Displaying items by tag: globaldata

North America generation equipment contracts activity down 27% in Q2 2021

There were 40 generation equipment contracts announced in the North America region in Q2 2021, marking a drop of 27% over the last four-quarter average of 55, according to GlobalData’s power industry contracts database.

Electricity Procurement stood at first place when compared with other power tender categories in the North America region in Q2 2021 with 89 contracts and a 44.3% share, followed by Power Plant with 41 contracts and a 20.4% share and Generation Equipment with 40 contracts and a 19.9% share during the quarter.

Electricity Procurement stood at first place when compared with other power tender categories in the North America region in Q2 2021 with 89 contracts and a 44.3% share, followed by Power Plant with 41 contracts and a 20.4% share and Generation Equipment with 40 contracts and a 19.9% share during the quarter.

The proportion of contracts by category tracked by GlobalData in the quarter was as follows:

- Supply & Erection: 27 contracts and a 67.5% share

- Repair, Maintenance, Upgrade & Others: 12 contracts and a 30% share

- Project Implementation: one contract and a 2.5% share.

Solar is top technology for North America generation equipment contracts in Q2 2021

Looking at generation equipment contracts by the type of technology in the North America region, solar accounted for 13 contracts with a 32.5% share, followed by thermal with 12 contracts and a 30% share and wind with nine contracts and a 22.5% share.

North America generation equipment contracts in Q2 2021: Top issuers by capacity

The top issuer of generation equipment contracts for the quarter in terms of power capacity involved in North America was: Concord Pacific Developments (Canada) with 106MW from one contract.

North America generation equipment contracts in Q2 2021: Top winners by capacity

The top winner of contracts for the quarter in terms of power capacity involved in North America was: Gp Joule Canada (Canada) with 106MW from one contract.

All publicly-announced contracts are included in this analysis drawn from GlobalData’s Power database, which covers power plants, T&D projects, equipment markets, analysis reports, capacity and generation, and tracks tenders and contracts on a real-time basis.

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis, and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, technology, energy, financial and professional services sectors.

Middle East and Africa power industry contracts up 15% in Q2 2021

Middle East and Africa power industry contracts activity in Q2 2021 saw 106 contracts announced, marking a rise of 15% over the last four-quarter average of 92, according to GlobalData’s power database.

Middle East and Africa power industry contracts in Q2 2021: Saudi Arabia leads activity

Looking at contracts by country, Saudi Arabia led the activity in Q2 2021 with 24 contracts and a share of 22.6%, down 4.3% over the previous quarter and up 85% when compared with the last four-quarter average, followed by the United Arab Emirates with 11 contracts and a share of 10.4% and Iran with nine contracts and a share of 8.5% during the quarter.

Looking at the last four-quarter average, Saudi Arabia held the top spot with 13 contracts, followed by the United Arab Emirates with seven and Egypt with seven contracts.

Looking at the last four-quarter average, Saudi Arabia held the top spot with 13 contracts, followed by the United Arab Emirates with seven and Egypt with seven contracts.

Solar is top technology area for contracts in Q2 2021

Looking at contracts divided by the type of technology, solar accounted for the largest proportion with 42 contracts and a 60.9% share, followed by thermal with 13 contracts and an 18.8% share and hydro with five contracts and a 7.2% share.

Looking at power industry contracts divided by segment as tracked by GlobalData, T&D Project was the most popular segment in Middle East and Africa power contracts activity during Q2 2021, with 30 contracts, followed by Power Plant (28) and Generation Equipment (23).

The proportion of contracts by category tracked by GlobalData in the quarter was as follows:

- Project Implementation: 39 contracts and a 36.8% share

- Supply & Erection: 25 contracts and a 23.6% share

- Consulting & Similar Services: 20 contracts and an 18.9% share

- Power Purchase Agreement: 14 contracts and a 13.2% share

- Repair, Maintenance, Upgrade & Others: eight contracts and a 7.5% share.

Power contracts in Q2 2021: Top issuers by capacity

The top issuers of contracts for the quarter in terms of power capacity involved in Middle East and Africa were:

- Saudi Power Procurement (Saudi Arabia): 2,970MW from seven contracts

- Ministry of Electricity, Iraq (Iraq): 2,000MW from one contract

- ACWA Power International (Saudi Arabia) and The Saudi Public Investment Fund (Saudi Arabia): 1,500MW capacity from one contract.

Power contracts in Q2 2021: Top winners by capacity

The top winners of contracts for the quarter in terms of power capacity involved in Middle East and Africa were:

- Abu Dhabi Future Energy (United Arab Emirates): 2,600MW from three contracts

- ACWA Power International (Saudi Arabia): 2,500MW from four contracts

- Larsen & Toubro (India): 1,800MW capacity from two contracts.

All publicly-announced contracts are included in this analysis drawn from GlobalData’s Power database, which covers power plants, T&D projects, equipment markets, analysis reports, capacity and generation, and tracks tenders and contracts on a real-time basis.

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis, and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, technology, energy, financial and professional services sectors.

ESG disruption will shake up oil and gas market and is an opportunity for companies, says GlobalData

Hydrocarbon demand is set to fall in the coming decades due to the measures the Paris Agreement signee governments will take to discourage emissions and ensure the success of net-zero goals. This agreement will render conventional oil and gas activity less and less viable. In order to reduce emissions and minimize loses, oil and gas companies should adopt measures such as carbon pricing by altering processes across the value chain, says GlobalData, a leading data and analytics company.

GlobalData’s report, ‘ESG (Environmental, Social, and Governance) in Oil and Gas – Thematic Research’, reveals that technological innovation and increased consumer mindfulness will make sustainable alternatives to hydrocarbon-intensive products more and more attractive. For example, in transport, historically the largest hydrocarbon-demanding sector, conventional cars will be displaced almost entirely by electric vehicles (EVs).

George Monaghan, Oil and Gas Analyst at GlobalData, comments: “Though some demand will remain, survival for most current oil and gas companies will mean transitioning to a new product. While there are many options for products, with renewable energy being the most popular, companies will only succeed if they invest while demand is there to capitalise on already strong cashflows by the time demand falls. Companies that wait until hydrocarbon revenues dry up will have insufficient cash to fund a transition.”

Oil and gas companies will need effective governance to steer themselves through the existential disruption that the next three or four decades will bring. A balancing act will be necessary: meeting net-zero objectives while retaining scale demands deft leadership. For example, companies must sustain sufficient cashflows to handle demand volatility, overhaul their asset portfolios, make astute investments, and satisfy sustainability-minded stakeholders, all while providing stable dividends.

Monaghan continues: “As millennials come to dominate the consumer base and workforce and begin to assert their preferences, companies that fail to maintain good social practices (toward workers and affected local communities) will struggle to attract and retain customers and employees.”

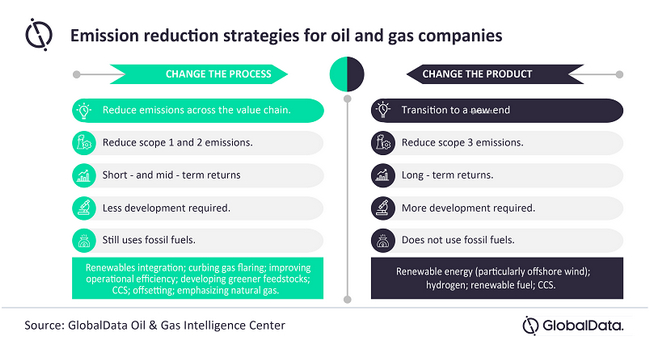

The emission reduction strategies available to oil and gas companies can be divided into two broad approaches: change the process and change the product. It is easy but unwise to underestimate the effectiveness of the ‘change the process’ approach. It involves multiple small and unglamorous changes but can deliver significant emission reductions. At the same time, meeting 2040 or 2050 net-zero goals and dealing with the increasing unavailability of hydrocarbon reserves will require companies to change the product.

Monaghan continues: “Scope 1 and 2 emissions represent the majority of emissions for which the oil and gas industry is responsible. These emissions can be reduced by altering value chain practices. Since the end product is unchanged, this ‘change the process’ approach requires less R&D and infrastructural investment. It promises short- and mid-term returns.

“However, other emissions are inextricable from oil and gas, particularly those produced by end-user combustion of the hydrocarbons (termed scope 3). Technological innovations may reduce the carbon content of the end-product, but practically, so long as the end-product is oil and gas, the company producing it will be responsible for significant scope emissions. To eliminate these emissions, companies must transition to a new end-product. This is the ‘change the product’ approach.”

- Quotes provided by George Monaghan, Oil & Gas Analyst at GlobalData

- Information based on GlobalData’s thematic report: ESG (Environmental, Social, and Governance) in Oil and Gas – Thematic Research

- This press release was written using data and information sourced from proprietary databases, primary and secondary research, and in-house analysis conducted by GlobalData’s team of industry experts

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.

5G to drive mobile services market in China through 2026, forecasts GlobalData

The total mobile service revenues in China are poised to grow at a compounded annual growth rate (CAGR) of 3.1% from US$131.3bn in 2021 to US$152.7bn in 2026, mainly supported by growing 5G subscriptions, according to GlobalData, a leading data and analytics company.

According to GlobalData’s China Mobile Broadband Forecast Pack, mobile voice revenues will decline at a CAGR of 5.2% between 2021 and 2026, due to falling voice average revenue per user (ARPU) levels. Mobile data revenues, on the other hand, will increase at a CAGR of 6.8%, driven by rising adoption of 5G services and the subsequent rise in data ARPU.

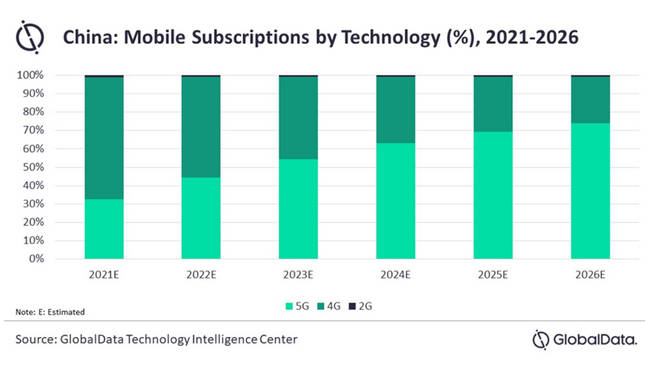

Harika Damidi, Telecoms Analyst at GlobalData, says: “5G subscriptions will surpass 4G subscriptions in 2023 and go on to account for 73.8% of the total mobile subscriptions share in 2026, driven by the ongoing 5G network expansion by operators and increase in the availability of 5G-enabled smartphones. Moreover, increasing penetration of IoT and M2M services are also expected to drive market growth during the forecast period.”

The average monthly mobile data usage is forecasted to increase from 9.9GB per month in 2021 to around 32.6GB per month in 2026, driven by the growing consumption of high-bandwidth online entertainment and social media content over smartphones.

Ms Damidi concludes: “China Mobile led the Chinese telecom market in terms of mobile subscriptions in 2020, followed by China Telecom. Moreover, China Mobile is the leading provider of 5G services which are poised to dominate the Chinese market in the future. In addition, the operator is making strategic investments in 5G base stations, data centers, industrial Internet, and IoT to ensure its leadership.”

- Quotes provided by Harika Damidi, Analyst of Telecoms Market Data & Intelligence at GlobalData

- Information based on GlobalData’s Mobile Broadband Forecast Pack

- China Mobile Broadband Forecast Pack quantifies current and future demand and spending on mobile voice and data services. The data is published quarterly.

- This press release was written using data and information sourced from proprietary databases, primary and secondary research, and in-house analysis conducted by GlobalData’s team of industry experts

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.

AR overtakes AI to become the most disruptive emerging technology, GlobalData survey shows

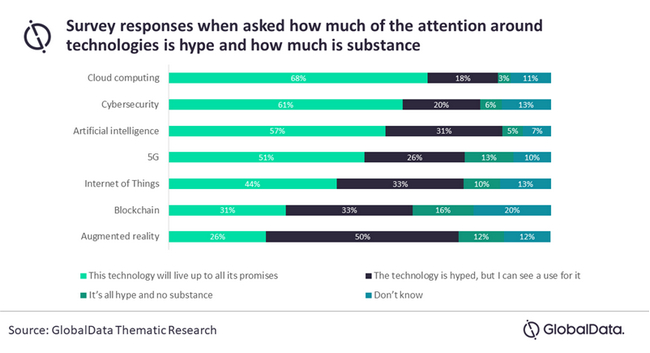

Augmented reality (AR) has replaced artificial intelligence (AI) as the most disruptive emerging technology, according to a survey by GlobalData, a leading data and analytics company.

GlobalData’s latest report, ‘Emerging Technology Sentiment Analysis Q2 2021’, reveals that 70%* of industry professionals surveyed stated that AR would disrupt their industry most out of a selection of seven emerging technologies AI, cybersecurity, cloud computing, IoT, blockchain, and 5G, in addition to AR. This was a sharp increase from the previous quarter, where only 51% selected AR. In addition, 58% said they had become more positive towards the technology over the last 12 months.

Filipe Oliveira, Senior Analyst at GlobalData, commented: “This change in how people see AR will likely be long term, and not just a temporary blip. It is clear that people are warming towards the technology, even if they don’t believe that it will make a big difference tomorrow.”

When asked when AR will disrupt their industries, survey respondents were cautious. They expect the impact to be felt later in the decade. While more than half of Q2 respondents said that cybersecurity and cloud computing are already disrupting their industries, only 24% said the same about AR. Moreover, only 10% think that the disruption will come in the next 12 months.

The same pattern was observed when respondents were asked which technologies would live up to all their promises. More than 60% expected cloud computing and cybersecurity to deliver fully, but only 26% expected the same from AR. Further, 50% of respondents said that the technology was hyped, but they could see a use for it.

Oliveira added: “The contrast between the large share of respondents that said AR is disruptive and the low share that said AR was already disrupting their industry suggests that there is some way to go before AR becomes ubiquitous in business. However, several conditions are aligned to make the promotion of AR as a business tool easier.”

COVID-19 has put some AR use cases in the spotlight, namely in healthcare and ecommerce, and new uses are continuing to emerge. For example, in April, Delta Air Lines announced that it would equip all flight attendants with AR technology delivered via 5G to enhance training and help staff with in-flight catering.

- ‘slight’ or ‘significant’ responses combined

GlobalData’s quarterly “Emerging Technology: Sentiment Analysis” report is based on six polls that received 2,341 responses from participants that work across over more than 30 business sectors. The polls were conducted online in Q2 2021 on the Verdict network of B2B websites, which have 49 million unique visitors a year. The polls were designed to help GlobalData understand current sentiment of the business community towards emerging technologies and evaluate how sentiment is likely to evolve in the near future. The questions asked are a snapshot of GlobalData’s annual Emerging Technology survey.

Quotes provided by Filipe Oliveira, Senior Analyst at GlobalData,

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.

Russia to contribute 23% of global new-build gas processing capacity growth by 2025, says GlobalData

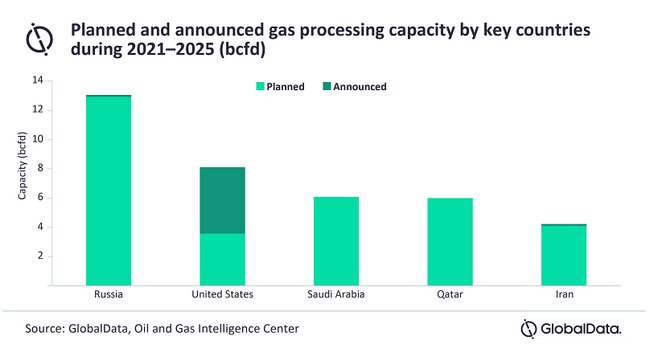

Russia is expected to drive new-build gas processing capacity growth in the global gas processing industry from planned and announced (new-build) projects between 2021 and 2025, contributing around 23% of global gas processing capacity growth by 2025, according to GlobalData, a leading data and analytics company.

The company’s report, ‘Global Capacity and Capital Expenditure Outlook for Gas Processing Plants, 2021–2025 – Russia Continues to Underpin Global Gas Processing Capacity Growth’, reveals that the Russia is expected to witness a new-build gas processing capacity of 13.0 billion cubic feet per day (bcfd) by 2025. Planned projects that received approvals account for nearly the entire capacity growth in the country during the outlook period.

Nachiket Kaware, Oil and Gas Analyst at GlobalData, comments: “Russia is expected to add ten new-build gas processing plants during the outlook period. Of these, the Ust-Luga plant will have the highest capacity with 4.3 bcfd and is expected to start operations in 2024. Amur II will have second highest capacity of 2.7 bcfd and is set to begin operations in 2025. Both projects will help Russia to meet domestic demand and export gas as LNG and through pipelines.”

GlobalData identifies the US as the second highest country globally in terms of gas processing capacity growth, adding a new-build gas processing capacity of 8.1 bcfd by 2025. Bighorn and Smithburg II-VI are the largest upcoming gas processing plants in the US, each with a capacity of 1 bcfd by 2025.

Saudi Arabia stands third with new-build gas processing capacity growth of 6.1 bcfd by 2025. Tanajib and Jafurah gas processing plants are the largest upcoming plants in Saudi Arabia, each with a capacity of 2.5 bcfd by 2025.

- Quotes provided by Nachiket Kaware, Oil & Gas Analyst at GlobalData

- Information based on GlobalData’s report: Global Capacity and Capital Expenditure Outlook for Gas Processing Plants, 2021–2025 – Russia Continues to Underpin Global Gas Processing Capacity Growth

- Announced/Planned: Denotes only new-build assets that are in different stages of development and have not started commercial operations

- A new-build project that has not received relevant/ required approvals to develop/build the project is considered as Announced

- A new-build project that has received relevant/ required approvals is considered as Planned

- This report was built using data and information sourced from proprietary databases, primary and secondary research, and in-house analysis conducted by GlobalData’s team of industry experts

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis, and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, technology, energy, financial and professional services sectors.

US methane emissions on track for tighter monitoring and additional regulations, says GlobalData

The US Congress recently approved a resolution that reverses a rule from President Trump’s administration, which had lowered the requirements for targeting methane emissions in oil and gas well operations. This makes a 2016 Environmental Protection Agency (EPA) rule the valid standard again with respect to reducing methane emissions and shows that that the current administration of President Biden is moving ahead with initiatives aimed at contributing to a net-zero emission targets by 2050. At the same time, the oil and gas industry is aligning with the effort, and although the degree of commitment varies across the many US operators, there is no strong confrontation to these measures, at least in their narrative, says GlobalData, a leading data and analytics company.

According to EPA, US methane emissions in 2019 amounted to 197 million annual metric tons of CO2 equivalent. Of this number, approximately 48% come from oil and gas production, and within this segment, most emissions are generated in pneumatic controllers, gathering, and boosting stations.

According to EPA, US methane emissions in 2019 amounted to 197 million annual metric tons of CO2 equivalent. Of this number, approximately 48% come from oil and gas production, and within this segment, most emissions are generated in pneumatic controllers, gathering, and boosting stations.

Adrian Lara, Senior Oil & Gas Analyst at GlobalData, comments: “Reducing emissions of methane is somehow in line with what many operators have been doing to monetize natural gas production that is otherwise flared. The main difference is that leaks of methane are normally in small volumes which don’t justify an investment for their recovery. In this respect, it is true that for small operators installing monitoring devices for leaks and replacing pneumatic controllers can be at a relatively high cost, specifically for low producing wells.

“In general, issues related to reduction of GHG emissions require a degree of government intervention to regulate and incentivize. While investors are already doing their part by scrutinizing sustainability goals of oil and gas companies, given the amount of investment needed, policy is arguably necessary for aligning the also influential oil and gas industry.

“This legislative action also allows for EPA to further establish other regulations for existing and new wells. Based on statements from major operators, their position is one of support and cooperation with government policy, both at federal and state level, on climate change actions. Still, Republican Party members argue that these reinstatement of regulations in some cases duplicate measures already in place at the state level, and that they will ultimately hurt and reduce the international competitiveness of the US oil in gas industry.”

- The rule requires oil and gas operators to plug and capture methane leaks from wells and storage tanks. It also requires cutting volatile organic compounds and toxic air pollutants such as benzene.

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.

TotalEnergies looks to oil growth amid conflicting energy transformation strategy, says GlobalData

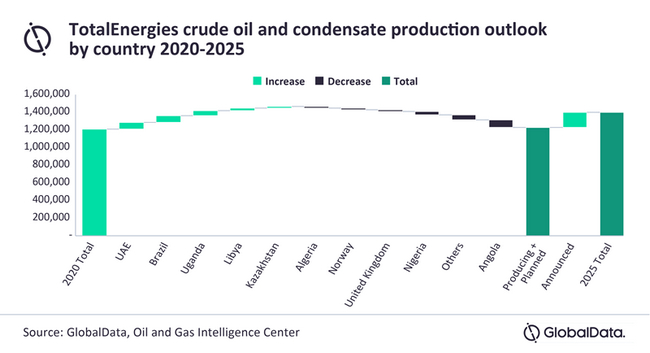

Total SE of old has recently gone through a rebranding to become TotalEnergies by an almost unanimous decision by shareholders. This rebranding is in the hopes that the company can pull itself away from the traditional business practices which focused on oil and gas developments and become more of an all-encompassing energy company. However, the company, unlike its peers, is forecast to see a material growth in its oil production over the near term, says GlobalData, a leading data and analytics company.

Conor Ward, Oil & Gas analyst at GlobalData, comments: “TotalEnergies has made significant strides to investing more heavily in its low carbon, renewables business, however, unlike most other major European oil and gas companies, TotalEnergies is forecast to see a rise in its oil production over the near term. Most of the European majors have made the commitment to pull back on oil developments and push their focus more towards gas and low carbon technologies, while TotalEnergies is proving to still be committed to large scale oil developments and within the next five years oil production is forecast to grow.”

Despite its ageing fields declining, TotalEnergies is forecast to see a steady growth in crude oil and condensate production through to 2025 from 1.2 million barrels per day to 1.23 million barrels per day equivalent. The largest portion of this growth is expected to come from its recently approved Ugandan assets surrounding Lake Albert in the west of the country, where TotalEnergies holds a 66.6% stake in a 230,000 barrel per day project.

Ward continues: “The company has a significant amount of crude oil and condensate production, which could come from unsanctioned projects such as Cameia in Angola, North Platte in the USA, and Gato Do Mato in Brazil. However, based on the decision taken in Uganda and the company’s recent acquisition in Block 20 Angola, these projects may suffer delays if the company seeks to reduce its crude oil production.”

TotalEnergies has suggested that it does not intend to reduce its scope 1 and 2 emissions in the short-term at least, meaning that many of its projects currently on hold have a higher chance of going ahead than would have been thought otherwise. The company is then planning to reduce its net scope 1 and 2 emissions from 2025 onwards and reach net zero by 2050.

Ward concludes: “For the company to continue investing in low carbon and renewable technologies, the increase in oil production and continued investment in major oil developments sends a clear signal that these types of projects continue to showcase attractive economic returns that may help the company deliver its longer-term strategic transformation goals. It remains unlikely that the company can continue to develop large scale oil projects given its long term ESG commitments.”

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.

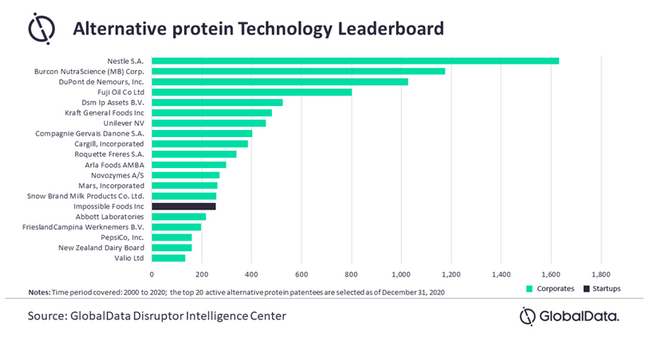

Food, beverage startups must understand evolving market dynamics to meet growing demand for alternative protein products, says GlobalData

Soaring appetite for livestock-based products are creating prolonged and persistent environmental and social issues. As a result, changing consumer behavior towards alternative protein options—due to health awareness as well as animal welfare, disruptive R&D technologies, new product launches, and subsequently venture capital (VC) investments are driving the growth of the global alternative protein industry. In addition, the COVID-19 pandemic has accelerated the shift towards alternative protein. Against this backdrop, food and beverage startups must understand the evolving market dynamics to meet the growing demand, says GlobalData, a leading data and analytics company.

GlobalData’s latest report, ‘Is Alternative Protein The Next Big Thing For Your Sector?’, highlights the growing discussions around alternative protein on social media platforms and mentions for the same in companies annual filings. It also reveals that while start-ups have been creating a new wave of change, big players are also showing interest in the alternative protein space.

Shagun Sachdeva, Innovation Analyst at GlobalData, comments: “As veganism continues to become mainstream, companies are making efforts to replicate certain animal proteins ranging from the development of egg white cell cultures to lab grown cultured meat.

“With VC investments rising exponentially in the alternative protein space, the total deal value witnessed growth from US$111.5m in 2017 to US$1,586.3m in 2020. The average deal value indicates that there are several new start-ups raising early-stage funding. There appears to be two waves in the alternative protein VC investments space – the first wave reached its peak in around 2015-16, when companies such as Beyond Meat raised late-stage funding to expand operations. Another wave was witnessed in the recent years, when a number of start-ups started exploring parallel options in producing alternative protein related products.”

Companies are coming up with innovative product launches that resonate with the millennials, diversify away from the core traditional protein categories and increase touchpoints with the younger generation. Flavor innovation, channel expansion, anti-allergic variants, private label growth, hybrid products and edible packaging are some of the notable product innovations in the alternative protein space.

Ms Sachdeva adds: “As consumers are embarking on the growing trend of plant-based protein, companies intend to engage with the new set of consumers by retooling their product portfolios and reformulating their strategies. Companies are patenting their product manufacturing techniques and investing in novel technologies right from AI, 3D printing to cell-culture and fermentation. Subsequently, investors are eager to grab a spoonful of alternative protein start-ups that believe in the potential of technology to radically recreate the protein ecosystem.”

GlobalData’s Technology Leaderboard matrix reveals that Nestle SA remains clearly the disruptive innovator with total patent filings of more than 1,600 as of 31 December 2020. While corporates seem to be patenting heavily in the alternative protein area, Impossible Foods Inc is the only startup in the top 20 patentees list and is ranked 15th among top 20 patentees.

Ms Sachdeva concludes: “Firms looking to enter the alternative protein space will need to continuously evolve and remain relevant for consumers by using insightful innovation and capitalize on current trends. Furthermore, innovative food companies need to focus on customer experience, new distribution channels and strong social media push to garner attention for their products.”

- Quotes provided by Shagun Sachdeva, Innovation Analyst at GlobalData

- Information based on GlobalData’s report: Is Alternative Protein The Next Big Thing For Your Sector?

- GlobalData’s Technology Leaderboard matrix provides unique insights on companies’ growth and innovation category that these companies belong to which indicates the nature of their innovation in terms of patent filings. While, Patent Strength Indicators (based on number of parameters) are needed to evaluate technological innovation competitiveness between companies and identifying the quality of the patent.

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis, and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.

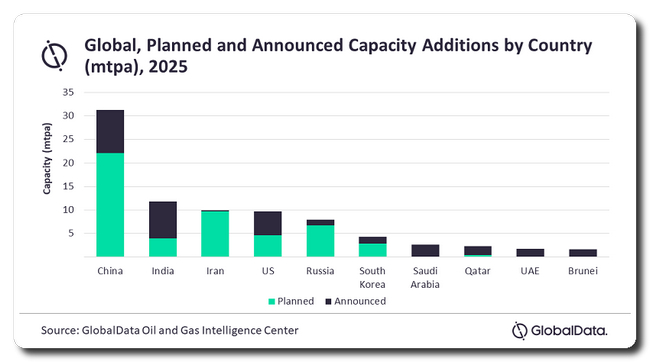

China to lead global ethylene capacity additions by 2025, says GlobalData

Asia is expected to lead the ethylene capacity additions globally with a capacity of 52.94 million tons per annum (mtpa) by 2025. China, which accounts for more than half of the ethylene capacity additions within Asia, is likely to lead the global ethylene capacity additions by 2025, says GlobalData, a leading data and analytics company.

GlobalData’s report, ‘Global Ethylene Industry Outlook to 2025 – Capacity and Capital Expenditure Forecasts with Details of All Active and Planned Plants’ reveals that Ethylene capacity is poised to see considerable growth by 2025, potentially increasing from 201.32 mtpa in 2020 to 299.42 mtpa in 2025, registering a total growth of 49%.

Amareswari Kanaparthi, Oil and Gas Analyst at GlobalData, says: “China leads the capacity additions in the region with a capacity of 31.25 mtpa by 2025. Majority of the additions will be from a planned project Shandong Yulong Petrochemical Longkou Ethylene Plant 1, with the capacity of 3.00 mtpa by 2025.”

GlobalData identifies India as the second highest country in terms of capacity additions with a capacity of 11.85 mtpa by 2025. Majority of the capacity additions will be from one planned and one announced project, Haldia Petrochemicals Cuddalore Ethylene Plant and Nayara Energy Vadinar Ethylene Plant with a capacity of 1.80 mtpa each by 2025.

Iran will be the third highest country in terms of capacity additions with a capacity of 9.99 mtpa by 2025. Majority of the capacity additions will be from a Planned project, Sepehr Makran Chabahar Ethylene Plant, with the capacity of 1.35 mtpa by 2024.

China Petrochemical Corp, Exxon Mobil Corp and Saudi Arabian Oil Co., will be the top three companies globally in terms of planned and announced capacity additions over the outlook period.

- Quotes provided by Amareswari kanaparthi, Oil & Gas Analyst at GlobalData

- Information based on GlobalData’s report: ‘Global Ethylene Industry Outlook to 2025 – Capacity and Capital Expenditure Forecasts with Details of All Active and Planned Plants’

- This press release was written using data and information sourced from proprietary databases, primary and secondary research, and in-house analysis conducted by GlobalData’s team of industry experts

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, technology, energy, financial and professional services sectors.