Personal & Home Care. Omya further provides Environmental Solutions targeting the agriculture, water and energy markets.

Founded in 1884 in Switzerland, Omya has a global presence extending to more than 175 locations in over 50 countries with 9,000 employees. Committed to implementing the principles of sustainability at all company levels, Omya provides added value products and services from responsibly sourced materials to meet the essential needs of current and future generations. www.omya.com

ABB to deliver trolley assist solution to meet Copper Mountain Mining’s sustainable development goals in Canada

ABB will install haul truck trolley assist infrastructure to help Copper Mountain achieve a reduction in carbon intensity by more than 50 percent in medium-term with a final target of zero by 2035

ABB has grown its footprint in the journey to the all-electric mine by winning an order to deliver a complete open-pit haul truck trolley assist solution for Copper Mountain Mining in Canada. The installation, which includes engineering, supply and construction management for a DC substation and an overhead catenary system (OCS), combines ABB’s electrification and automation expertise in the mining industry.

Copper Mountain mine near Princeton, British Columbia is the mining company’s flagship site. It is a conventional open-pit, truck and shovel operation which produces approximately 100 million pounds (45,000 metric tons) of copper equivalent per year. It is estimated that the initial phase of the trolley assist system, which will be installed in late 2021, will reduce carbon emissions at the site by up to 7 percent. Copper Mountain Mining has advised that overall the mine will reduce carbon intensity by more than 50 percent in 5-7 years through electrification and capacity increase.

ABB just announced that it will deliver a trolley assist solution to help Copper Mountain Mining in Canada

ABB just announced that it will deliver a trolley assist solution to help Copper Mountain Mining in Canada

The company’s sustainable development journey has a final target of zero by 2035 and the project, using electric-drive haul trucks, is indicative of the move towards mine electrification in the region.

Each truck will be fitted with a pantograph to receive external electric power. ABB will take responsibility for the off-truck trolley assist infrastructure and provide engineering, project management, equipment supply, system commissioning and construction management. ABB will design the overhead catenary system (OCS) infrastructure and deliver a rectifier substation providing in excess of 12MW of DC power to the trolley assist system. The trolley control system can provide connectivity to the existing distributed control system (DCS) automation platform for seamless integration and monitoring of trolley operations and energy consumption. ABB is also providing OCS components customized for mining applications.

“From initial feasibility study onwards, ABB has been aligned with our commitments to develop our mining operations in a way that fits with energy conservation and emissions reduction goals,” said Walt Halipchuk, Copper Mountain Mining’s Director of Energy Management. “The trolley assist infrastructure is an essential part of our plans to reach our bold medium to long-term targets, and ABB has proven the results it can have in terms of helping reduce greenhouse gas (GHG) emissions. We trust their expertise and have achieved past successes together, notably with grinding and automation systems already in operation in the mine.”

“A trolley assist system significantly reduces GHG emissions for ultra-class mining haul trucks, which are typically the biggest source of emissions in a mining operation,” said Sachin Jari, Industry Lead – Mining, North America at ABB. “Together with Copper Mountain Mining, we look forward to making this happen again so they can meet their sustainability goals, while staying competitive and ensuring high performance. ABB is a reliable and committed partner for all-electric transformation and this project underlines our world-class expertise in mine electrification.”

ABB collaborates with mining companies from initial feasibility studies through to full deployment. ABB has previously installed a similar substation at Boliden AB’s Aitik mine, Sweden's largest open-pit copper mine and is part of ongoing expansion plans at the site. This included a 4.8 megawatt rectifier, connected to the ABB Ability™ System 800xA DCS.

ABB (ABBN: SIX Swiss Ex) is a leading global technology company that energizes the transformation of society and industry to achieve a more productive, sustainable future. By connecting software to its electrification, robotics, automation and motion portfolio, ABB pushes the boundaries of technology to drive performance to new levels. With a history of excellence stretching back more than 130 years, ABB’s success is driven by about 105,000 talented employees in over 100 countries. www.abb.com

Process Automation: ABB’s Process Automation business is a leader in automation, electrification and digitalization for the process and hybrid industries. We serve our customers with a broad portfolio of products, systems, and end-to-end solutions, including our #1 distributed control system, software, and lifecycle services, industry-specific products as well as measurement and analytics, marine and turbocharging offerings. As the global #2 in the market, we build on our deep domain expertise, diverse team and global footprint, and are dedicated to helping our customers increase competitiveness, improve their return on investment and run safe, smart, and sustainable operations.

Rocket Composter investment helps AstraZeneca reduce waste and embrace circular economy

Multinational pharmaceutical and biopharmaceutical giant AstraZeneca has invested in an A900 Rocket Composter from Tidy Planet, to process its 100-acre manufacturing site’s 24 tonnes of annual food and green waste.

The investment forms part of the organisation’s wider sustainability target to reduce waste and embrace a circular economy. As part of this environmental commitment, the company is also aiming to achieve zero-carbon status at its 4,000-person-capacity campus, by 2025.

This represents the first commercial-scale composter to be installed on an AstraZeneca site – a move the firm hopes will drive sustainability forward across its network globally.

Commenting on the project, FM development manager at AstraZeneca’s Macclesfield site, Guy Camm, said: “We’re deeply committed to making our campus more sustainable, and we want to be best-in-class for how we handle our food and green waste.

“Installing an on-site composter seemed like a great fit for us, as by recycling our food and green waste at source, we can create a closed loop model that reduces both wastage and our carbon footprint.

“Our horticultural team will be using the resulting compost across the campus, and there is a proposal in place that it will also be used to grow fresh produce – further reducing food transportation miles and carbon emissions.

“We’re also working with our catering supplier to ensure all our takeaway cups and tableware are compostable, to make sure our approach is a truly holistic one.”

Prior to purchasing the three-quarter-tonne machine, last year members of the AstraZeneca team had a virtual meeting with The University of Liverpool’s Guild of Students, to discuss its existing installation and composting operation.

Huw Crampton, sales manager and composting expert at Tidy Planet, added: “It’s great to be working with a fellow local company, helping to harness its resource potential, and cut down carbon emissions associated with off-site waste transportation.”

And Guy concluded: “In terms of why we chose Tidy Planet, we loved the fact they were local to us – down the road in fact. And after speaking to their reference site in Liverpool, we gained a real feel for how the same model could work for us – and this was really exciting.

“We’ve made sure that we have space for another machine – futureproofing the demands of the campus if our food waste levels increase. And we’ve also recruited a ‘composter champion’ from our catering workforce to support, govern, and train others in how to use the equipment.

“Further down the line, we also aim to make the compost available for employees to take home with them, following a small donation to one of our local charities of choice.

“We hope that this is the beginning of a long-term composting journey not only here in Macclesfield, but at our other UK and global sites, too.”

The Rocket Composter was installed at the end of last month, and will soon be given a name, to be chosen in AstraZeneca’s staff-wide competition.