Displaying items by tag: globaldata

China to lead global LNG regasification capacity additions by 2025, says GlobalData

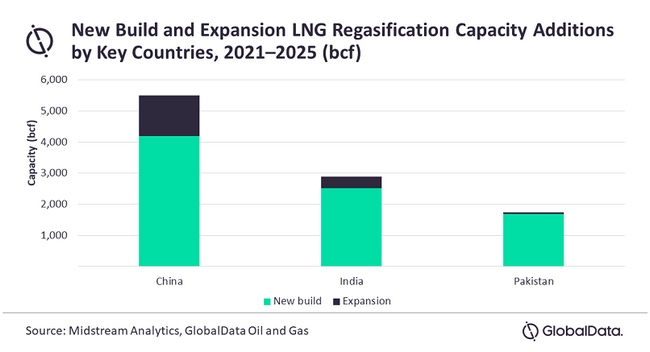

China is expected to lead the global LNG regasification capacity additions, contributing 27% of the total LNG regasification capacity additions between 2021 and 2025, says GlobalData, a leading data and analytics company.

The company’s report, ‘Global Capacity and Capital Expenditure Outlook for LNG Regasification Terminals, 2021–2025 - Asia Dominates Global Regasification Capacity Additions and Capex Spending’ reveals that China is expected to add a new- build LNG regasification capacity addition of 4,191 bcf (billion cubic feet) by 2025, while expansion projects account for the rest with 1,308 bcf.

Bhargavi Gandham, Oil and Gas Analyst at GlobalData, comments: “In China, 26 new- build and expansion projects are likely to start operations by 2025. Tangshan II is the largest upcoming project in the country with a capacity of 584.4 bcf by 2025. Yantai I and Zhoushan III are the other major projects with capacities of 487 bcf and 340.9 bcf, respectively.

GlobalData identifies India to be the second-highest contributor to the global LNG regasification capacity additions with new build LNG regasification capacity additions of 2,882 bcf by 2025. Expansion projects account for the rest of the capacity additions with 365 bcf by 2025. ‘Karwar Floating’ and ‘Jaigarh Port Floating’ projects lead LNG regasification capacity additions in the country with capacities of 365 bcf and 274 bcf, respectively.

Pakistan is expected to be the third largest contributor to the LNG regasification capacity additions globally with 1,752 bcf. Of these, new build capacity additions account for 1,697 bcf and expansion capacity additions account for 55 bcf by 2025. Among the new build projects in the country, Port Qasim is the largest upcoming project with a capacity of 438 bcf. It is expected to start operations in 2023.

- Comments provided by Bhargavi Gandham, Oil & Gas Analyst at GlobalData

- Information based on GlobalData’s report: ‘Global Capacity and Capital Expenditure Outlook for LNG Regasification Terminals, 2021–2025 - Asia Dominates Global Regasification Capacity Additions and Capex Spending’

- Announced/Planned: Denotes only new-build assets that are in different stages of development and have not started commercial operations

- A new-build project that has not received relevant/ required approvals to develop/build the project is considered as Announced

- A new build project that has received relevant/ required approvals from the national government/ energy ministry/ regulatory authority/ local environmental authority/ port authority/local government, etc to develop/build the project is considered as Planned

- Expansion – Denotes capacity expansion of existing/operational terminal

- This report was built using data and information sourced from proprietary databases, primary and secondary research, and in-house analysis conducted by GlobalData’s team of industry experts.

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis, and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, technology, energy, financial and professional services sectors.

Global IoT market will surpass the $1 trillion mark by 2024, says GlobalData

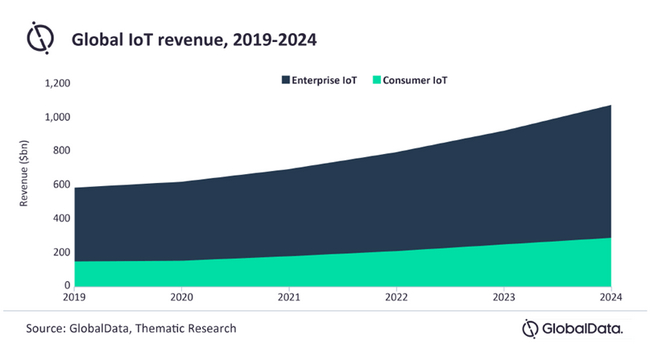

The global internet of things (IoT) market by revenue will be worth $1.1 trillion by 2024, with much of the growth coming from wearables, says GlobalData, a leading data, and analytics company.

GlobalData’s latest report, ‘Thematic Research: Internet of Things,’ explains how a COVID-19 driven new digital transformation wave will fuel higher growth across all IoT markets. The global IoT market was worth $622bn in 2020, up from $586bn in 2019, and will grow to reach $1,077bn by 2024, with a compound annual growth rate (CAGR) of 13% over the period, according to GlobalData forecasts. The enterprise IoT dominates the overall IoT market, generating 76% of total revenue in 2020. This dominance of the enterprise IoT will continue for the foreseeable future. GlobalData expects this segment to still occupy 73% of the overall IoT market in 2024.

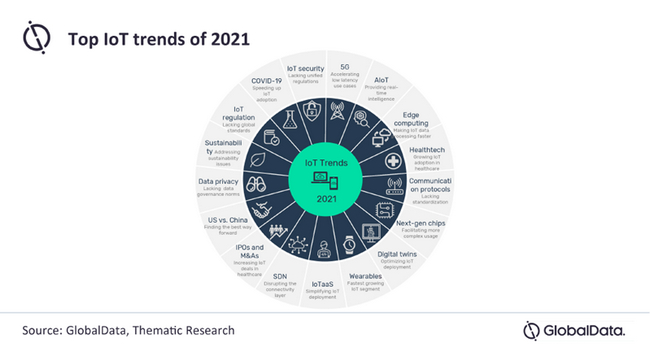

Jasaswini Biswal, Associate Project Manager for Thematic Research at GlobalData, comments: “The ongoing COVID-19 pandemic has highlighted the crucial role the IoT has come to play in our lives. Several IoT use cases saw growing adoption during the pandemic, including using connected thermal cameras to detect potential COVID-19 infections and sensors for monitoring office occupancy levels.

“The demand for technologies that can help the workforce get safely back to work is rising and will likely continue to grow. IoT applications such as contact tracing devices and health-monitoring wearables provide critical data to help fight the pandemic.”

These new use cases have created a positive attitude towards IoT as a critical enabler of the future. According to Globaldata’s ‘*Emerging Technology Trends Survey 2020’, approximately 48% of respondents showed a positive sentiment towards IoT, and 45% believed IoT would play a critical role in the new business generation over the next three years.

Biswal continues: “The next phase of IoT has the potential to transform how we live and work. As IoT penetration extends to the point of being pervasive, entirely new business models will emerge. IoT networks will even do business with one another - providing services resulting from autonomous or near-autonomous collaboration.

“However, today’s IoT systems lack three critical features: Firstly, unstructured and fragmented security regulations are major roadblocks to broader IoT adoption: be it in consumer or enterprise IoT.

“Secondly, there is no global IoT communication standard. The global IoT market can only take off once all connected devices speak the same language.. Thirdly, alongside this lack of standardization, current IoT ecosystems lack real-time intelligence, which relies largely on edge computing and the artificial intelligence of things (AIoT). In order for IoT to be pervasive, these three deficiencies need to be addressed.”

*GlobalData Emerging Technology Trends Survey 2020- polled more than 1,700 senior executives worldwide in the summer of 2020.

- Quotes provided by Jasaswini Biswal, Associate Project Manager for Thematic Research at GlobalData

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.

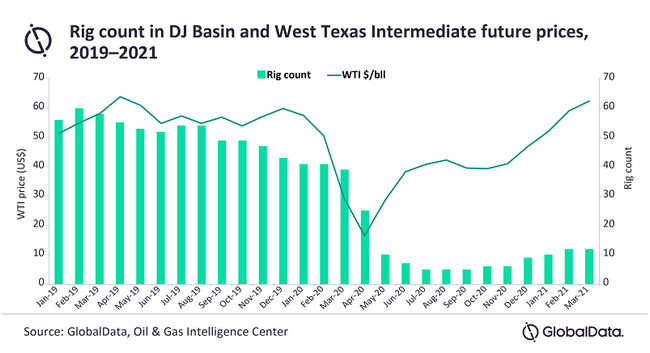

Boosting investments allocation among oil and gas operators could strengthen production in DJ Basin, says GlobalData

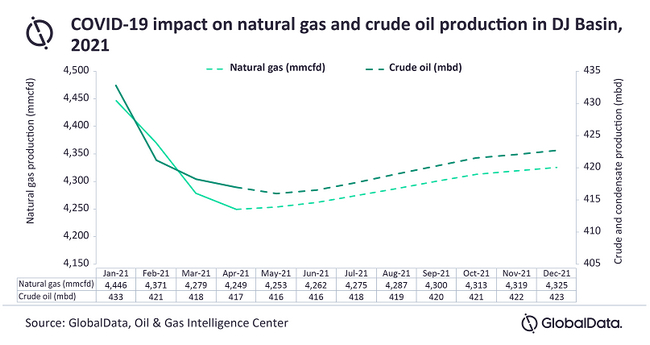

The Denver Julesburg (DJ) Basin located in Colorado and Wyoming has experienced a constant decline since production peaked in November 2019. Reversing this trend will depend on the capital allocation from major oil and gas operators in this region, says GlobalData, a leading data and analytics company.

According to GlobalData’s latest report, ‘DJ Basin in the US, 2021 – Oil and Gas Shale Market Analysis and Outlook to 2025’, the DJ Basin accounted for 7.02% of oil and 6.65% of natural gas production in the United States Lower 48 for 2020.

Oil and gas production in the DJ Basin was adversely affected by the COVID-19 outbreak and subsequent restrictions on economic activity. However, H1 2021 imparted optimism in the market, paving the way for recovery. As restrictions and travel bans were gradually eased, demand prospects improved and encouraged production. However, even with this improvement, production of both oil and gas is not expected to recover to pre-pandemic level.

Svetlana Doh, Oil & Gas Analyst at GlobalData, comments: “The DJ Basin averaged 26 drilling rigs in 2019 and then decreased by 65% to an average of nine rigs in 2020. While other basins throughout the US have increased their rig count with commodity prices rising to pre-pandemic levels, the DJ Basin has lagged with its rig count and remained at seven rigs since the beginning of the year.

“A rise in production will depend on the capital allocation for the major operators in this region. Major operators, such as Occidental Petroleum and Chevron, are earning better returns from their investments in other basins, such as Permian. Thus, companies are going to deploy their capital to the acreage with the best economics in DJ Basin, but could grow production from drilled but uncompleted wells (DUCs).”

With West Texas Intermediate (WTI) future prices averaging US$62.85 per bbl for the remainder of 2021, GlobalData expects a slight uptick in the rig count, but it will not reach the level that was present in 2019. Additionally, while production is expected to increase over the next two to five years, it will still not recover to 2019 levels.

Doh adds: “Another effect on overall production growth from the DJ Basin will depend on small independent companies. While commodity prices have increased and companies are able to generate free cash flow, pure play DJ Basin operators are able to increase their rig count.”

- Quotes provided by Svetlana Doh, Oil & Gas Analyst at GlobalData

- Data taken from GlobalData’s report: DJ Basin in the US, 2021 – Oil and Gas Shale Market Analysis and Outlook to 2025

- The report provides a comprehensive review of the DJ Basin shale play, comprising the effects of the COVID-19 outbreak on operations in the Basin. The report also forecasts the future trend of oil and gas production supported by investment plans by major operators in the Basin.

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.

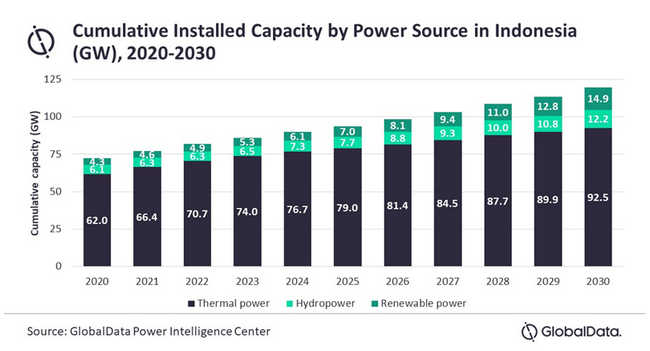

Thermal power to dominate Indonesia energy mix over next decade, reveals GlobalData

Major global economies are moving away from coal to curb carbon emissions. This has landed Indonesia in a tight spot as thermal power capacity is expected to maintain its dominance in the country during 2021-2030, according to GlobalData, a leading data and analytics company.

GlobalData’s latest report, ‘Indonesia Power Market Outlook to 2030, Update 2021 - Market Trends, Regulations, and Competitive Landscape’, reveals that the thermal power capacity in Indonesia is expected to increase from 59.38 GW (85.6% share in total power capacity in 2020) to 92.53 GW in 2030. During 2021-2030, thermal power generation will be dominated by coal-based electricity generation.

Pavan Vyakaranam, Practice Head at GlobalData, comments: “In the last two years, Indonesia announced plans to transition away from coal power. The energy ministry even announced that they are considering shutting down aging coal power plants to replace with renewable power plants. However, with no nuclear power capacity and minimal hydropower capacity, a rapid transitioning from dominant thermal power to renewable power threaten the energy security of the country.”

The growth of renewable power in Indonesia is still in its infancy. In 2000, renewable power capacity in Indonesia stood at 1.3 GW, which increased to 4.3 GW in 2020. Renewable power capacity is expected to grow at a CAGR of 12.5% to reach 14.9 GW in 2030. The country is expected to produce 62.2 TWh of its electricity from renewable sources in 2030, which will only be around 13% of the total power generation in the country.

Mr Vyakaranam concludes: “Indonesia has a significant potential for renewable power development. However, compared to other Asia-Pacific (APAC) countries Indonesia lags in renewable energy development. One of the prominent factors is the absence of decisive renewable energy policy and over-regulation with respect to foreign investment.”

- Comments provided by Pavan Vyakaranam, Practice Head at GlobalData

- Information based on GlobalData’s report Indonesia Power Market Outlook to 2030, Update 2021 - Market Trends, Regulations, and Competitive Landscape

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, technology, energy, financial and professional services sectors.

Latham & Watkins and Vinson & Elkins top M&A legal advisers by value and volume in oil & gas sector for Q1 2021, finds GlobalData

Latham & Watkins and Vinson & Elkins were the top mergers and acquisitions (M&A) legal advisers in the oil & gas sector for Q1 2021 by value and volume, respectively. Latham & Watkins advised on six deals worth US$14.6bn, which was the highest value among all the advisers. Meanwhile, Vinson & Elkins led in the volume terms having advised on 11 deals worth US$12.8bn. A total of 352 M&A deals were announced in the sector during Q1 2021, according to GlobalData, a leading data and analytics company.

According to GlobalData’s report, ‘Global and Oil & Gas M&A Report Legal Adviser League Tables Q1 2021’, deal value for the sector increased by 66.7% from US$39bn in Q1 2020 to US$65bn in Q1 2021.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Latham & Watkins and Vinson & Elkins were among the only five advisors that managed to surpass the US$10bn mark, while Vinson & Elkins was the only firm to advise on more than 10 deals.

“Both these firms also advised on some of the high-value transactions but Vinson & Elkins LLP advised on two billion-dollar deals while Latham & Watkins managed to advise on three billion-dollar deals, which also helped it occupy the top position by value.”

Baker Botts occupied the second position in terms of value with six deals worth US$14bn followed by Burnet Duckworth & Palmer with three deals worth US$13.2bn. Vinson & Elkins occupied the fourth position by value.

Kirkland & Ellis occupied the second position by volume with eight deals worth US$1.4bn. Latham & Watkins occupied the third position by volume followed by Baker Botts.

- Quotes are provided by Aurojyoti Bose, Lead Analyst at GlobalData

- The information is based on GlobalData’s Financial Deals Database

- This press release was written using data and information sourced from proprietary databases, primary and secondary research, and in-house analysis conducted by GlobalData’s team of industry experts

Methodology for League Tables

GlobalData league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions from leading advisers, through an adviser submission forms on GlobalData, which allows both legal and financial advisers to submit their deal details.

For league tables, we have considered M&A including asset transactions, venture capital and private equity deals where advisors were involved.

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.

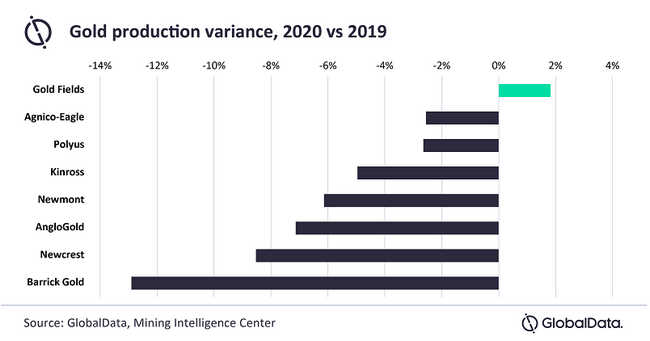

Gold production from top eight companies expected to increase by up to 3.1% in 2021, says GlobalData

Production from the world’s eight largest gold producers (Newmont, Barrick, AngloGold, Polyus, Kinross, Gold Fields, Newcrest and Agnico-Eagle) decreased by 6.5% to 25 million ounces (moz) in 2020 due to lower ore grades, sale of assets, lower mill throughput and lower recoveries. Production from the top eight companies is expected to recover and will be between 25-25.75 moz in 2021, which is an increase of up to 3.1% compared with the collective output in 2020 (24.98moz), according to GlobalData, a leading data and analytics company.

The most significant falls in production were observed among the top three companies: Newmont (6.1%), Barrick (12.9%) and AngloGold (7.1%). The collective output from these companies declined to 13.7moz in 2020 from 15moz in 2019.

Vinneth Bajaj, Associate Project Manager at GlobalData, comments: “After a strong first quarter in 2020, Newmont’s production was impacted by lower ore grades at the Ahafo, Yanacocha and Merian mines and the temporary suspension of the Cerro Negro, Yanacocha, Eleonore, Penasquito and Musselwhite mines between March and mid-May. In addition, the sale of Red Lake and Kalgoorlie projects further reduced output.”

For Barrick, several gold mines were forced to cease operations temporarily due to the COVID-19 pandemic, including the Veladero, Pueblo Viejo and Porgera mines. Meanwhile, divestment of African assets by AngloGold was a major factor behind the fall in the company’s output in 2020.

Bajaj continues: “Lower ore grades, sale of assets, lower mill throughput and lower recoveries were key factors affecting production across the remaining major gold producers. For example, lower ore grades at Paracatu, Round Mountain and Chirano mines were behind the drop in production from Kinross, although it was partially offset by higher output from the company’s Bald Mountain and Kupol operations.”

Newcrest’s production was severely affected by the sale of Gosowong mine, which was acquired by Indotan Halmahera in Q2 2020. Lower throughput rates and lower grades at Cadia, Lihir, Red Chris, and Telfer mines, amid a series of planned shutdowns, also impacted the company’s production subsequently.

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.

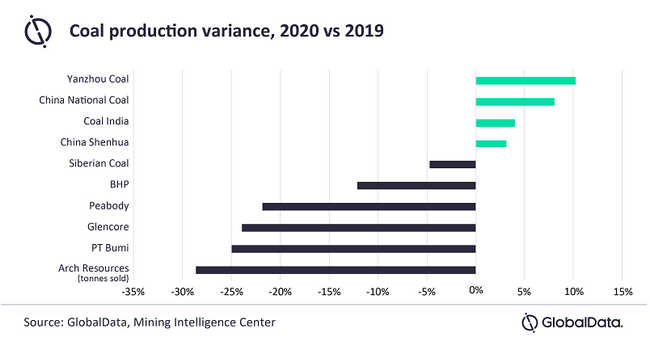

Coal production from top ten mining companies expected to increase by up to 6.6% in 2021, says GlobalData

Coal production from the top ten mining companies (Coal India, China Shenhua, Yanzhou Coal, Peabody, China National Coal, Glencore, Siberian Coal, PT Bumi, BHP and Arch Resources) fell from a collective 1,704Mt in 2019 to 1,633Mt in 2020, which is a 4.2% decline. The most significant declines were observed from Arch Resources (28.6%), PT Bumi (24.9%), Glencore (23.9%), and Peabody (21.8%), according to GlobalData, a leading data and analytics company.

GlobalData expects production from the top ten companies to be between 1,683-1,740Mt in 2021, which is an increase of up to 6.6% compared with the collective output in 2020 (1,633Mt). Operating activities, backed by the rollout of vaccine and strict COVID-19 protocols on-site, returning to normal is expected to be a key production driver for companies in 2021.

Production from Arch Resources (formerly Arch Coal) declined primarily due to the sale of the Holden #22 Surface mine in December 2019, coupled with weak economic conditions during Q1 2020. In addition, the temporary suspension of the Viper mine in Q2 2020 further disrupted the company’s coal production.

Vinneth Bajaj, Associate Project Manager at GlobalData, comments: “Heavy rainfall amid the outbreak of COVID-19 impacted PT Bumi’s output in 2020, while Glencore’s coal output fell for the fourth consecutive quarter as the company’s Colombian coal assets remained suspended as part of the COVID-19 preventive measures. Scheduled production cuts across the Australian portfolio also impacted the company’s overall output as did the placement of the Prodeco mine under care and maintenance and strikes at Cerrejon between August and December 2020.”

Peabody’s output dropped primarily due to the upgrade of the main line conveyor system at Shoal Creek, alongside pit sequencing work at Moorvale and a dragline outage at Coppabella. In addition, the company also suspended operations at the Wambo underground mine for around 59 days during the second half of 2020. The closure of mines including Kayenta and Cottage Grove (Q3 2019) and Wildcat Hills (Q2 2020) further impacted the company’s output.

Bajaj continues: “BHP’s coking coal production was impacted by planned maintenance at the Saraji and Caval Ridge mines, environmental disruptions at La Nina, and lower yields at the South Walker Creek and Poitrel mines. Meanwhile, the thermal coal segment, from which the company is expected to exit in the near future, was affected by a 91-day strike at Cerrejon, which started on August 31, 2020.

“In contrast, production from Coal India rose by 4% owing to a recovery in the offtake from India’s power sector, which was supported by a resumption in industrial and commercial activities as the country’s electricity demand started to recover from the COVID-19 setback. Output from China Shenhua, Yanzhou and China National Coal Group also increased, rising by 3.1%, 10.2% and 8.1%, respectively, in 2020, mainly owing to a quick recovery in China, particularly during the second half of 2020.”

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.

COVID-19 and sustainability among top themes set to impact power industry in 2021, according to GlobalData

COVID-19 and sustainability will continue to heavily impact the power industry, according to data and analytics company GlobalData, which has identified the top 20 themes set to have the most influence on the sector.

GlobalData’s report, ‘Power Predictions 2021 – Thematic Research’, also identifies the other key themes that will shape the industry in 2021, such as hydrogen, renewable energy, electric vehicles (EVs), energy storage, technology diversification and mergers and acquisitions (M&A).

Sneha Susan Elias, Power Analyst at GlobalData, comments: “Tech themes such as drones, artificial intelligence (AI), big data, internet of things (IoT), cloud computing, virtual and augmented reality (VR/AR), microgrids and digitalization will be of paramount importance as the industry looks to function with the highest efficiency and reliability levels. Power companies are likely to take a varied approach concerning different tech themes, depending upon their immediate requirements.”

Sneha Susan Elias, Power Analyst at GlobalData, comments: “Tech themes such as drones, artificial intelligence (AI), big data, internet of things (IoT), cloud computing, virtual and augmented reality (VR/AR), microgrids and digitalization will be of paramount importance as the industry looks to function with the highest efficiency and reliability levels. Power companies are likely to take a varied approach concerning different tech themes, depending upon their immediate requirements.”

Cloud computing and VR and AR themes will come to the fore with the post-pandemic new normal of remote working. The ongoing COVID-19 pandemic has pushed businesses and power utilities to opt for remote working, and this is when cloud computing solutions have played a role in maintaining business continuity. Cloud adoption in the utilities industry is expected to pick up in 2021. Early cloud adopters have taken advantage of these turbulent COVID times, while the ones that were previously apprehensive about adopting cloud computing solutions are now planning to deploy them. COVID-19 has also led to an increased demand for virtual collaboration tools that are based on AR and VR technologies. These technologies have proven use cases of enhanced safety, remote assistance and improved productivity.

The ongoing COVID-19 pandemic has also affected stakeholders across the power sector value chain, to varying levels. Decreased cash flows, limited workforce availability, and changes in consumer behavior are some of the effects on the power sector caused by COVID.

Elias continues: “Pre-COVID-19, clean energy transition was at the forefront in the minds and policies of governments, corporate agencies, developers and investors. Due to the ongoing pandemic, the course of action taken by them to alleviate the detrimental impact of COVID had initially dented the progress towards clean energy. However, globally, renewable energy has remained resilient during the pandemic crisis and this is likely to continue into 2021. GlobalData forecasts continued growth in renewables throughout 2021 due to electricity demand returning to pre-pandemic levels, low operating costs, and priority or guaranteed access of renewable power generators to the grid through regulations.”

In addition to these trends, the renewable energy industry will witness a major shift toward local manufacturing, reducing supply chain dependence on imports and encouraging the setup of new domestic manufacturing facilities. The pandemic has underscored the need for clean air and healthful considerations more generally. Emissions reductions due to COVID-19 have led environmentalists to advocate for more renewable energy to maintain these levels and avoid potential crisis in future. This will further help to boost renewable energy.

Elias adds: “COVID-19 will also drive sustainability changes. The pandemic is driving the urgent need for evaluation of issues in the power sector which have potentially been underplayed, including environmental, social and governance policies. As consumers are looking towards brands for environmental leadership, many companies have pledged to drive sustainability changes, most notably in the power sector by announcing a transition to cleaner resources and energy efficiency. Climate change will become a greater priority for communities’ post-COVID-19, henceforth, utility providers can no longer position themselves as monolithic providers and will have to understand the business climate in which they operate. Moreover, they will have to consider demographic, economic, political, as well as consumer sentiments related to energy transition.”

- Quotes provided by Sneha Susan Elias, Power Analyst at GlobalData

- Information based on GlobalData’s thematic report: ‘Power Predictions 2021 - Thematic Research’

- GlobalData classifies the top 20 themes for 2021 into three categories – industry, technology and macroeconomic themes

- This press release was written using data and information sourced from proprietary databases, primary and secondary research, and in-house analysis conducted by GlobalData’s team of industry experts

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.

UK drives upcoming oil and gas projects in Europe, says GlobalData

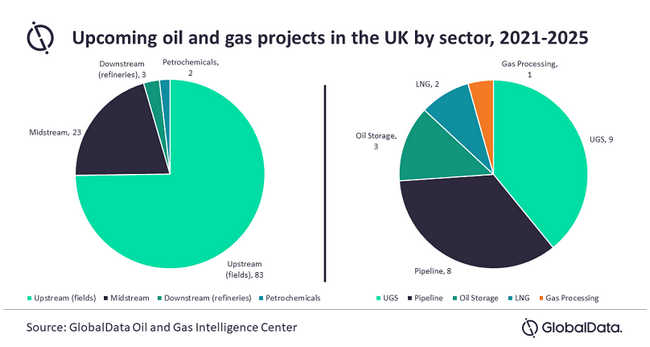

The UK is expected to drive the upcoming projects across oil and gas value chain in Europe, accounting for about 25% of the total projects which are likely to start operations by 2025. Amongst these, new build projects lead with 62% while the remaining are expansion projects mainly in the upstream sector (fields), according to GlobalData, a leading data and analytics company.

GlobalData’s report, ‘Europe Oil and Gas Projects Outlook to 2025 - Development Stage, Capacity, Capex and Contractor Details of All New Build and Expansion Projects’, reveals that 111 projects are expected to commence operations in the UK during the period 2021-2025. Out of these, 83 will be upstream projects, 23 will be midstream with refinery and petrochemical at three and two, respectively.

Soorya Tejomoortula, Oil & Gas Analyst at GlobalData, comments: “The shallow waters of the North Sea will continue to drive the growth of upstream production projects in the UK. The upcoming projects’ list has a good mix of both oil and gas developments and will help the country to continue to meet its oil and gas needs and reduce reliance on imports.”

Among the upcoming production projects in the UK, Rose Bank is a key project with a total production capacity of 121,000 barrels of oil equivalent per day. Proposed in deep waters of West of Shetland, the project will further enhance the UK energy security with supply of both oil and gas.

GlobalData notes that 23 midstream projects are expected to start operations in the UK during 2021-2025. Rosebank Export Line transmission pipeline is a key midstream project with a length of 236km and a project cost of US$2bn. The pipeline helps to transport gas produced from the Rosebank field to the UK onshore.

Deborah is another key midstream project in the UK for underground storage of gas. It is expected to have a working gas capacity of 174 bcf and a project cost of US$3bn. The project increases the country’s gas storage capacity and can serve both the UK and northwest European markets.

The capacity increase of Isle of Grain regasification terminal is also being planned with a cost of US$396m, which would make it the largest LNG import terminal Europe once it starts operations in 2025.

A few refinery and petrochemical projects are also expected to start operations in the UK during 2021-2025. While the 45MW Pembroke Cogeneration Plant Expansion is a key refinery project with a cost of US$170m, the INEOS Group Hull Vinyl Acetate Monomer (VAM) Plant 2 is a major petrochemical project during this period with a capacity of 0.30 mtpa and costing US$213m.

- Comments provided by Soorya Tejomoortula, Oil & Gas Analyst at GlobalData

- Information based on GlobalData’s report: Europe Oil and Gas Projects Outlook to 2025 - Development Stage, Capacity, Capex and Contractor Details of All New Build and Expansion Projects

- This report was built using data and information sourced from proprietary databases, primary and secondary research, and in-house analysis conducted by GlobalData’s team of industry experts

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.

China to lead global chlorine capacity additions by 2025, says GlobalData

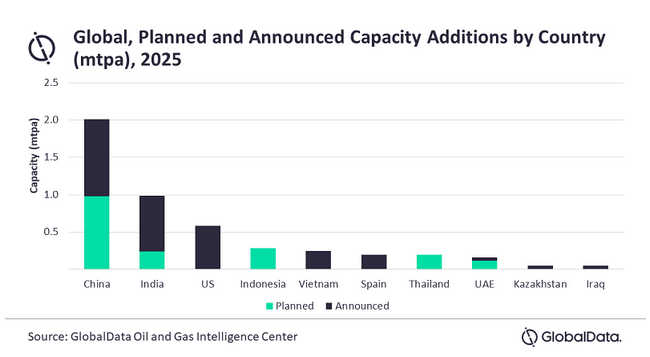

Asia is expected to lead the global capacity additions among the regions and its chlorine capacity is expected to increase from 54.59 mtpa in 2020 to 58.03 mtpa in 2025 at an average annual growth rate (AAGR) of 1.2 %. Within Asia, China will account for more than half of the region’s capacity additions with the country likely to lead the global chlorine capacity addition, says GlobalData, a leading data and analytics company.

GlobalData’s report, ‘ Global Chlorine Industry Outlook to 2025 – Capacity and Capital Expenditure Forecasts with Details of All Active and Planned Plants’, reveals that chlorine capacity is poised to see considerable growth by 2025, potentially increasing from 89.60 million tonnes per annum (mtpa) in 2020 to 94.23 mtpa in 2025, registering a total growth of 5%.

Amareswari Kanaparthi, Oil and Gas Analyst at GlobalData, says: “China is set to lead the capacity additions in the region with a capacity of 2.01 mtpa by 2025. Majority of the additions will be from a planned project Xinjiang Zhongtai Chemical Company Baicheng Chlorine Plant with a capacity of 0.71 mtpa by 2025.”

GlobalData identifies India as the second highest country in terms of capacity additions with a capacity of 0.98 mtpa by 2025. Majority of the capacity additions will be from a planned project, GACL-NALCO Alkalies with a capacity of 0.23 mtpa by 2025.

The US will be the third highest country in terms of capacity additions where the entire capacity additions will be from a planned project Shintech Plaquemine Chlorine Plant 2 with capacity of 0.59 mtpa, by 2025.

Xinjiang Zhongtai Chemical Co Ltd, Tianjin Bohai Chemical Industry Co Ltd and Shin-Etsu Chemical Co Ltd will be the top three companies globally in terms of planned and announced capacity additions over the outlook period.

- Quotes provided by Amareswari kanaparthi, Oil & Gas Analyst at GlobalData

- Information based on GlobalData’s report: ‘ Global Chlorine Industry Outlook to 2025 – Capacity and Capital Expenditure Forecasts with Details of All Active and Planned Plants’

- This press release was written using data and information sourced from proprietary databases, primary and secondary research, and in-house analysis conducted by GlobalData’s team of industry experts

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, technology, energy, financial and professional services sectors.