Displaying items by tag: Cerulean Winds

CERULEAN WINDS AND PING PETROLEUM SIGN AGREEMENT TO CREATE ONE OF THE UK’S FIRST WIND-POWERED OIL AND GAS PRODUCTION FACILITIES

UK green energy infrastructure developer, Cerulean Winds, and Ping Petroleum UK today announced the signing of an agreement to create one of the UK’s first oil and gas facilities powered mainly by offshore wind.

- Cerulean Winds and Ping Petroleum UK sign agreement to create one of the UK’s first offshore oil and gas facilities powered by offshore wind.

- The pioneering project marks a critical step in the journey towards making oil and gas production the cleanest in the world and is welcomed by UK Government.

- The deal will deliver the UK’s first Floating Offshore Wind unit manufacturing and assembly in the UK, kick-starting the much-anticipated floating offshore wind supply chain.

Under the agreement signed in a meeting hosted by Secretary of State, Kwasi Kwarteng, the production facility at Ping Petroleum’s Avalon site, located in the UK Central North Sea, will be mainly powered by floating offshore wind. The pioneering project will help meet the emissions reduction targets agreed between government and industry in the North Sea Transition Deal in March 2021.

The provision of wind power will remove up to 20,000 metric tonnes of CO2 emissions every year from the offshore production facility – the equivalent of taking over 4,000 cars off the road.

The project will demonstrate the use of floating offshore wind in decarbonising oil and gas production. Later this summer, applications will open to developers for seabed leases to drive the decarbonisation of other oil and gas assets across the North Sea.

Ping Petroleum UK acquired a 100% stake in the Avalon site in August 2021, with production expected to begin in 2025. The field has a total estimated recovery of 23 million barrels of oil. The proposed development concept for the plans have already been cleared by the North Sea Transition Authority (NTSA), and a field development plan is to be submitted later this year.

Secretary of State Kwasi Kwarteng observes the signing between Zainal Abidin Abd Jalil and Rob Fisher of Ping Petroleum, Dan Jackson of Cerulean Winds and Tan Sri Syed Zainal Abidin Syed Mohamed Tahir of DNeX

Secretary of State Kwasi Kwarteng observes the signing between Zainal Abidin Abd Jalil and Rob Fisher of Ping Petroleum, Dan Jackson of Cerulean Winds and Tan Sri Syed Zainal Abidin Syed Mohamed Tahir of DNeX

Under these plans, Cerulean Winds with its consortium of Tier 1 industrial partners will provide a large floating offshore wind turbine which will be connected, via a cable, to Ping Petroleum’s Floating Production & Storage vessel.

This will be one of the largest floating wind turbines built in the UK and will provide the majority of power required by the production & storage vessel. It is expected that green power produced by the turbine will exceed the energy needs of the production vessel, with the partners exploring options to supply excess energy to other nearby production facilities. The production vessel is a 60-metre diameter facility with a storage capacity of 270,000 barrels of oil and is capable of producing up to 30,000 barrels of oil per day.

As part of the agreement with Ping, Cerulean Winds have committed to fully manufacturing and assembling the offshore wind turbine in the UK. The project is expected to realise between £80-100 million in investment in the development and in the UK’s renewable energy supply chain. The project was enabled by a grant to Cerulean Winds through the Floating Offshore Wind Demonstration Programme from the UK Government’s Department of Business, Energy and Industrial Strategy (BEIS) to support the innovation and optimisation of the technology that will be deployed.

Tan Sri Syed Zainal Abidin Syed Mohamed Tahir, Group Managing Director of DNeX, said: “As the world transitions to a low-carbon future, Ping is excited to be an early implementor of this revolutionary technology in the UK North Sea for our new greenfield project, Avalon. This project which uses offshore wind to power operations demonstrates our long-term commitment to establish a low carbon development concept. It will substantially lower the emissions intensity of our operations which supports long term climate change goals globally.”

“In addition, it enables us to seize market opportunities arising from the energy sector’s low-carbon transformation and development. The creation of an additional revenue stream via the supply of excess energy to nearby facilities will positively contribute to our financial performance. “

“Furthermore, we will gain experience and exposure to the relevant markets and stakeholders within the renewable energy sector which may lead to strategic business developments ahead.”

Dan Jackson, Founding Director of Cerulean Winds, said: “Our partnership marks a significant milestone for the oil and gas industry in creating one of the UK’s first production facilities to be powered by clean, green and affordable offshore wind energy.

“This innovative and pioneering project will be ‘Made in the UK’ and through our delivery partners, we will be realising significant investment in UK fabrication yards and ports. This is a critical step in scaling the UK supply chain and building experience and a track-record to exploit future opportunities in the fabrication, assembly and servicing of offshore wind developments.

“This project will demonstrate how we can harness the power of affordable, offshore wind to deliver significant reductions in the carbon emissions of oil and gas production. The UK has a golden opportunity to make our domestic oil and gas production the cleanest in the world - scaling the green economy and creating thousands of jobs in the process. We are thankful to BEIS for encouraging research and development which highlights to potential investors that the UK Government endorses the rapid development of integrated floating offshore wind technologies to support industrial decarbonisation."

This important step in progressing the Avalon project was today welcomed by the UK Government.

Business and Energy Secretary Kwasi Kwarteng said: “The North Sea oil and gas sector has been a major British industrial success story for decades. We must keep supporting production on the UK Continental Shelf for security of supply as we transition to clean, affordable, home-grown energy. In the meantime, we need to cut emissions from production. Platform electrification projects such as this are a welcome step forward to reduce emissions from oil and gas production, secure jobs and new skills and deliver on the commitments of the landmark North Sea Transition Deal.”

Cerulean Winds has previously announced a floating offshore wind and green energy proposal for Crown Estate Scotland’s Innovation & Targeted Oil and Gas seabed leasing round. The initiative provides seabed leases to green energy developers to support the electrification and decarbonisation of oil and gas facilities in the UK Continental Shelf. Cerulean Winds’ plans to bid for multiple sites at 1.5 GW scale of floating offshore wind would unlock £6 billion proposed investment per site, and would abate significant CO2 emissions of UKCS oil and gas assets from 2027.

Cerulean Winds reveals scale of offshore wind bid to make UK’s oil and gas production cleanest in the world

Green energy infrastructure developer Cerulean Winds has revealed it will bid for four seabed lease sites to decarbonise the UK’s oil and gas sector as this scale will remove more emissions quickly, keep costs lower for platform operators and provide the anchor for large scale North-South offshore transmission.

The floating offshore wind and green energy proposal for Crown Estate Scotland’s Innovation and Targeted Oil and Gas leasing round (INTOG) includes four 1.5 GW sites of floating wind power.

With well over £6 billion of investment proposed for each 100-turbine site, the scheme would abate tens of millions of tonnes of CO2 in line with North Sea Transition Deal targets.

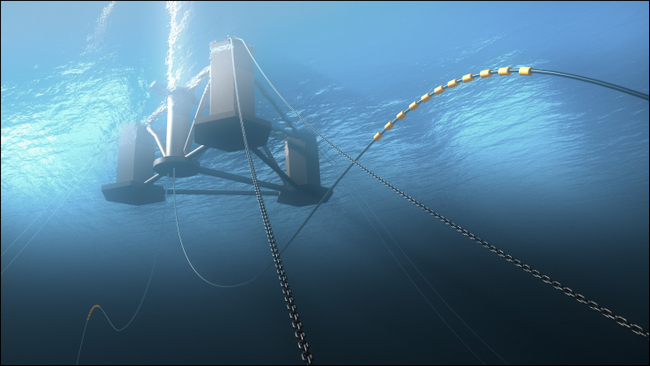

NOV’s Tri-Floater design is custom built from a modular configuration for the most extreme environments

NOV’s Tri-Floater design is custom built from a modular configuration for the most extreme environments

Cerulean Winds, with its selected delivery partner NOV, has been engaging the supply chain for over 18 months and has a live request for information (RFI) with UK yards for the fabrication and assembly of its tri-floater technology.

The steel floating bases would constitute hundreds of thousands of tonnes of steel, which unlike cement fixtures, can be floated out from shore which is ideal for the UK.

The development would create over 10,000 jobs many of which would be high value manufacturing jobs in Scotland as a new generation of automated and hi-tech fabrication and assembly is established.

Dan Jackson, founding director of Cerulean Winds said: “We have a big, bold bid, which is ready to go on scaling the green economy, creating thousands of jobs and making Scotland’s oil and gas production the cleanest in the world.

“The scale we are proposing makes the project economics appealing for providing affordable green power to the platforms to replace gas and diesel generation through a combination of green electrons from wind and molecules from hydrogen.

Unlike cement fixtures, the NOV Tri-Floater base structure design can be floated in very shallow water depths suitable for the UK

Unlike cement fixtures, the NOV Tri-Floater base structure design can be floated in very shallow water depths suitable for the UK

“We are absolutely committed to the local supply chain benefitting from this development and far surpassing local content targets. Our base structure design can be floated in very shallow water depths suitable for the UK, unlike alternative cement floating wind structures which require 90 metres so can’t be built here.”

The Cerulean Winds team is led by serial entrepreneurs Dan Jackson and Mark Dixon, who have more than 25 years’ experience working together on large-scale offshore infrastructure developments in the energy industry.

A consortium of tier 1 contractors are in place as well as a number of industrial and financial partners, leading financial services groups Société Générale and Piper Sandler, who have robustly engaged the financial markets. The development requires no subsidies so there is no expectation on the public purse. INTOG is for a very specific purpose and cleaning up the oil and gas industry does not need to be subsidised by the taxpayer, say Cerulean.

Jackson added: “There is a lot of concern about rising energy prices and energy security. Wind and green energy at this scale are a big part of the solution. We are engaging with oil and gas operators and can see the appetite is there to get behind cleaning up production, and we can deliver in a way that minimises disruption. Whilst smaller piece meal wind developments are useful for testing concepts or innovations, it will take a UK wide solution to remove the emissions at the pace required to hit the net zero targets governments. Furthermore, our large scale scheme lowers the LCOE – cost of the power – which is highly attractive to the operators.”

About Cerulean Winds

Cerulean Winds is a green infrastructure developer founded by Dan Jackson and Mark Dixon, who have together, over 25 years, led large scale offshore infrastructure developments. With exclusive Tier 1 contractor relationships in place, Cerulean Winds has a market funded infrastructure construct to deliver integrated floating wind and hydrogen developments at scale.

Dan and Mark have extensive experience in the offshore sector including establishing successful global subsea engineering consultancy DeepSea Engineering, which was acquired by McDermott International. DeepSea advised clients across the market from the outset of the deep water era from 2000 onwards. DeepSea was engaged with almost all the deep water projects at the time representing the different stakeholder groups; operators, contractors, banks and investors. Various spin off companies and technologies associated with deep water from this time are very relevant to the Cerulean proposition and included the development of patents and IP for floating technologies and mooring systems.

Another notable venture created by the founders is the joint venture between McDermott and Baker Hughes (formerly GE Oil & Gas), io oil & gas consulting. Its purpose at launch in 2015 was to bring integrated contracting to the upstream oil and gas sector including contractor-backed project finance. Whilst the oil price was at an all-time low at the time the new venture secured several multibillion dollar projects for the parent companies by providing suitably economic development plans to the oil and gas companies when these projects would otherwise have languished until the oil price recovered.

Both Mark and Dan have held a variety of leadership roles across multinational corporations advising on the planning, construction, and operation of some of the largest offshore projects. They have significant experience managing integrated contracting and project finance to enable funding of major capital projects from the financial markets, including both UK and international development with a variety of commercial models and Build Own Operate Transfer (BOOT) funding constructs.