Green energy infrastructure developer Cerulean Winds has revealed it will bid for four seabed lease sites to decarbonise the UK’s oil and gas sector as this scale will remove more emissions quickly, keep costs lower for platform operators and provide the anchor for large scale North-South offshore transmission.

The floating offshore wind and green energy proposal for Crown Estate Scotland’s Innovation and Targeted Oil and Gas leasing round (INTOG) includes four 1.5 GW sites of floating wind power.

With well over £6 billion of investment proposed for each 100-turbine site, the scheme would abate tens of millions of tonnes of CO2 in line with North Sea Transition Deal targets.

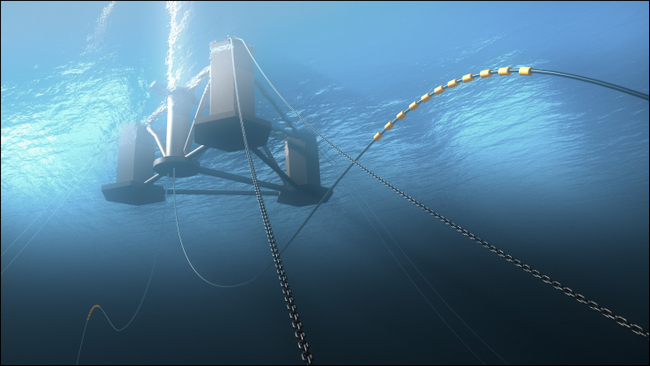

NOV’s Tri-Floater design is custom built from a modular configuration for the most extreme environments

NOV’s Tri-Floater design is custom built from a modular configuration for the most extreme environments

Cerulean Winds, with its selected delivery partner NOV, has been engaging the supply chain for over 18 months and has a live request for information (RFI) with UK yards for the fabrication and assembly of its tri-floater technology.

The steel floating bases would constitute hundreds of thousands of tonnes of steel, which unlike cement fixtures, can be floated out from shore which is ideal for the UK.

The development would create over 10,000 jobs many of which would be high value manufacturing jobs in Scotland as a new generation of automated and hi-tech fabrication and assembly is established.

Dan Jackson, founding director of Cerulean Winds said: “We have a big, bold bid, which is ready to go on scaling the green economy, creating thousands of jobs and making Scotland’s oil and gas production the cleanest in the world.

“The scale we are proposing makes the project economics appealing for providing affordable green power to the platforms to replace gas and diesel generation through a combination of green electrons from wind and molecules from hydrogen.

Unlike cement fixtures, the NOV Tri-Floater base structure design can be floated in very shallow water depths suitable for the UK

Unlike cement fixtures, the NOV Tri-Floater base structure design can be floated in very shallow water depths suitable for the UK

“We are absolutely committed to the local supply chain benefitting from this development and far surpassing local content targets. Our base structure design can be floated in very shallow water depths suitable for the UK, unlike alternative cement floating wind structures which require 90 metres so can’t be built here.”

The Cerulean Winds team is led by serial entrepreneurs Dan Jackson and Mark Dixon, who have more than 25 years’ experience working together on large-scale offshore infrastructure developments in the energy industry.

A consortium of tier 1 contractors are in place as well as a number of industrial and financial partners, leading financial services groups Société Générale and Piper Sandler, who have robustly engaged the financial markets. The development requires no subsidies so there is no expectation on the public purse. INTOG is for a very specific purpose and cleaning up the oil and gas industry does not need to be subsidised by the taxpayer, say Cerulean.

Jackson added: “There is a lot of concern about rising energy prices and energy security. Wind and green energy at this scale are a big part of the solution. We are engaging with oil and gas operators and can see the appetite is there to get behind cleaning up production, and we can deliver in a way that minimises disruption. Whilst smaller piece meal wind developments are useful for testing concepts or innovations, it will take a UK wide solution to remove the emissions at the pace required to hit the net zero targets governments. Furthermore, our large scale scheme lowers the LCOE – cost of the power – which is highly attractive to the operators.”

About Cerulean Winds

Cerulean Winds is a green infrastructure developer founded by Dan Jackson and Mark Dixon, who have together, over 25 years, led large scale offshore infrastructure developments. With exclusive Tier 1 contractor relationships in place, Cerulean Winds has a market funded infrastructure construct to deliver integrated floating wind and hydrogen developments at scale.

Dan and Mark have extensive experience in the offshore sector including establishing successful global subsea engineering consultancy DeepSea Engineering, which was acquired by McDermott International. DeepSea advised clients across the market from the outset of the deep water era from 2000 onwards. DeepSea was engaged with almost all the deep water projects at the time representing the different stakeholder groups; operators, contractors, banks and investors. Various spin off companies and technologies associated with deep water from this time are very relevant to the Cerulean proposition and included the development of patents and IP for floating technologies and mooring systems.

Another notable venture created by the founders is the joint venture between McDermott and Baker Hughes (formerly GE Oil & Gas), io oil & gas consulting. Its purpose at launch in 2015 was to bring integrated contracting to the upstream oil and gas sector including contractor-backed project finance. Whilst the oil price was at an all-time low at the time the new venture secured several multibillion dollar projects for the parent companies by providing suitably economic development plans to the oil and gas companies when these projects would otherwise have languished until the oil price recovered.

Both Mark and Dan have held a variety of leadership roles across multinational corporations advising on the planning, construction, and operation of some of the largest offshore projects. They have significant experience managing integrated contracting and project finance to enable funding of major capital projects from the financial markets, including both UK and international development with a variety of commercial models and Build Own Operate Transfer (BOOT) funding constructs.