Administrator

Graphene and related materials inks improve solar cells

Imagine the environmental benefits if we could all simply paint solar cells onto the roof of our houses, or onto any surface for that matter. We could do this using perovskite solar cells (PSC), but, due to their instability, they have not yet been widely introduced. Now, researchers from the Graphene Flagship have developed hybrids of graphene and molybdenum disulphide quantum dots to stabilise PSCs.

Progress in PSCs means that they are primed to become an affordable and flexible solar cell option for smart, low-intensity applications. This is because PSCs are less complex to produce, are made with cheaper materials and, due to their flexibility, can be used in locations where traditional silicon solar cells cannot be placed.

A collaboration between the Flagship Partners Istituto Italiano di Technologia, University of Rome Tor Vergata, and BeDimensional resulted in a novel approach based on graphene and related materials to stabilize PSCs.

PSCs are improving fast. When they were first developed in 2009, they had an initial efficiency of 3.8%. Today, they can achieve efficiencies above 22%. In comparison, silicon solar cells have been around since 1880, only reaching efficiency levels of 26.1% in 2018.

The main weakness of PSCs is their stability. This is where the molybdenum disulphide quantum dot/graphene hybrids come into play. The collaboration between research institutions and industrial partners enabled by Graphene Flagship, yielded a GRM based ink. Layering this over the PSCs saw them drastically increase the stability.

Graphene was central, as molybdenum disulphide was anchored to reduced graphene oxide. This allowed for both materials’ properties to be applied and the ink not only increased the stability but also the performance of the PSC.

“The Graphene Flagship was central to this development,” explained Professor Emanuel Kymakis, work package deputy leader for energy generation. “The funding and structure that they put in place were key to allowing new research teams to take part, such as the University of Rome Tor Vergata.

“Thanks to this research, we have overcome a major hurdle to adopting this new technology,” continued Professor Kymakis. “With the new levels of stability and performance, we could see the mass adoption of PSCs in the next few years.”

Once the PSCs stability is solved, attention can focus on scaling up production. Manufacturing PSCs requires solution processing, that can be ramped up to an industrial scale. Due to the flexibility, PSCs can be applied to nearly any surface and produce electricity.

Stable PSCs could change the way we power our homes and devices, as every available surface could be made to generate electricity.

Andrea C. Ferrari, Science and Technology Officer of the Graphene Flagship and Chair of its Management Panel added: "the potential of graphene and related materials to improve solar cells has been recognized since the beginning of the Flagship. Their combination with the emerging field of perovskite solar cells now allows a crucial step forward in stability. This validates the major investments in spearhead projects on solar cells done by the Flagship.”

Reference:

Graphene-Induced Improvements of Perovskite Solar Cell Stability: Effects on Hot-Carriers

P. O’Keeffe, D. Catone, A. Paladini, F. Toschi, S. Turchini, L. Avaldi, F. Martelli, A. Agresti, S. Pescetelli, A. E. Del Rio Castillo, F. Bonaccorso, and A. Di Carlo

Nano Letters 2019 19 (2), 684-691

DOI: 10.1021/acs.nanolett.8b03685

About: The Graphene Flagship

The Graphene Flagship is one of the largest research projects funded by the European Commission. With a budget of €1 billion over 10 years, it represents a new form of joint, coordinated research, forming Europe's biggest ever research initiative. The Flagship is tasked with bringing together academic and industrial researchers to take graphene from academic laboratories into European society, thus generating economic growth, new jobs and new opportunities.

Meldrum Ltd rebrand to Actemium Carlisle

Meldrum Ltd will rebrand as Actemium Carlisle on the 30th September 2020 and join the wider Actemium network of Business Units in its mission to boost industrial performance.

Established in 2005, Meldrum provides electrical and instrumentation engineering services, predominantly within the industrial sector. It partners with companies working at the forefront of the UK’s nuclear sector to provide services including electrical installation, safety and security enhancement, testing, automation services and maintenance.

Since the acquisition of Carlisle-based Meldrum Ltd by VINCI Energies UK & RoI in April 2017, the electrical and instrumentation engineering specialist has been working closely with Actemium, the VINCI Energies brand dedicated to industry, to enhance the company’s offering in the nuclear sector.

The rebrand of Meldrum Ltd to Actemium Carlisle is the direct result of this successful and close relationship with the wider network of Actemium Business Units and demonstrates its clear ambitions for growth.

Actemium is a global network of over 400 specialist Business Units, assisting customers in the transformation to a smarter industry through the design, build and maintenance of industrial processes and sites.

It has a strong presence in the UK with sites in Birmingham, Coventry, Nottingham, Gloucester, Teesside and Walsall, and the combined expertise of this network will support Actemium Carlisle in the next stage of its development.

Actemium Carlisle Business Unit General Manager Martin Hand added: “We are delighted and excited to announce this next phase of our company’s development. Joining Actemium will enhance our capabilities and offering to our customers, by enabling us to draw on the technical know-how and experience of a vast network of international engineers.”

Actemium UK Director Andrew Hunter commented: “By joining the wider Actemium network, Meldrum Ltd is not only enhancing its capabilities and expertise, it is joining a family. In joining this family, it will make collaborating with other Actemium Business Units and connecting with UK and International customers much easier.”

HARTING UK awarded prestigious IRIS Silver Quality Performance Level

HARTING UK are delighted to announce that they have been awarded the prestigious Silver Quality Performance Level award from the International Railway Industry Standard (IRIS). This is a globally recognised standard which evaluates management systems for the railway sector.

Silver Performance is currently the highest performance level issued by IRIS and is a significant achievement for HARTING UK, making them one of only 60 companies worldwide to receive Silver status and putting them in the top 3% globally of all IRIS certified companies.

IRIS is established as a European Rail Industry Association (UNIFE) group and is recognised by both system manufacturers and railway operators. It was set up with the aim of establishing higher quality and reliability of rolling stock and infrastructure in the railway industry. Via an efficient system for auditing railway suppliers, the aim is to create transparency throughout the supply chain.

HARTING UK manufactures bespoke cable assemblies and intercar jumpers for the rail market.

HARTING UK manufactures bespoke cable assemblies and intercar jumpers for the rail market.

Stuart Fisher, Director of Operations at HARTING Manufacturing UK Ltd, was delighted with the award, saying:

“To receive such a prestigious award is great testimony to everybody at HARTING and really endorses our commitment to quality. It also clearly demonstrates our passion for quality throughout the business and offers our customers great confidence in our products. It's also clear that as a business we have a culture of continuous improvement and that we will strive to get even better at what we do.”

The HARTING UK manufacturing facility in Northampton produces bespoke cable assemblies and intercar jumpers for the rail market, based on the extensive HARTING product portfolio. Additional services include full design and development support and onsite testing of cabling and wiring. As well as the IRIS Silver Quality Award, the facility also holds ISO 9001 certification for Quality Management, the ISO 14001 Environmental Standard and UL certification for Wiring Harnesses ZPFW2 / ZPFW8.

To learn more about HARTING UK’s manufacturing capabilities, please visit www.harting.com/UK/en-gb/solutions/harting-customised-solutions-uk

About HARTING:

The HARTING Technology Group is one of the world's leading providers of industrial connection technology for the three lifelines of Data, Signal and Power and has 14 production plants and 44 sales companies. Moreover, the company also produces retail checkout systems, electromagnetic actuators for automotive and industrial series use, charging equipment for electric vehicles, as well as hardware and software for customers and applications in automation technology, mechanical and plant engineering, robotics and transportation engineering. In the 2017/18 business year, some 5,000 employees generated sales of EUR 762 million.

For further information visit https://www.harting.com/UK/en-gb

Metso Outotec to bring unique fasteners and wear monitoring technology to its minerals customers by acquiring Davies Wear Plate Systems in Australia

Metso Outotec has closed today the acquisition of the Australia-based fastener and wear monitoring technology provider Davies Wear Plate Systems, extending its wear lining portfolio and capabilities.

The acquired technology includes fasteners with a unique locking mechanism that does not require traditional studs and nuts and thus enables faster and safer maintenance work. Davies Wear Plate Systems’ portfolio also includes wear monitoring technology, which provides a real-time forecast of wear and expected liner change-out timing. The monitoring solution can be fitted to any metallic or ceramic liner, independent of attachment systems.

“This acquisition supports our target to offer comprehensive and unique solutions for the entire wear lining value chain. We are eager to introduce these advanced solutions globally to our customers; we now have the market’s widest range of optimized wear protection solutions, tools and services. The new technology will increase safety during maintenance and increase uptime. I warmly welcome the new colleagues to become part of the Metso Outotec team,” says Sami Takaluoma, President of Consumables business area at Metso Outotec.

WearSense™ monitors wear in real time and tells when it is time to change the liners

WearSense™ monitors wear in real time and tells when it is time to change the liners

The acquired technology is already used by major mining companies, such as Rio Tinto, BHP Group and Fortescue Metals Group in Australia.

“We have been improving our product offering for years and we have received good feedback from our customers in Australia. Our products are ready to be rolled out to the global mining market. We are excited that we are now a part of a truly international company,” says Brian Davies, Founder, Davies Wear Plate Systems.

The parties have agreed not to disclose the value of the transaction.

About Davies Wear Plate Systems

The Davies Wear Plate Systems offering includes patented fastening systems, wear liner monitoring system and wear plates. Davies also supplies tools that provide safer and faster change-outs.

The company’s sales in fiscal year 2020 were AUD ~ 17 million (EUR 10 million) and it has approx. 30 employees. Davies has an office in Malaga, Perth and an operation facility in Esperance, Western Australia. https://www.davieswps.com/

Metso Outotec offers a wide range of optimized wear protection solutions, tools and services

Metso Outotec offers a wide range of optimized wear protection solutions, tools and services

Metso Outotec is a frontrunner in sustainable technologies, end-to-end solutions and services for the aggregates, minerals processing, metals refining and recycling industries globally. By improving our customers’ energy and water efficiency, increasing their productivity, and reducing environmental risks with our product and process expertise, we are the partner for positive change.

Headquartered in Helsinki, Finland, Metso Outotec employs over 15,000 people in more than 50 countries and its illustrative combined sales for 2019 were about EUR 4.2 billion. The company is listed on the Nasdaq Helsinki. mogroup.com

Brenntag links its distribution network of caustic soda in the Eastern United States

Brenntag (ISIN DE000A1DAHH0), the global market leader in chemical and ingredients distribution, announces the acquisition of the operating assets of US-based Suffolk Solutions, Inc’s caustic soda distribution business.

“The business and the related terminals of Suffolk Solutions fit seamlessly into our ambitions to further link Brenntag’s caustic soda network in the Eastern United States. There is great potential to strengthen our supply chain and expand our customer base in this geography,” says Steven Terwindt, Member of the Management Board of Brenntag Group and CEO Brenntag North America.

“The business and the related terminals of Suffolk Solutions fit seamlessly into our ambitions to further link Brenntag’s caustic soda network in the Eastern United States. There is great potential to strengthen our supply chain and expand our customer base in this geography,” says Steven Terwindt, Member of the Management Board of Brenntag Group and CEO Brenntag North America.

The Virginia headquartered company, founded in 2005, has access to a bulk terminal as well as to a rail transloading facility within the state. The business relies on long-term suppliers and a loyal customer base.

Anthony Gerace, Managing Director Mergers & Acquisitions at Brenntag Group, summarises the locational advantages of the acquisition: “Suffolk Solutions will strengthen Brenntag’s footprint in the Virginia market and thus will enable us to improve our logistical infrastructure throughout the region. It will provide us with greater supply flexibility, manoeuvrability, and additional storage capacity on the east coast of the United States.”

The acquired business generated sales of approximately USD 15.6 million in a 12-month period ending April 30, 2020.

About Brenntag:

Brenntag is the global market leader in chemical and ingredients distribution. We connect our suppliers and customers in value-adding partnerships. Our almost 17,500 employees provide tailor-made application, marketing and supply chain solutions. Technical and formulation support, market, industry and regulatory expertise as well as advanced digital tools are just some examples of our services that are aiming to create an excellent customer experience. Our full-line portfolio comprises specialty and industrial chemicals and ingredients of a world-class supplier base. Building on its long-standing experience, unmatched global reach and local excellence, Brenntag works closely alongside its partners to make their business more successful. We are committed to contribute towards greater sustainability in our own business and the industries we serve, and to achieve sustainable profitable growth. Headquartered in Essen (Germany) and with regional headquarters in Philadelphia, Houston and Singapore, Brenntag operates a unique global network with more than 640 locations in 77 countries. The company generated sales of EUR 12.8 billion (USD 14.4 billion) in 2019. Brenntag shares are traded at the Frankfurt Stock Exchange (BNR).

US metals & mining industry sees a rise of 9.5% in deal activity in Q2 2020

The US metals & mining industry saw a rise of 9.5% in overall deal activity during Q2 2020, when compared with the last four-quarter average, according to GlobalData’s deals database.

A total of 46 deals worth $1.84bn were announced in Q2 2020, compared to the last four-quarter average of 42 deals.

M&A was the leading category in the quarter with 42 deals which accounted for 91.3% of all deals.

M&A was the leading category in the quarter with 42 deals which accounted for 91.3% of all deals.

In second place was venture financing with four deals, accounting for 8.7% of overall deal activity in the country’s metals & mining industry during the quarter.

In terms of value of deals, M&A was the leading deal category in the US metals & mining industry with total deals worth $1.83bn, followed by private equity deals totalled $5.19m.

The US metals & mining industry deals in Q2 2020: Top deals

The top five metals & mining deals accounted for 99.1% of the overall value during Q2 2020.

The combined value of the top five metals & mining deals stood at $1.82bn, against the overall value of $1.84bn recorded for the month.

The top five metals & mining industry deals of Q2 2020 tracked by GlobalData were:

- ‘s $1.78bn merger of Alacer Gold and SSR Mining

- The $23.78m merger of Evrim Resources and Renaissance Gold by

- Metalla Royalty and Streaming’s $5.77m asset transaction with

- The $4m acquisition of Idaho North Resources by Metalla Royalty and Streaming

- Greenpro Capital’s acquisition of Millennium Sapphire for $4m.

This analysis considers only announced and completed deals from the GlobalData financial deals database and exclude all terminated and rumored deals. Country and industry are defined according to the headquarters and dominant industry of the target firm. The term ‘acquisition’ refers to both completed deals and those in the bidding stage.

GlobalData tracks real-time data concerning all merger and acquisition, private equity/venture capital and asset transaction activity around the world from thousands of company websites and other reliable sources.

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis, and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, technology, energy, financial and professional services sectors.

ABB’s new analytics and AI software helps producers optimize operations in demanding market conditions

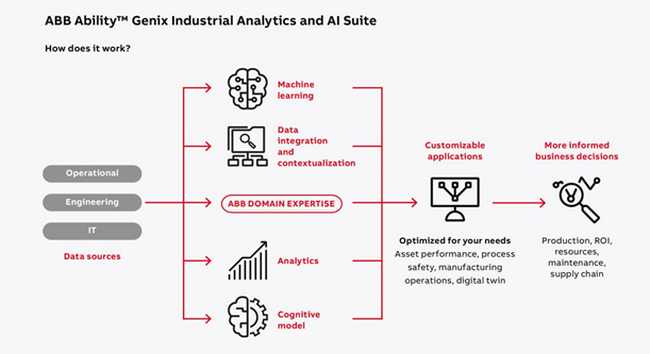

ABB launches analytics software and services that combines operational data with engineering and IT data to deliver actionable intelligence

The ABB Ability™ Genix Industrial Analytics and AI Suite is a scalable advanced analytics platform with pre-built, easy-to-use applications and services. It collects, contextualizes and converts operational, engineering and information technology data into actionable insights that help industries improve operations, optimize asset management and streamline business processes safely and sustainably.

Analyst studies suggest that industrial companies typically are able to use only 20 percent¹ of the data generated, which severely limits their ability to apply data analytics meaningfully. ABB’s new solution operates as a digital data convergence point where streams of information from diverse sources across the plant and enterprise are put into context through a unified analytics model. Application of artificial intelligence on this data produces meaningful insights for prediction and optimization that improve business performance.

“We believe that the place to start a data analytics journey in the process, energy and hybrid industries is by building on the existing digital technology – the automation that controls the production processes,” said Peter Terwiesch, President of ABB Industrial Automation. “We see a huge opportunity for our customers to use their data from operations better, by combining it with engineering and information technology data for multi-dimensional decision making. This new approach will help our customers make literally billions of better decisions.”

ABB AbilityTM Genix is composed of a data analytics platform and applications, supplemented by ABB services, that help customers decide which assets, processes and risk profiles can be improved, and assists customers in designing and applying those analytics. Featuring a library of applications, customers can subscribe to a variety of analytics on demand, as business needs dictate, speeding up the traditional process of requesting and scheduling support from suppliers.

Scalable from plant to enterprise, ABB Ability™ Genix supports a variety of deployments including cloud, hybrid and on-premise. ABB Ability™ Genix leverages Microsoft Azure for integrated cloud connectivity and services through ABB’s strategic partnership with Microsoft.

“The ABB Ability™ Genix Suite brings unique value by unlocking the combined power of diverse data, domain knowledge, technology and AI,” said Rajesh Ramachandran, Chief Digital Officer for ABB Industrial Automation. “ABB Ability™ Genix helps asset-intensive producers with complex processes to make timely and accurate decisions through deep analytics and optimization across the plant and enterprise.

“We have designed this modular and flexible suite so that customers at different stages in their digitalization journey can adopt ABB Ability™ Genix to accelerate business outcomes while protecting existing investments.”

A key component of ABB AbilityTM Genix is the ABB Ability™ Edgenius Operations Data Manager that connects, collects, and analyzes operational technology data at the point of production. ABB Ability™ Edgenius uses data generated by operational technology such as DCS and devices to produce analytics that improve production processes and asset utilization. ABB Ability™ Edgenius can be deployed on its own, or integrated with ABB AbilityTM Genix so that operational data is combined with other data for strategic business analytics.

“There is great value in data generated by automation that controls real-time production,” said Bernhard Eschermann, Chief Technology Officer for ABB Industrial Automation. “With ABB AbilityTM Edgenius, we can pull data from these real-time control systems and make it available to predict issues and prescribe actions that help us use assets better and fine-tune production processes.”

Further details can be found online:

ABB Industrial Automation ABB’s Industrial Automation business offers a broad range of products, systems, and solutions for customers in the process and hybrid industries. These include industry-specific services, as well as measurement and analytics, marine and turbocharging offerings. ABB’s Industrial Automation business is #2 in the market globally. With deep domain knowledge, experience and expertise, ABB Industrial Automation helps customers increase their competitiveness, improve their return on investment and run safe, smart, and sustainable operations.

ABB (ABBN: SIX Swiss Ex) is a leading global technology company that energizes the transformation of society and industry to achieve a more productive, sustainable future. By connecting software to its electrification, robotics, automation and motion portfolio, ABB pushes the boundaries of technology to drive performance to new levels. With a history of excellence stretching back more than 130 years, ABB’s success is driven by about 110,000 talented employees in over 100 countries. www.abb.com

¹ARC Advisory Group

Nidec ASI presents its 8 Guidelines for restarting the economy in the name of sustainability

The Group is committed to creating an electric and green future, placing the Made-in-Italy excellence of its technologies at the heart of this revolution. Nidec ASI's goal is to increase its current turnover of €400 million to €1 billion by the end of 2023, concentrating on the energy sector, mobility and industrial efficiency

Nidec ASI, the commercial platform of the Nidec Group, which has always been committed at an international level to ensuring a more sustainable economic development, has decided to elaborate some guidelines for a green restart inspired by concepts of sustainability and circular economy which focus on the transformation towards an “All Electric” world. A responsibility that the globally present multinational has been particularly aware of throughout this delicate and challenging period which has created an important sense of community.

Each of the 8 Guidelines elaborated focuses on a different aspect: renewables, energy efficiency, logistics, mobility, circular economy, digital, young people and health. They represent Nidec ASI's desire to inform everyone on how the Group is evolving (also by strengthening its R&D) and what principles and areas it is working on in order to contribute to an evolution which can no longer be delayed, creating awareness among institutions, businesses and citizens alike on the need to take climate change very seriously and restart in the wake of this crisis by acting decisively as true enablers of a green and digital future.

"As Nidec ASI, we firmly believe that by supporting the evolution of energy, logistics and industry, it really is possible to make a difference and we are developing solutions that can reduce energy consumption by building on renewables, the sustainable movement of people and goods and on promoting greater energy efficiency, not only in the industrial sector, but also in every aspect of our lives," said Dominique Llonch, CEO of Nidec ASI and Chairman of Nidec Industrial Solutions. "The future will be electric; this is the only key for promoting a model of sustainable development. Institutions must allow this change to happen in the shortest possible time while companies currently operating in the industrial solutions market must make the technologies they produce accessible to all. An offer of quality and affordable green technologies which are also sustainable must represent the main and moral objective of the players operating in the market, and as always, we want to do our part, continuing to develop technologies such as Power Quality, at the center of hydrogen production, and BESS, which are essential for optimizing the use of renewables and represent the excellences of our Italian production facilities."

"As Nidec ASI, we firmly believe that by supporting the evolution of energy, logistics and industry, it really is possible to make a difference and we are developing solutions that can reduce energy consumption by building on renewables, the sustainable movement of people and goods and on promoting greater energy efficiency, not only in the industrial sector, but also in every aspect of our lives," said Dominique Llonch, CEO of Nidec ASI and Chairman of Nidec Industrial Solutions. "The future will be electric; this is the only key for promoting a model of sustainable development. Institutions must allow this change to happen in the shortest possible time while companies currently operating in the industrial solutions market must make the technologies they produce accessible to all. An offer of quality and affordable green technologies which are also sustainable must represent the main and moral objective of the players operating in the market, and as always, we want to do our part, continuing to develop technologies such as Power Quality, at the center of hydrogen production, and BESS, which are essential for optimizing the use of renewables and represent the excellences of our Italian production facilities."

1) Renewables

Today the Energy & Utilities sector is undergoing a radical transformation which is impacting every phase of the value chain. Upstream of the value chain, we are witnessing the progressive transition from a centralized system to a much more distributed, interactive and interconnected ecosystem for the production of electricity from renewable sources. The transition towards renewable energies is in fact the most effective way to combat climate change and air pollution and, rightly so, the European Recovery Plan envisages investments to support growth of the clean energy sector. It is therefore more necessary than ever to move away from a fossil fuel economy towards an electric economy and an "All Electric" world.

Italy, a land of sun, water and wind, is starting out from an environmentally advantageous position, consequently it is desirable that institutions work with the aim of facilitating this essential change, allocating funds to the development of renewables.

Nidec ASI has understood the needs arising from the transition towards renewable energy sources, offering solutions that enable optimum usage, such as: BESS (Battery Energy Storage Systems), a sector in which the Group is a leader with more than 70 projects worldwide and over 700MWh of systems installed, microgrids, important innovations in the field of LNG (Liquefied Natural Gas) extraction and the development of the hydrogen market. Nidec technology is also present in two of the three most important nuclear fusion research centers.

2) Improving energy efficiency

A reduction in greenhouse gas emissions, but above all improved electricity consumption efficiency, must apply in every socio-economic context.

Our homes and public buildings can represent a good starting point, as highlighted by the European Recovery Plan. The adoption of innovative technologies, new low energy impact home appliances, heat pumps and photovoltaic panels that make it possible to zero energy needs, together with the renovation of buildings with the aim of achieving net-zero energy, represent the simplest and most effective solutions in this race against climate change.

Nidec Group supports the decision of the European Council, included in the latest Recovery Plan, to move in this direction, setting up over 20 research laboratories dedicated to studying how to optimize the efficiency of electric motors and drives.

In addition to houses, however, it is also essential to focus on the energy efficiency of industry, especially heavy industry. The goal, which Nidec ASI has also adopted as its own, is therefore to transform these plants to make them more efficient.

3) Diversified and digital logistics

The COVID-19 emergency uncovered a number of weak points in logistics leading to considerations useful for rethinking the approach towards a more agile, flexible, green and sustainable supply chain. In the future, those businesses which adopt enlightened procurement policies and logistics, relying on diversified zero-kilometer suppliers, located in different countries, and not only those able to offer the lowest price, will find themselves with a huge competitive advantage also in times of emergency situations.

It is precisely with a view to diversifying the supply chain that the European Union will implement the Trade Policy Review, to ensure a continuous flow of goods and services. In this scenario, Nidec ASI already has a head start, given that the Group's flagships are still the Italian factories.

Consequently, it becomes evident that it is essential for those players operating in logistics to rethink their way of seeing things, activating leaner decision-making processes, accelerating the digital transformation by making use of IoT (Internet of Things) solutions, thus strengthening the entire supply chain. Another important aspect in this transformation concerns accelerating port automation which, thanks to digitalization, will be able to significantly reduce emissions.

Connected, fast and streamlined logistics will increase the efficiency of moving vehicles, goods and even people, and will make it possible to reduce energy consumption and, consequently, also the environmental impact.

4) Electric mobility

The world of mobility, increasingly strategic for the development of all economic sectors, especially those related to the digital economy, will become 100% electric: ports, ships, cars, trains and public transport will all be connected and powered through the electricity grid.

Promoting this transformation is fundamental, partly because this is the sector where it is most necessary to reduce CO2 emissions and where the objectives set by the authorities are highest and partly to guarantee a green restart of tourism, of primary importance above all in a country like Italy, where this sector accounts for 13% of the national GDP and employs 15%-20% of the Italian workforce, thus confirming its strategic nature for relaunching the country.

Also in this case, the European Recovery Plan traces out the direction to be followed, focusing on the need to support the development of electric transport, the relative recharging infrastructure and alternative fuels.

Electric vehicles will become increasingly more popular, as they represent the most efficient option to completely eliminate emissions. This process has been going on for years, but it must also be supported through the allocation of ad hoc funds for the widespread diffusion of recharging points and upgrading of the electricity grid to ensure that during times of peak demand sudden drops in voltage are avoided that could cause blackouts in the cities and also to meet car sharing needs which will become more and more common.

Nidec is at the forefront of this sector, thanks to its Ultra Fast Charger for electric vehicles. The Group also contributes to the development of hybrid and electric buses connected via cable and wheels by making use of its knowledge of the battery market.

Maritime transport, which also contributes heavily to the emission of pollutants harmful to the air, will also have to undergo a radical green transformation. Nidec ASI was among the first players in the world to promote the adoption of solutions for electric navigation, starting with the electrification of port docks, which allow ships to turn off their engines and hook up to the electricity grid. It is in fact currently involved in a "shore-to-ship" project for the port of Genoa as well as in 8 other similar projects around Europe. The Group also offers solutions for on-board energy storage systems, such as those installed on the Seasight ferries which today navigate Norwegian waters without producing any type of pollution or noise.

5) Circular economy

A further essential pillar for an industrial restart from a green perspective follows the principles of the circular economy, an area into which huge European investments will be channeled, as envisaged by the new Circular Economy Action Plan, with particular reference to the development of infrastructures and technologies capable of optimizing waste management.

The world in which we find ourselves has increasingly scarcer resources, hence the need for effective recycling and the activation of a virtuous circle is emerging that makes it possible to minimize waste and the use of raw materials.

Nidec ASI, which invests 3% of its turnover in power electronics alone, is committed, with its research activities, to dealing with these principles, reducing the number of components in the field. A virtuous example is its VDF AFE, a new variable frequency medium voltage drive. By eliminating the transformer, it guarantees extremely high energy efficiency, it is 30% more compact and about 60% lighter than other solutions, reducing not only energy consumption and emissions but also the use of difficult to dispose of metals such as copper and iron. A particularly innovative product is also the CAplus, a new electric motor characterized by the fact that over 95% of the materials used in its construction can be recycled at the end of its service life.

6) Digital transformation

The electric and green transformation of logistics, transport and industry goes hand in hand with digital transformation, where connectivity is able to bring enormous benefits not only with a view to more sustainable development, but also in terms of quality of the services offered, safety and competitiveness of the relative industries.

In the future, for example, ports will be increasingly integrated and connected thanks to the Internet of Things, based on the extensive use of sensors, and the evolution of big data, which will make it possible to optimize the collection and analysis of the data produced, improving the traceability of goods, staff safety and sustainability.

Even the evolution of steel works is undergoing integration with new technologies, primarily wi-fi, up to a prospective vision of creating a "Steel Industry 4.0", experiments into which are already in progress. Nidec ASI's automation and system integration solutions are developed and implemented to successfully complete revamping projects, even very complex ones, with the aim of making advanced solutions, such as wireless technologies 'talk' to older technologies.

As rightly envisaged by the European Recovery Plan, investing in the process of digitalization of Italy and Europe in general (which has accelerated during this period of crisis) is therefore a priority in order to be able to bring about a real transformation in the direction of dematerialization and therefore a reduction in emissions, with consequent benefits everywhere. However, all of this requires, first and foremost, substantial investments in telecommunication networks and innovative technologies (AI, robotics, cybersecurity, data cloud infrastructure, blockchain), adequate partners and incentives, a reduction in red tape and an effective education process.

7) Engagement with young people

In the race towards a sustainable economy, it will be essential to guarantee a future for young people and engage them, given that they are increasingly more attentive to green issues. Companies and institutions must therefore target the main issues concerning sustainability at the new generations who can become the main testimonials of the urgency for a green restart.

Also in the industrial solutions sector, it will be essential to continue to attract and retain young talents who will be able to develop the sustainable innovations of the future, increasing funding for internships, also extending the time spent in companies and supporting the insurance / additional costs caused by the new safety standards, as well as investing in advanced welfare programs capable of ensuring a good work-life balance and a satisfactory training path.

With the aim of initiating a constructive dialog with young people on these issues, the idea was born to launch Nidec ASI's new social communication campaign, I WANT A GREEN FUTURE on a worldwide level, which aims to awaken everyone's consciences, starting with young people, raising awareness on the values of environmental sustainability.

8) Health

The spread of the coronavirus throughout the world has highlighted the undeniable link and interconnection between all human beings on the planet, uncovering enormous economic imbalances that still persist in different parts of the globe.

In this scenario, it is increasingly more evident how a company cannot grow and thrive in an unhealthy environment where safeguarding health is not a priority. Institutions must therefore allocate huge investments to protecting people's health.

A concrete demonstration of how the focus on people's health is crucial is given by the path Nidec has taken, also with the recent announcement of the "Nidec Health Declaration", aimed at strengthening and focusing even more on the management of employee wellbeing, and the establishment, by the Nidec Group, of a Health Promotion Committee. The Group also boasts an employee welfare program, which offers wellbeing benefits.

Nidec ASI is also committed to continuously minimizing the impact of its activities on the environment and society by adopting a vision of the future that is also "collective", and therefore takes the community into huge consideration. Recognizing that we are part of the ecosystem which surrounds us and understanding that our actions can have an impact on the territory where we operate is the duty of each and every one of us.

Nidec Industrial Solutions is the commercial platform created by Nidec Group which brings together all Nidec ASI products and services. The company designs, manufactures and installs reliable and efficient control and power systems, with particular attention to life cycle, performance and energy consumption, making it one of the world's technological leaders operating in the process of energy transition towards an "All Electric" and therefore green and sustainable future. Nidec Industrial Solutions offers customised solutions throughout the world for a wide range of industrial applications. Its reference markets are the petrochemical, traditional and renewable energy, steel, naval and industrial automation markets. The multinational is specialised in heavy duty applications in which high power and high performance are key: electric motors and generators up to 65 MW of power (87,000 HP); power electronics inverters and converters; automation and software for industrial processes; retrofitting of power plants and hydroelectric generators; integrated systems for producing electricity from renewable sources and their integration in power grids; medium and low power drives. Thanks to the acquisitions of Control Techniques and Leroy-Somer, the company is also able to offer technologies optimised for the control of motors and to develop automation solutions for specific applications, tailored to the needs of the client to provide a flexible response to each requirement.

US metals & mining industry M&A deals total $1.83bn in Q2 2020

Total metals & mining industry M&A deals in Q2 2020 worth $1.83bn were announced in the US, according to GlobalData’s deals database.

The value marked an increase of 65.5% over the previous quarter and a rise of 11.9% when compared with the last four-quarter average of $1.64bn.

The US held a 20.7% share of the global metals & mining industry M&A deal value that totalled $8.86bn in Q2 2020.

The US held a 20.7% share of the global metals & mining industry M&A deal value that totalled $8.86bn in Q2 2020.

In terms of deal activity, the US recorded 42 deals during Q2 2020, marking a rise of 35.5% over the previous quarter and a rise of 20% over the last four-quarter average.

The US metals & mining industry M&A deals in Q2 2020: Top deals

The top five metals & mining industry M&A deals accounted for 99.4% of the overall value during Q2 2020.

The combined value of the top five metals & mining M&A deals stood at $1.82bn, against the overall value of $1.83bn recorded for the month.

The top five metals & mining industry deals of Q2 2020 tracked by GlobalData were:

- ‘s $1.78bn merger of Alacer Gold and SSR Mining

- The $23.78m merger of Evrim Resources and Renaissance Gold by

- Metalla Royalty and Streaming’s $5.77m asset transaction with

- The $4m acquisition of Idaho North Resources by Metalla Royalty and Streaming

- Greenpro Capital’s acquisition of Millennium Sapphire for $4m.

This analysis considers only announced and completed deals from the GlobalData financial deals database and exclude all terminated and rumored deals. Country and industry are defined according to the headquarters and dominant industry of the target firm. The term ‘acquisition’ refers to both completed deals and those in the bidding stage.

GlobalData tracks real-time data concerning all merger and acquisition, private equity/venture capital and asset transaction activity around the world from thousands of company websites and other reliable sources.

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis, and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, technology, energy, financial and professional services sectors.

Transmission license exemptions grant UK offshore wind farm generators time to complete ownership transfer, says GlobalData

With the onset of COVID-19, the UK Government proposed time-bound exemptions for wind project generators in tender rounds 5 and 6 of the Offshore Transmission Owner (OFTO) regime. GlobalData anticipates that the exemption is likely to provide the developers of the projects that were impacted by the virus valuable time to execute the transfer process.

Somik Das, Senior Power Analyst at GlobalData, comments: “With the lockdown in-situ, there was a scarcity of working personnel. Now, because the lockdowns are gradually being lifted within the UK, movement is predicted to be restrained for some time. Conventional working practices are still impacted and uncertainties looming in the near term are expected to cumulatively delay any ownership transfers.”

Somik Das, Senior Power Analyst at GlobalData, comments: “With the lockdown in-situ, there was a scarcity of working personnel. Now, because the lockdowns are gradually being lifted within the UK, movement is predicted to be restrained for some time. Conventional working practices are still impacted and uncertainties looming in the near term are expected to cumulatively delay any ownership transfers.”

The Beatrice project was nearest to the end of its commissioning period, with the date set for October this year. Social distancing norms in the UK have hindered the project’s transfer, and, although things are expected to be back to shape by the end of the year, the cloud of uncertainty still looms ahead. An extension to the timeline is anticipated to bring utmost relief to the current owner.

Das continues: “In this Build-Own-Operate-Transfer (BOOT) model, the new owners after the transfer might need to rework project finances to account for any potential delay. In addition, the average monthly electricity price had been on the decline since March, and, as economic activities resume and demand normalizes, electricity tariffs are likely to improve. This tariff increase will benefit the new owners by way of improved revenues.”

to Editors

- Comments provided by Somik Das, Senior Power Analyst at GlobalData

- The government proposes a 12-month extension in the transfer of ownership of the 1.2GW Hornsea One Project to preferred OFTO bidder Diamond Transmission Corporation (DTC), 588MW Beatrice Project, and the 400.2MW Rampion project to Transmission Capital Partners. The transfer deadlines for Hornsea One, Beatrice, and Rampion projects are proposed to be extended to 14th January 2022, 2nd October 2021, and 27th November 2021, respectively.

- For new offshore wind projects in the UK, the generator builds the project and can own and operate the offshore transmission system for a maximum commissioning period of 18 months without possessing a transmission license.

- The proposal for granting an extension of the timeframe of ownership transfer, depends largely on the extent the wind project owners have been impacted by the crisis.

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.